Gold exploration company Spartan Resources [ASX:SPR] excites investors today with its latest assay results from its aggressive drilling campaign.

The company saw high-grade gold intercepts at its Never Never site in WA. The drilling campaign has focused on this site which sits near the company’s old mined pit at the Dalgaranga Project.

With the expansion of the Never Never, the company stands on an enviable pathway back to production.

Shares are up by 4.35% today, trading at 48 cents per share as the company continues its strong momentum along with gold prices.

Spot gold prices are currently at AU$3,049 after a slight selloff at the end of October but still remain bullish for gold miners and investors.

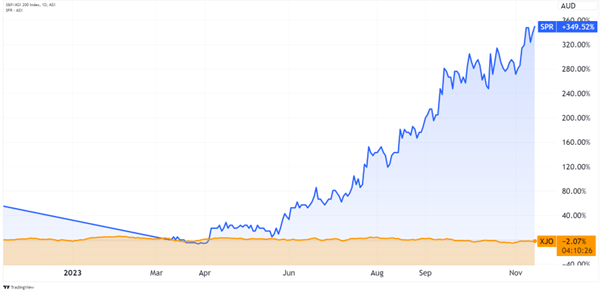

The share price has seen a 146% gain over the past 12 months as the company focuses on the Never Never site, which has doubled its MRE this year.

What are the steps from here to production, and what is the outlook for Spartan moving forward?

Source: TradingView

Spartan’s latest results

Spartan, formerly known as Gascoyne Resources, is reminding us why you should remember its new name today.

The old company shuttered the project at the end of 2022 and laid off 160 staff as the company struggled to make it through the pandemic.

In August, the company changed its name to Spartan and announced the discovery of the Never Never site just 1km from its 2.5Mtpa processing plant.

With multiple rigs at Never Never, more assay results are due. Today’s results also include strikes at the outer parts of the Never Never Resource, leaving the door open for further finds.

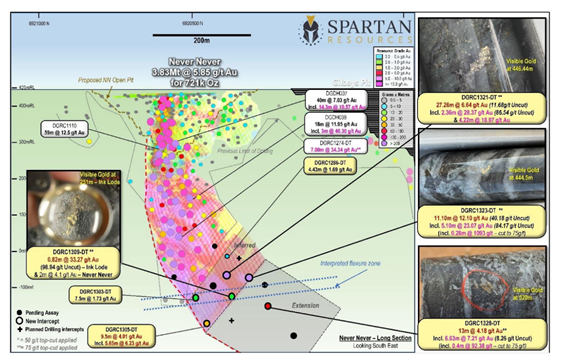

Highlights from the latest Intercepts include:

- 27.26m @ 6.64 g/t goldfrom 441.46m, including:

- 2.36m @ 28.34 g/t and 4.22m @ 18.94 g/t

- 11.10m @ 12.10 g/t goldfrom 444.90m, including:

- 5.10m @23.07 g/t and 0.28m @ 1,093 g/t

- 9.50m @ 4.01 g/t from 570.5m, including:

- 5.65m @ 6.23 g/t

- 13.0m @ 4.18 g/t from 520m, including:

- 6.63m @ 7.21 g/t

In September, the company gave a JORC Mineral Resource Estimate (MRE) update of 721,200 ounces of gold at an average grade of 5.85 g/t, plus a sizeable exploration target.

The company holds an approximate total MRE of 1.96 million ounces at an average grade of 1.6 g/t.

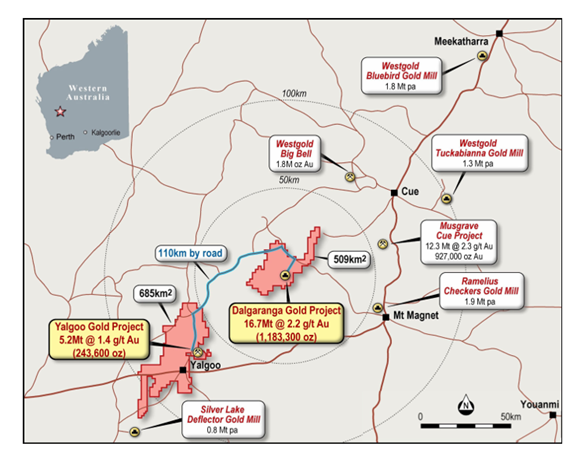

Source: Spartan Resource

This has been pivotal to the company’s turnaround, with its strategy focusing on expanding the Never Never site’s resource estimate. Spartan has also begun the leg work of pre-production and derisking, with more updates due next year.

The company is actively exploring a 500km² target around the surrounding tenements and owns two other sizeable projects in the area.

With today’s results in and more assays pending, the exploration targets appear to bear fruit for the company.

Spartan Managing Director and CEO Simon Lawson remarked today:

‘These latest drill-holes provide a window into the growing excitement at Spartan. Our Mineral Resource asset base is growing strongly with each drilling campaign, we are well on the path to establishing new high-grade reserves and we have shown we can discover, define and deliver. We are determined to keep driving sustainable and long-term value into our company for all our shareholders.’

Outlook for Spartan Resources

These latest exploration results are exciting for the future of Spartan’s development. With the drilling campaign covering 32,000 metres, all eyes are on the deepest assays, which show the bullish sign of visible gold.

The company has set out on a 5-year mine plan to incorporate both an open pit and an underground mine at the site. These will be able to leverage the existing processing plant and nearby gravity circuit.

It will be one to watch as the company transitions from a low-grade open pit miner to a new mine with some of Australia’s highest-grade gold discoveries in recent years.

From here, a decision to restart mining is due in mid-2024 and then production for 2025. The mine will have around a 5-year life with a yearly gold output of 130,000–150,000 oz.

Source: Spartan Resources (Never Never Long Section)

Digging deeper at the numbers, we can get a rough idea of how this could play out.

Suppose we assume all-in-sustaining costs (AISC) of around $1,600/oz and gold prices above AU$2,800 (currently AU$3,049).

In that case, the company is well positioned to generate strong margins of over 50% and annual cash flows above $100 million.

While these estimates aren’t gospel, you can see why the stock is on the move today.

Ideas for the next mining boom

If results like this excite you for opportunities within the Australian mining sector, we have three more where that came from.

Our resident geologist and mining insider, James Cooper, has been looking for hot stocks for investors to capitalise on the next mining boom.

We’re already seeing commodity prices on the rise at the tail end of this year, and gains are up for grabs.

Why? The world faces critical shortages of metals and minerals that Australian juniors hold.

Best of all— after a tough start to the year— many of these stocks are at bargain prices.

If you want to learn more about why this could be the best time to pick up mining stocks, click here to learn more.

Regards,

Charlie Ormond

For Fat Tail Daily