The Dow Jones Industrial Average surged massively overnight, jumping 11.4% or 2,113 points, marking the largest increase since 1933.

The ASX 200 followed markets in the US, surging 5.82% in the first 30 minutes of trading this morning.

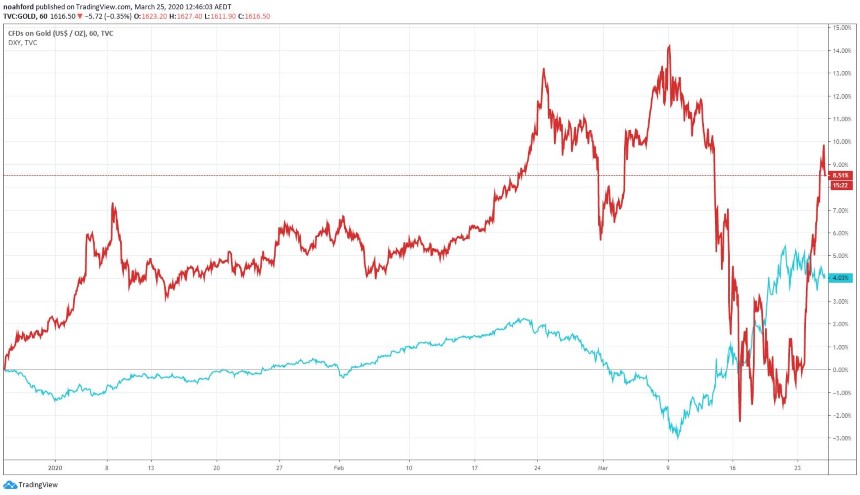

Coinciding with the meteoric rising of global market indices was a 4.75% rise in the gold price overnight and sharp drop in the US dollar.

The Bloomberg Dollar Spot Index declined 0.6%, ending a 10-day rally that took the USD to the strongest level on record after the Fed announced unprecedented stimulus.

This could be a sign that markets are beginning to feel the wave of liquidity the federal governments are now providing.

Source: Tradingview

Gold price USD/oz (red) and USD Index (blue) over the last three months

Does this bode well for the gold price?

Often, when the market is looking shaky and volatility is high (which seems like the norm now), investors will turn to buying gold and gold stocks to shelter from the storm.

This time the usual haven hasn’t withstood the storm.

Instead, investors flocked the sanctuary of the US dollar.

In the graph above we can see the USD Index storm upwards as the gold price crashed during the middle of March.

But with governments around the globe now injecting liquidity back into their economies and quantitative easing strategies coming into effect, investors have started to move on from the Greenback.

Maybe don’t let yourself get too carried in the recent stock market surge.

The current economic forecast is still looking bleak and profit outlooks could get worse before they get better.

In a brand-new report titled ‘The Looming Aussie Recession and How to Survive It’, Nick Hubble reveals why a recession in Australia is inevitable and three steps to recession-proof your wealth. Click here to receive your free report.

Closures of mines and refineries, and unprecedented monetary action could push the gold price to new highs.

The past three days has gold jumped more than 11% off the lows we saw last week.

The near-zero interest environment, market uncertainty and ongoing liquidity injections provides a bullish outlook for the precious metal.

When is the right time to buy?

It is worth paying attention to what the Aussie dollar is doing if you’re going to make a play for gold.

Personally, I like the idea of a longer-term position in gold, especially if we are expecting the current COVID-19 crisis to carry on like it is.

The economy is going to take time to heal and I don’t expect volatility to recede anytime soon.

The one thing you should pay attention to is the fact that we have gone straight up in the air like this, and it’s difficult to keep up this type of momentum.

If you can wait on value, you may be rewarded.

Perhaps it’s best to not go gung-ho at this point, because you would be paying up for the trade.

If you’re looking to invest in gold but are unsure how the best way to go about it is, check out our free report that teaches you the easiest ways to start investing. Download it here.

Regards,

Lachlann Tierney,

For The Daily Reckoning

Comments