In today’s Money Morning…RBA clearly worried about China…China needs commodity prices lower…China’s precarious financial high-wire act will accelerate digital yuan…and more…

|

Dear reader,

After yesterday’s piece on central bankers’ crypto trash-talk, our attention quickly pivots to events unfolding in China right now.

In a bizarre way, what’s coming out of China circles back to crypto eventually.

We’ll get to that at the end, but for now, here’s the context…

First up, an enormous Chinese property developer called China Evergrande is on the brink.

Evergrande holds the title of world’s most-indebted property developer.

Here’s how the Australian Financial Review frames it:

‘Evergrande’s Hong Kong-listed shares have slumped 63 per cent this year, while the price of bonds issued by the company slumped to record lows last week after reports that creditor lawsuits against the company will be centrally handled in a Guangzhou court…

‘Beijing has maintained a resolute silence on whether it intends to support the embattled group, causing investors to fret about the property titan’s ability to repay its $US300 billion ($408 billion) debt burden…’

On the back of the iron ore trade, Australia’s record trade surplus is now under threat too.

Will Beijing step in to save Evergrande and in turn Rio, FMG, BHP, and the Aussie mining bull?

‘It’s a question that has serious implications for Australian investors after the near-30 per cent slump in the price of iron ore since the May peak.

‘There are fears that a collapse of Evergrande — which would send tremors through the Chinese real estate market, making it more difficult and expensive for Chinese property developers to raise debt — would further reduce demand for iron ore, given that China’s construction industry accounts for more than half of the steel used in the country.’

Given Evergrande can’t sell assets quick enough to service its debt, the problem at the heart of China is spooking investors this morning.

At time of writing, the ASX is due to fall.

Which brings us to what’s on the mind of Australia’s Money-Printer in Chief, Philip Lowe.

RBA clearly worried about China

Here’s what RBA Governor Philip Lowe had to say on the China problem in the context of Evergrande:

‘In the steel market, you see the Chinese authorities trying to contain emissions by effectively limiting steel production…So you’ve got COVID, the concept of common prosperity, some stresses in the financial system and their efforts to achieve their climate goals…There are a lot of moving parts there at the moment. We’re continuing to watch all those moving parts very closely.’

It’s remarkably candid stuff from the normally cautious and opaque governor.

Meaning one of three things could happen.

Either this is the real-deal threat to the backbone of Aussie mining — iron ore.

Beijing will bail out Evergrande and the iron ore bull will come roaring back…

Or the third option (which I think is the most likely) — China does a ‘soft bailout’ of Evergrande.

Here’s why I think the third option is most likely…

China needs commodity prices lower

When commodity prices go through the roof, China’s manufacturing monster feels the pinch in the form of lower margins.

In this instance, China needs commodity prices to go lower, so it could be a case of a managed decline for Evergrande.

A restructure, a few corporate heads will roll, but no implosion.

China has got a mountain of debt, so they need to walk a tightrope here.

Too hasty a collapse and then the house of cards falls hard.

Too easy a bailout and then commodity prices go higher, hurting their manufacturing sector.

It’ll be a case of the Middle Way for the state-managed economy.

Which, funnily enough, points to a more subdued bullishness on commodity prices for the short to medium term.

But this is where things get really interesting with regards to crypto…

Three Innovative Fintech Stocks to Watch Now. Discover more.

China’s precarious financial high-wire act will accelerate digital yuan

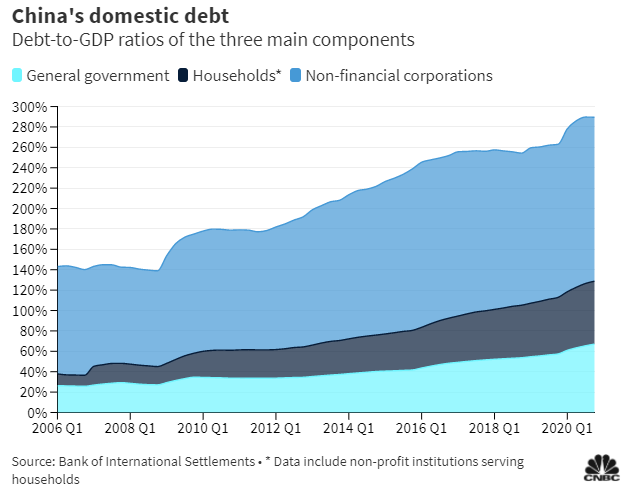

Check out China’s debt burden:

|

|

| Source: CNBC |

Non-financial corporations in China are highly-leveraged.

Meaning that the digital yuan rollout should accelerate (China’s recently launched CBDC).

Don’t like the money rules because you’ve printed a bucketload of cash to prop up your GDP growth figures?

Change ‘em.

That’s the play for China in the coming years, I think.

It also sets in motion a cascading series of events where the supposedly democratic West will be forced to reckon with the implications of CBDCs.

Do we really want super-centrally-controlled money?

Our answer will tell us more about Western ideals than any other monetary-political decision in the last hundred years.

Whatever the answer proves to be, one thing is clear.

You need to wrap your head around the changing concept of money.

There are opportunities in this environment.

If you want a head start on navigating this new money world, definitely check out Ryan Dinse and Greg Canavan’s New Money Investor service.

Regards,

|

Lachlann Tierney,

For Money Morning