Energy, energy, energy!

That’s where all the market action is right now.

Coal stocks have stormed up in the last six months.

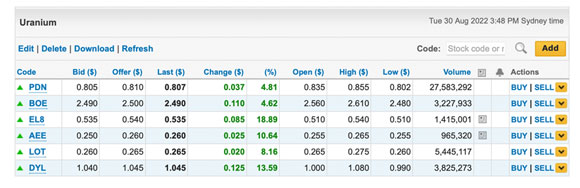

And uranium plays ramped up 5–20% in yesterday’s session.

Here’s a taste:

|

|

| Source: CommSec |

Apparently, the juicing came via a tweet from Elon Musk, of all people.

Nuclear is good, declared the King of EVs.

Is he right? I don’t know. Probably.

The danger with Musk is the same as with Barack Obama back in the day.

All the fanboys swallow whatever he says without question or second thought.

What about natural gas?

Check out this report from The Guardian yesterday:

‘Gas shortages across Europe are likely to last for several winters to come, the chief executive of Shell has said, raising the prospect of continued energy rationing as governments across the continent push to develop alternative supplies.’

Europe is scrambling to source whatever gas or alternatives it can find.

The current drought isn’t helping.

Already, Norway is moving to limit exports from its hydropower industry.

That’s not going down so well with its neighbours, who see it as funny as Scott Morrison’s tweets regarding his secret portfolio antics.

Norway wants to keep the power to serve its domestic economy first. Australia may be in a similar situation shortly.

We’re a big exporter of natural gas via the Gladstone LNG terminals in Queensland.

That’s a problem when the Australian Competition and Consumer Commission (ACCC) says Aussie domestic gas supply will be 10% too low in 2023, relative to the projected demand.

The ACCC says: keep it here!

But the world price is currently double, even triple in some parts, what it is here.

The Australian Financial Review quoted the chair of the ACCC as saying:

‘We know there’s a forecast shortfall, there is sufficient uncontracted gas well to meet it.

‘What needs to happen is that it is offered domestically, contracted domestically and then by next year we will not have a shortfall and we’ll have sufficient supply.’

Western Australia, for example, already demands that 15% of local gas production be reserved for the WA economy.

It’s hard to see gas producers as anything but the sweet spot regarding free market dynamics. Global demand is high and unmet because of the war in Ukraine.

But regulatory risk could come from domestic pressure, per above, or the government going for a ‘windfall’ profit tax on oil and gas producers.

We already saw the UK pull this move.

Regardless, you’d have to argue the market is bullish here anyway.

Check out the chart of Origin Energy [ASX:ORG] below:

|

|

| Source: Optuma |

You’ll notice I’ve put a circle on it. That’s the day Origin released its full-year results.

The stock sunk heavily on the day, early after the results came out, only to get bid back up by the time trade closed. It’s kept going since.

That’s a bullish sign.

Go back to 1 June. You can see that the strong uptrend in the stock was broken with a massive down bar.

That came about when Origin surprised the market with news that its coal supply was interrupted and affecting its Eraring Power Station.

Origin withdrew its guidance for the entire financial year, citing too many unpredictable variables.

The market hates uncertainty, but investors seem happy to go with it despite its blatant risks.

Surely it can only come from the huge cash flows off its stake in Australia Pacific LNG.

The danger of running with momentum like that is that Origin could come out with some sort of downgrade related to its Energy division, like the one in June.

The share market can be a tricky dance with the devil at times.

Those uranium stocks above, for example, are either developing or exploring for the stuff. I doubt one will see a dollar of profit anytime soon.

That’s not to say they can’t keep running. The market often moves ahead of earnings. But your risk can be higher than you think without deep research and a gameplan in place for when volatility hits in a big way, like it did on Monday.

We can’t forget the economic implications here, either. Higher energy costs are a boon for producers.

But there are more input costs for businesses and charges for consumers like you and me. That means less discretionary income.

I’d say Australia is OK on this front for the moment. But the costs in Europe are appalling.

That’s problematic when we have signs of stress coming from China too. Iron ore is back below $US100.

That puts two of the ‘Big 3’ economies (the EU, US, and China) under stress. And we know the US now has high natural gas prices to contend with…plus a potential rip roarer of a hurricane season coming.

Note to the unfamiliar: A huge proportion of the US energy industry is along the Gulf Coast in the flight zone of this type of weather.

Join me and get down on your knees and pray it all stays operational this year.

As it is right now, watch energy stocks, whether it be coal, gas, oil, renewable and, of course, battery minerals.

For my full presentation on how to play this, go here now!

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

Comments