Embattles casino operator Star Entertainment Group [ASX:SGR] has seen its share price collapse today, falling 15% after a capital raise, where it offered heavily discounted shares to institutional investors at 60 cents per share.

The raise is part of an extensive strategic review by the company, which has seen its share prices plunge this past year as it came under the scrutiny of regulators for its involvement with criminal activity and money laundering.

The ‘heavy discount’ is close to today’s price, trading at 63.8 cents per share.

In the past 12 months alone, the company has seen its stock drop by 74% as it collected fines and legal costs like poker chips.

Fines levied by financial crimes watchdog AUSTRAC and regulators NICC and OLGR, two revoked casino licences and four class action lawsuits have been part of the company’s operations in the last financial year, totalling $2.2 billion in non-cash impairments.

So, what’s the company’s strategic plan to turn it around?

Strategic raise to clear the table

The Star announced the successful completion of its institutional placement today, where the struggling casino operator raised $565 million.

The company also recently secured $450 million in debt facilities from Barclays and Westpac to repay all of its $668 million in debt as it attempts to clear the decks.

The Star’s Chief Executive Officer, Robbie Cooke, commented on the raise today, saying:

‘We are pleased and appreciative of the support we have received from both our existing shareholders and new investors. The refinancing and further capital structure initiatives announced yesterday represent a key milestone in the renewal of The Star.’

‘With a strengthened balance sheet and additional flexibility, we have a strong platform from which to deliver on our renewal program and strategic priorities.’

With the institutional raise completed, the Star will undertake a retail raise of a further $185 million with eligible shareholders on Tuesday, 3 October.

The funds will also help bankroll the Star’s costs at its new casino build at Queen’s Wharf in Brisbane, which has faced rising costs and legal challenges amid delays.

Real estate developer Multiplex Construction is suing the company behind the Queen’s Wharf Casino, which includes the Star and Chow Tai Fook — a group accused of Triad gang links.

Legal battles aside, the capital raise is part of the Star’s new strategic plan to reduce its debts and strengthen its financial position amidst the ongoing crackdown on the gambling industry.

The irony here is that the Star caused the regulatory crackdown in the first place.

The list of crimes, accusations, and subsequent fines is too vast to list here. Suffice to say, it’s long.

The ‘NSW Bell inquiry’ undertaken by the New South Wales gaming regulator summed up its findings by saying the Star enabled organised crime to operate suspected money laundering to the degree that was ‘serious and systematic’, as well as fraud and foreign interference.

The NSW inquiry, which ultimately found the Star unfit to hold a licence, heard evidence that the Star knew Macau-listed Suncity, and operated junket gambling tours in its casinos. These tours were linked to several criminal enterprises, including the Triads, who illegally used Chinese credit cards to spend billions in their casinos.

There was also evidence that the Star lied to regulators in the inquiry and worked covertly to stop the public hearings taking place.

Star shares have dropped over 70% in the past 12 months as faith in the operators dwindled.

So, can Star Entertainment climb out of this financial hole?

Outlook for Star Entertainment

The future of Star Entertainment is looking like a gamble for investors.

While the company’s capital raise means it will not have to part with any of its assets, the regulatory environment is an uphill battle.

The Star’s FY23 results showed $2.17 billion for ‘ongoing regulatory and legal costs’, but even this mammoth amount could be short of the full extent of the bill.

Luckily, the NSW and QLD governments appear to have little appetite for stripping the operator of its permits despite both inquiries asserting that it was unfit to hold them.

The NSW Independent Casino Commission suspended Star Sydney’s casino licence and appointed a special monitor to run the casino until late January 2024.

Financially, the company saw bounce post lockdowns as punters returned to celebrate their new freedom, but its cash flows have been poor since then.

The one ray of hope was a 22% increase in revenues, which reached $1.9 billion.

This meant the company saw an NPAT of $41 million, but statutory net profit sank to a loss of $2.4 billion from its legal woes.

The company also stated it will not be providing guidance for FY24, as the full extent of its court costs has yet to be fully scoped.

This will likely be the near future for the casino as its regulatory battles are far from over, and the underlying costs to restore the casino to compliance will continue to sting.

Hopefully, they have good lawyers.

Golden opportunity with the latest data out

Before you go, I wanted to share the big news with the latest inflation data.

The ASX 200 has gone nowhere for a year. It’s currently down -0.21% for the year and looks shaky.

With gas prices likely to remain at record highs until the end of the year, inflation is creeping back into the market.

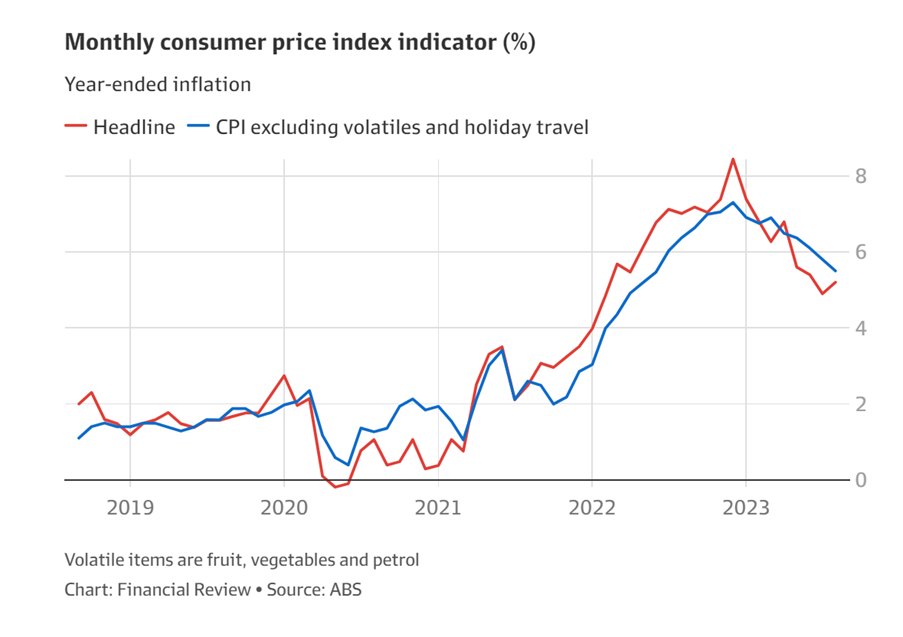

The latest inflation numbers from August saw annual consumer prices increase by 5.2%.

Source: AFR, ABS

Rent inflation is up 7.8% year over year; insurance inflation continues to accelerate.

When inflation creeps back into the market, smart investors look for plays outside of the equity market as central banks sit up and take notice.

Some people may decide to be defensive and hold cash, but inflation will eat away at your cash’s value.

That’s why our investing expert and Editorial Director, Greg Canavan, thinks gold is something you may want to consider right now.

He calls it the Great Gold Lock up, and he believes it’s where the financial insiders are heading.

Click here to learn more about investing in gold and why the timing couldn’t be better.

Regards,

Charles Ormond

For Money Morning