‘Capitalism Is Creative Destruction’

Austrian economist Joseph Schumpeter

We mouth support for capitalism, but at the first sign of ‘creative destruction’, society’s socialist characteristics come to the fore…the shrill cry of ‘the government must do something to help us’ goes up.

In a case of ‘chicken and the egg’, is the Political Cycle moving further to the Left and taking the Welfare Cycle with it or is it our demand for more and more government support making us shuffle to the left?

There are a myriad of schemes, handouts, and bureaucracies demanding a greater slice of the taxpayer pie. With some ‘grants’ being a tad more questionable than others:

‘A “bum puppeteer” and “bowel movement” poet are among those awarded $80,000 in arts grants, sparking questions over why taxpayers are funding “identity politics”.’

The Daily Telegraph, 2 February 2022

In the scheme of welfare spending, $80k is nothing. However, this sort of wasteful allocation of resources is indicative of a system that’s lost its fiscal bearings.

More than 2,000 years ago, Greek playwright Aristophanes wrote about the secret to electorate success:

‘To win the people, always cook them some savoury that pleases them.’

What was true in 400BC is equally as true today.

There’s nothing quite like a decent serving of OPM (other people’s money) to win votes.

And, in the context of history, there has been no better time to ask for more.

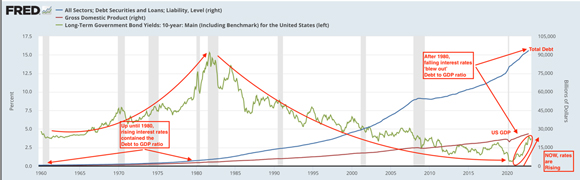

Since 1980, interest rates have been trending down…making the cost of borrowing cheaper with every passing decade.

With a picture painting a thousand words, this chart on US total debt, GDP, and interest rates since 1960, tells the story on how lower interest rates have been the great enabler over the past 40 years. This story is repeated in all Western economies:

|

|

| Source: FRED |

Over the decades, borrowing to fund promises (that come with a permanent and escalating cost) was a no-brainer for spendthrift politicians.

But what if the era of low interest rates is over?

What if the interest rates cycle is now rotating to a pre-1980, low to high, phase?

And where are we in…

The market cycle

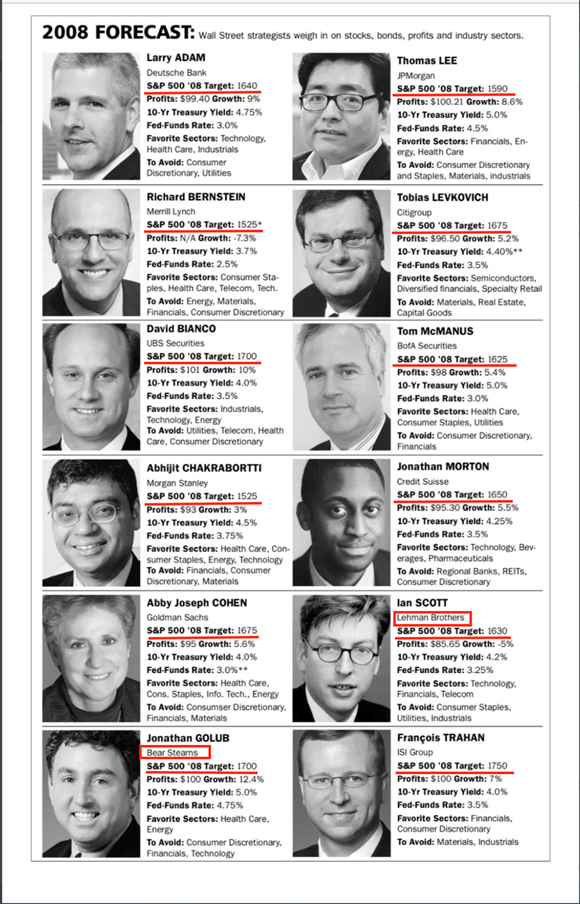

At the beginning of every year, analysts are asked for their forecast on where the market will be at the end of the year.

No matter what the conditions, things always look rosy.

On 2 January 2008 (the year Lehman Brothers collapsed), CNN reported (emphasis added):

‘Wall Street’s top forecasters have some good news and bad news for 2008. Many think stocks will head higher but that unemployment will rise and the overall economy will slow.’

|

|

| Source: Piper Sandler |

For the investment industry, the market cycle NEVER, EVER turns…it is always headed onwards and upwards.

When it comes to markets, you need to question everything…even what I am writing about.

Do your homework. But please remember, everything is cyclical…not lineal.

Therefore, do not expect ‘what has been, will continue to be so’.

Like the seasons, market conditions also change from sunny summer days to bitterly cold winter evenings.

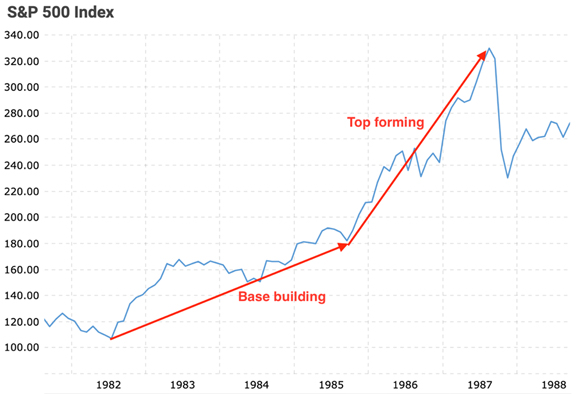

My investing cycle dates back to 1986…a good 12 months before the 1987 crash.

This is my recollection of what happened prior to and after the 1987 crash, 2000 tech wreck, and 2008/09 GFC.

From memory, the pattern in each of these memorable market events was (in broad terms) similar.

It started with a period of solid returns forming the foundation upon which the market would advance to a higher level at a more rapid pace…being driven higher in a belief of ‘what has been, will continue to be so’.

And that belief is the strongest at the peak.

The cycle always starts with a ‘slow and steady’ phase, followed by fast and unsteady.

To illustrate what I mean, here’s a few snapshots of the S&P 500 Index:

Pre- & Post-1987

|

|

| Source: Macrotrends |

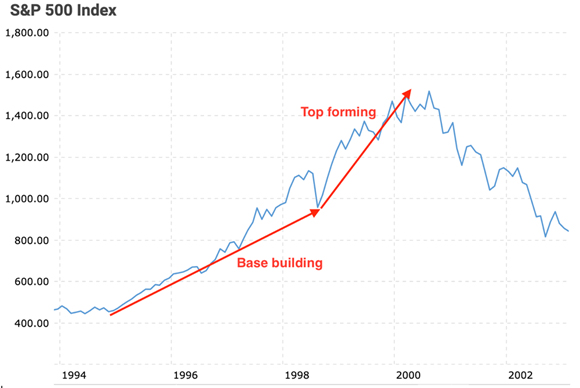

Pre- & Post-2000

|

|

| Source: Macrotrends |

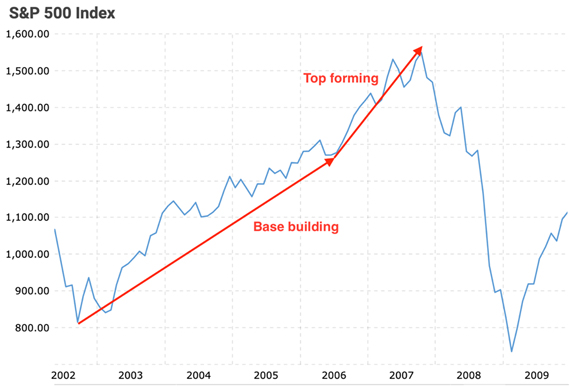

Pre- & Post-2008

|

|

| Source: Macrotrends |

The base building phases were not identical.

Some longer than others. Some steeper than others.

However, at some point in each base building phase, a switch gets flicked. The investor mindset moves from measured to hurried.

There’s an urgency to hasten the higher return process.

From memory (it’s more than 13 years since I left the industry), I recall clients being more optimistic (and, on average, wanting to be more aggressive in their asset allocation) during the top forming phase.

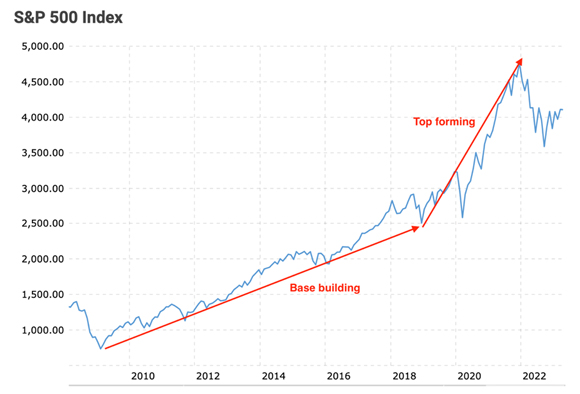

This chart of the S&P 500 Index since 2009 has me thinking, the process has once more repeated itself.

Pre-2022

|

|

| Source: Macrotrends |

It looks like the same old switch, from Base building to Top forming, was flicked sometime in 2018/19.

The top forming phase — investor urgency to participate — was set in motion.

Based on the cycles I’ve experienced; we are now in the DOWN phase of this market cycle…going from a Top to a Bottom.

A period where capital gains turn into capital losses.

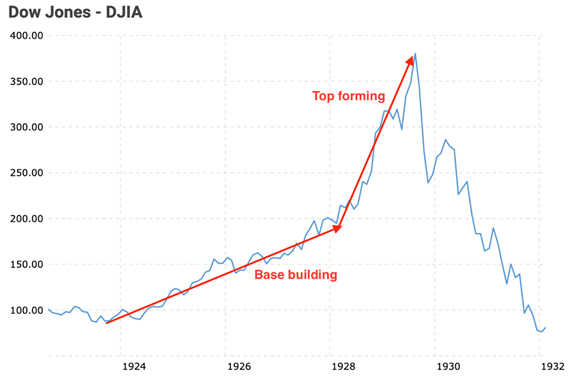

And, if we look a little further back in time, we see the greatest market collapse of all-time followed a similar pattern…

Dow Jones Index…pre- & post-1929

|

|

| Source: Macrotrends |

If cycles of markets past are a guide to the future, investors should brace for a torrid time in the coming months/years.

This is what happened after the Top toppled over…

1929 to 1954

|

|

| Source: Macrotrends |

1968 to 1982

|

|

| Source: Macrotrends |

2000 to 2013

|

|

| Source: Macrotrends |

When valuations become extreme, the market can take an extremely long time to correct the excesses.

Much longer than most people realise…or have experienced.

How will the rotation of the market cycle impact…

Your life cycle

If you’ve reached a stage in life where the years ahead are less than the ones behind, then waiting two decades for your investment dollar to be made whole again, is going to take away the best years of retirement.

Most people are dismissive of or are not seriously considering this prospect occurring.

Courtesy of four decades of falling interest rates, few people have lived AND invested through periods when the market has struggled to deliver.

But what if markets do plunge to lower levels and then go nowhere interesting for a decade or more?

What impact would this have on the retirements of millions of boomers?

Will we see even greater demand being placed on age pensions and health care services (as people drop their private health cover)?

How will governments fund the increased welfare and healthcare expenses in an environment of higher interest rates and potentially lower tax revenues (due to sluggish economic conditions)?

If the government does blink and gives in to the cries of ‘help us’ (with billions and trillions of printed dollars), we could experience a side of the inflation cycle we haven’t seen since the 1970s…a prolonged period of high inflation.

The interlocking cycles — political, welfare, interest rates, market, inflation — are all moving in a direction that, depending upon your age, could seriously impact your life cycle.

Unfortunately, in my opinion, the vast majority of society, to their own peril, are missing the Big Picture.

Until next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia