The Splitit Ltd [ASX:SPT] share price is down today following the release of its first quarter update.

At time of writing SPT share price is down 6.5%, trading at 79.5 cents.

The BNPL provider’s shares sank as low as 7.1% in early trade.

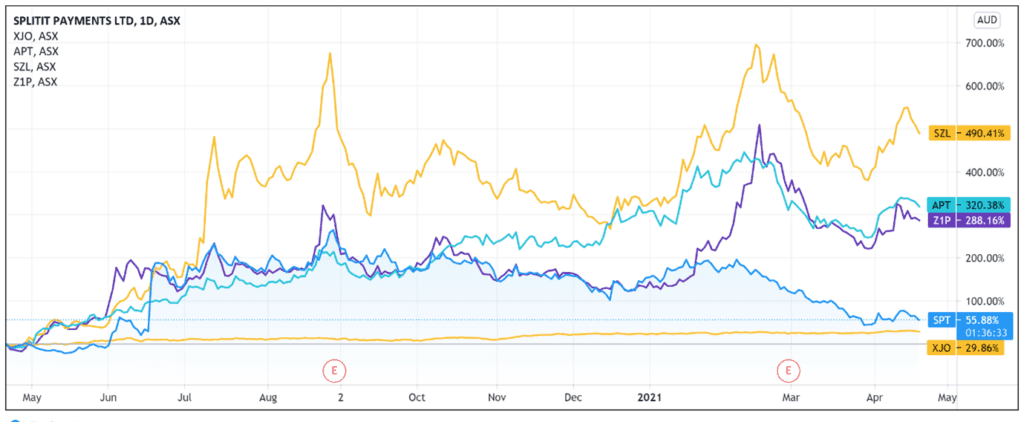

Today’s slide reflects Splitit’s recent fortunes, with the stock down 14% over the past month and down 38% year-to-date.

Despite the slump this year, SPT shares are still up 70% over the last 12 months on the back of investor interest in ASX BNPL providers.

How did Splitit perform in Q1 FY2021?

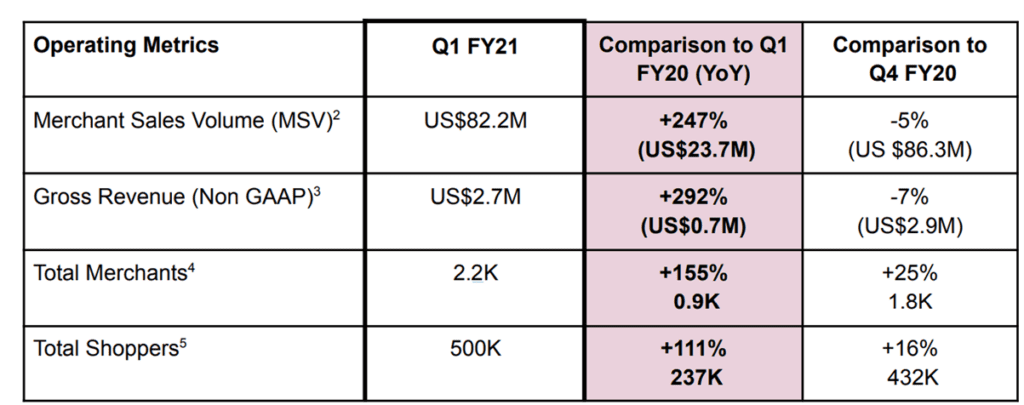

Splitit’s share price drop today may very well have to do with its slow growth quarter-over-quarter (QoQ) despite strong year-over-year (YoY) results.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

YoY, merchant sales volume (MSV) grew 247%, totalling US$82 million or US$328 million on an annualised basis.

And gross revenue rose 292% compared to Q1 FY20, coming in at US$2.7 million.

Splitit’s total shoppers count in Q1 FY21 was 500,000.

This was up 111% from Q1 FY20 and up 16% from Q4 FY20.

SPT’s total merchants base grew from 900 in Q1 FY20 to 2,200 in Q1 FY21, a 155% jump.

However, investors would have likely noticed the regression in MSV and gross revenue when compared to Q4 FY20.

Merchant sales volume was actually down 5% QoQ, with US$86.3 million recorded in Q4 FY20.

Additionally, gross revenue was down 7% compared to the previous quarter.

SPT attributed the QoQ decline to a ‘deliberate and strategic shift away from debit cards in January 2021 onwards.’

The company explained that this shift is part of its strategy to focus on its ‘core competency of credit cards which presents a significantly lower risk profile for the company.’

SPT share price outlook

Splitit’s recent slide may indicate that the BNPL is becoming a saturated market where the bigger players with network effects are beginning to distance themselves from the crowd.

Australia is a mature BNPL market at this stage, having incubated the likes of Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX:Z1P].

As we covered this week, Afterpay’s growth in Australia is slowing as it approaches full market penetration.

Tellingly however, in a mature market like Australia, Splitit is still heavily invested in raising brand awareness.

SPT today reported that one of its strategies is ‘raising awareness of Splitit’s product among consumers in key markets.’

According to the company, ‘brand awareness is growing through its ongoing targeted marketing strategy.’

Investors may be mulling over the fact that while its rival has almost become a verb denoting the whole industry (‘I’ll just Afterpay it’), Splitit is still investing in brand awareness.

If you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, then definitely read our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments