| |

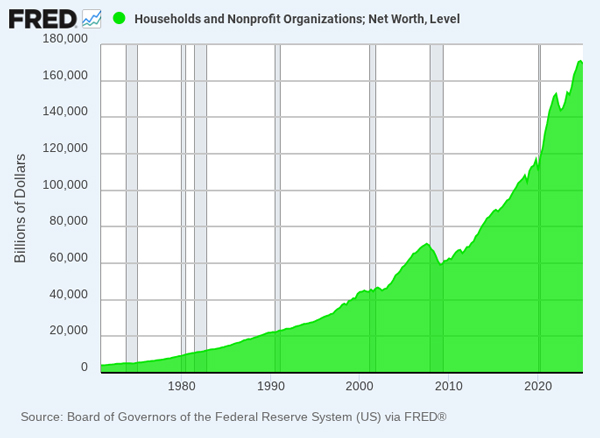

US household net worth is up nearly $60 trillion in just over five years, according to data from the Fed. Nearly half that increase is due to the rise stocks.

On CNBC, an analyst, Anthony Pompliano, told listeners that bitcoin is becoming a major source of revenue for Wall Street. People can’t wait to get into the bitcoin boom. Wall Street is developing more and more bitcoin-flavored products for them to buy.

“Over the last five years, the US dollar has lost 30% of its value,” he explained. “And the S&P, denominated in bitcoin, is down 85% since 2020. Bitcoin is a much better store of value.”

Say what? A store of value whose price goes up like a rocket? What kind of store is that? Bitcoin is trading like the biggest speculative asset since tulip bulbs, not like a safe place to store your wealth.

But let’s begin with the most basic question. Why…how…do sane, sensible people…people who put on their pants one leg at a time…trade their houses and cars for something that is as close to nothing as you can get?

And why…how…comes it to be that you can now get more than three times as many houses as you could last year…for the same amount of nothing? Twelve months ago, you would have needed about nine bitcoins to buy a house. Today, you only need three of them.

But wait. ‘Bitcoin is not nothing,’ you say? ‘It’s important information. It tells you how much money you have. And it protects your wealth from inflation.’

Maybe. But last week, we wondered how much of the stock market is ‘ghost wealth?’ A companion question: how much ‘wealth’ will go away when the shades back off?

The total value of all bitcoins known to exist is now about $2.3 trillion. But like the currency in which it is calibrated, bitcoin wealth is ghostly…spectral…unreal…and a bit scary. It appeared out of nowhere. No factory produced it. No one sweated to make it. It has no material existence of its own…and there has been no increase in the real economy to keep up with it.

At today’s prices, there is enough bitcoin wealth to buy three million houses…or 30 million F-150 pick-ups. These are real things, made by real people, working with real tools and real resources in the real economy. But they do not exist.

If investors all sold out of bitcoin in order to buy pick-ups or houses, prices of the former would go way down and prices for the latter, drawing on existing stocks, would go way up. What kind of ‘asset’ is it that loses value when you try to use it?

The value of a pick-up truck doesn’t go down when you start the engine. ‘Ghost wealth,’ on the other hand, drives away on its own.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

Suppose bitcoin rose to be worth $1,000,000…with the total market cap edging up to $20 trillion. Does that imply that there are more F-150s to buy? More houses available?

Of course not. It only means that there is an additional (theoretical) $20 trillion worth of purchasing power — more bitcoin ‘wealth’ that came out of nowhere and is not supported by real output.

And it competes with the ghost wealth in stocks — now estimated, by us, at about $30 trillion. Stock prices have gone up far more than the value of the real goods and services their companies produce. This ‘ghost wealth’ cannot be turned into real wealth because, as with bitcoin, there is no equivalent in goods and services.

Even in the darkest days of 1929, real wealth — the Model T Fords, raccoon coats, and ‘carpenter vernacular’ houses — still had value.

But the ghost wealth in stocks, bid up in the Roaring Twenties, disappeared. From a low around 67 in 1921, the Dow rose to 333 in 1929. But then it collapsed by 89% over the next three years…and didn’t return to 333 again until Eisenhower was president twenty two years later.

And, in the 1990s, there was the ghost wealth in dot.com stocks, concentrated in the Nasdaq. Like bitcoin, the dot.coms looked unstoppable. The Nasdaq rose from 1,500 in August of 1998 to over 4,600 in March of 2000.

Then, the shades split town…and took their money with them. The entire gain from the previous twenty months was wiped out…with the index falling to 1,300. It took fourteen years to fully recover.

Will the same thing happen again?

Most likely.

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia