In today’s Money Weekend…reverse Robinhood… who is the customer?… I reckon plenty of them will end up losing but it’s fun to watch… and more…

I have to kick off this week by expressing how flabbergasted I am at the incredible events during the week.

The manic trading in GameStop Corp [NYSE:GME] and other stocks that culminated in a number of brokers banning retail traders from entering new positions in a small list of affected stocks is big news.

If you ever wanted proof that the little guy is cannon fodder for the big end of town this is it.

It’s a remarkable story and if you haven’t been following it, I will give you the quick version.

A number of stocks had large outstanding short positions built up by various hedge funds. A reddit group called ‘Wallstreetbets’ managed to drive the share price of these stocks higher thus causing immense losses for the hedge funds that remain short.

The losses were so large for a hedge fund called Melvin Capital that they needed a bailout to the tune of $2.75 billion from Citadel and Point72. Citadel is one of the biggest hedge funds in the world.

The most interesting development happened yesterday when commission-free broker Robinhood Markets Inc started selling clients’ positions in these stocks and banned their customers from entering new positions.

Other brokers such as Ameritrade and Interactive Brokers also placed trade restrictions on the affected stocks.

The stocks in question crashed during the Thursday session as a result but have since bounced back strongly (I wrote this article yesterday so I’m not sure what happened overnight).

I am still shaking my head in disbelief that they had the gall to do such a thing.

How can a broker decide which stocks you’re allowed to trade?

If you are making too much money on a stock they can sell the position out from under you and tell you you’re not allowed to buy? Huh?

[conversion type=”in_post”]

Who is the customer?

It should be common knowledge that Robinhood sells their customers’ order flow to Citadel. Robinhood customers’ orders are routed through Citadel so they can take the other side to customer trades and give them worse fills than they would otherwise get.

I reckon they also front-run their orders and sell to them a penny higher. I have no proof of that, but I have traded long enough to be aware that algorithms front-run orders.

I wouldn’t trade through Robinhood if you paid me.

If you are getting something for free then you are the product being sold.

The reason Robinhood is making so much money is because they sell customers’ order flow. So, Citadel is actually the client of the firm that Robinhood wants to keep happy.

They just made that blatantly clear yesterday when they sold their customers completely down the river to protect the interests of Citadel and their hedge fund buddies.

I really hope Robinhood has to pay a heavy price for such behaviour. I even hope they go bankrupt because of it.

The irony of their name is now making them look like utter fools. They steal from the poor and give to the rich.

I think it’s fascinating that an online group has managed to take on Wall Street and win. I believe the size of the group is exploding as more people want to join in the fun, sticking it to the man.

I reckon plenty of them will end up losing but it’s fun to watch.

Class warfare

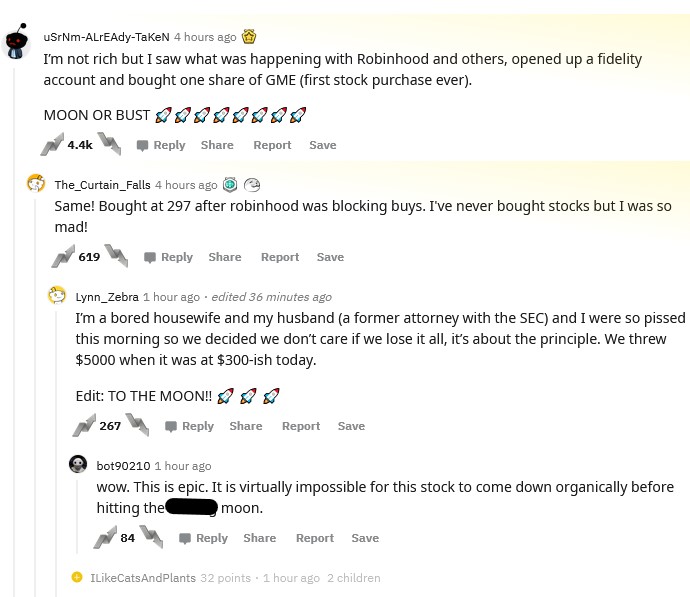

Here is a screenshot of the r/Wallstreetbets group a few hours after news broke that Robinhood had banned people from buying GME and other stocks:

|

|

| Source: Reddit.com |

It’s pretty clear a lot of the people on there aren’t experienced traders and investors. But they are joining in and buying one share of the stock to help the goal of causing huge losses for the hedge funds.

This has morphed into a class struggle against Wall Street. I think the brokers’ actions over the last couple of days have ignited a fire that they will not easily put out.

If the losses get large enough you can bet the hedge funds will start hitting the sell button on their long positions too, to cover margin calls.

That could ignite more selling from others as the trend shifts.

Who knows how this is going to play out and I fear the hedge funds will end up winning the battle, but I am rooting for Joe Sixpack.

Last week I pointed out that many hot stocks were starting to look stretched in the short term. I gave you a detailed analysis of Pilbara Minerals Ltd [ASX:PLS] to make my point. That stock is down over 28% since I wrote the article one week ago.

I sent out an alert to members of my trading service Friday morning to take profits in five of our biggest winners because I think there is increasing risk that we will see a correction before long.

The shenanigans going on in the most shorted stocks in the US may be the catalyst necessary to get the ball rolling to the downside.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Make Profitable Trades, More Often — Trading expert Murray Dawes reveals his unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.

Comments