Life is a multitude of cycles — personal, professional, political — within one big cycle.

From birth to death, our lives are subject to the constant force of change.

The Success Principles, written by Dr Jack Canfield, provided a formula to explain why some people cope better with change than others…E+R=O.

To quote from the book:

‘You can’t change the events that take place in life but you can change your response to the events to create the outcome that you desire.’

Events + Response = Outcome

Some events are beyond our individual control.

Like whether the RBA will or will not raise or lower rates.

Or whether the economically challenged Greens will hold the balance of power.

Or if US bank executives will act prudently or not.

Or the Saudis will exert influence over the price of oil.

While these events might be beyond your control, in some circumstances, you can pre-empt the change that’s coming and respond in advance to create an outcome that’s more favourable to you.

This week and next, we’ll try to divine how some big cycles are interlocking to impact your lifecycle.

The political cycle

In the early 1980s, conservative luminaries Margaret Thatcher and Ronald Reagan were swept into power.

Their homespun logic resonated with the voting public:

‘The problem with socialism is that you eventually run out of other people’s money.’

British PM Margaret Thatcher

‘The nine most terrifying words in the English language are “I’m from the government and I’m here to help.”’

US President Ronald Reagan

Oh, how the world has changed.

The political cycle has rotated 180 degrees.

Today, people want — no, make that demand — the government help with other people’s money…and the more of it, the better.

Any thoughts of where the money comes from or how long it can be paid for aren’t entertained. If you’re a politician who wants the reins of power, you’d better keep it coming.

In response to the recent election outcome in NSW — which turned mainland Australia red — former Minister for Foreign Affairs Alexander Downer wrote this Opinion piece for the Financial Review:

|

|

| Source: Financial Review |

Alexander Downer offered this observation on why conservative politics is currently out of favour with the broader electorate:

‘A combination of hysteria about climate change and Covid-19 has successfully pushed the public — especially the young — into abandoning concepts such as sound money, individual liberty and responsibility, and competitive markets…The state knows best and it doesn’t matter how much it spends. That’s the prevailing zeitgeist.’

Downer’s opinion is a reasonable assessment of the situation.

A generation ago, my conservative views on family life, living within your means, there are only two genders, Christian values providing a solid foundation for a civilised society, taking personal responsibility, and welfare being for those less fortunate in life, would not have raised an eyebrow. Not these days.

Have I moved further right or has society (in general) moved further left?

In failing to respond in a progressive manner to society’s new ‘values’, I have to accept the outcome…getting pigeon-holed as a privileged white guy who’s a far-right bigot/nutter.

Downer says, ‘the political cycle will turn’.

This is true. Cycles always turn.

But the $64 question is ‘when’?

Unfortunately, I don’t see this rotation happening for at least a decade and, most likely, longer.

It would be good to see it in my lifetime, but I won’t hold my breath.

Why?

The welfare cycle

In recent weeks, the US, Europe, and China have all raised red flags over the financial viability of funding indexed age pensions to a society that’s living longer:

‘Concerns are rising over the future of [US] Social Security as lawmakers on both sides discuss potential changes to extend the lifetime of the program, which risks running a shortfall in funds sooner than one might expect.

‘A report released by the [US] Congressional Budget Office (CBO) warned the Social Security trust fund could run out of money by 2032 — a year earlier than previously thought — if Congress doesn’t make changes to bring in more revenue or reduce benefit payouts.’

The Hill, 19 February 2023

‘Police in Paris have clashed with protesters after the French government decided to force through pension reforms without a vote in parliament.

‘Crowds converged on Place de la Concorde in response to raising the retirement age from 62 to 64.

‘The plans had sparked two months of heated political debate and strikes.’

BBC News, 16 March 2023

‘China is planning to raise its retirement age gradually and in phases to cope with the country’s rapidly aging population, the state-backed Global Times said on Tuesday, citing a senior expert from China’s Ministry of Human Resources.’

Reuters,14 March 2023

Communist, Socialist, and so-called Capitalist States are all facing the reality of Margaret Thatcher’s rational thinking. You cannot live forever on the never, ever. Something has to give.

But what’s been given is not easy to take away.

As mentioned in my Daily Reckoning Australia article last week, Social Security is now an entrenched right within society.

To quote from the article:

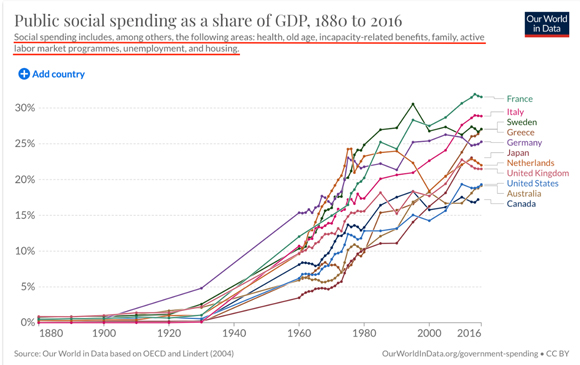

‘When originally introduced a century ago, to help the aged and most disadvantaged in society, social spending in Western economies represented a few percent of GDP.

|

|

| Source: Our World in Data |

‘Since then, governments of all stripes, have widened the “thin edge” to include all manner of welfare programs.

‘What was once considered a “handout to help the most needy” is now seen as an entitlement.’

Any hint of change to what people now consider to be their right is met with spirited opposition.

Promises were made (and expanded upon) when the demographic and life expectancy cycles were vastly different to today.

Irrespective of the damning evidence of numbers — more people living longer, lower birth rates, and budgets awash in red ink from the rising cost of healthcare and welfare — society is in no mood to listen to reason.

Promised entitlements must be honoured.

If not, we’ll bring ‘baseball bats’ to the street and ballot boxes.

In an effort to pre-empt what’s coming with social spending and how it’s funded, we can draw on the real-life experience of Japanese society.

According to the European Parliament Think Tank:

‘Japan is aging fast. Its “super-aged” society is the oldest in the world: 28.7 % of the population are 65 or older, with women forming the majority. The country is also home to a record 80 000 centenarians. By 2036, people aged 65 and over will represent a third of the population.’

Paying aged pensions to one-third of the population, for possibly three or four decades, was NEVER part of the original plan.

Common sense tells us, if something cannot continue, then it won’t.

However, life has taught me the time frame between reality and the dawning of it, can take an awfully long time.

But, be under no illusion, today’s age pension and the eligibility criteria to access it, are destined to change…and not for the better.

This is an event that is coming.

Fortunately, you have time to formulate your response.

And, in my opinion, your response should be to create a level of financial independence, so you do not need to rely on other people’s money or ask the government for help.

I appreciate this response runs counter to prevailing ‘wisdom’, but, if your life cycle is long enough, you’ll find old-fashioned values have a habit of being recycled into ‘new age’ thinking.

The market cycle

Next week’s issue will focus on where we might be at in the market cycle.

But, as a teaser, those who are relying on the traditional balanced fund to deliver the prize of financial independence may want to take note of what’s happening in US state and private pensions.

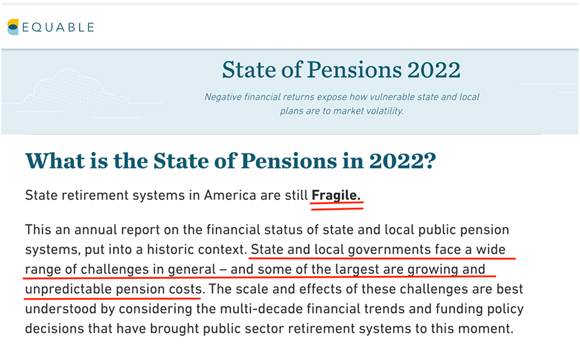

In January 2023, the bi-partisan US policy institute, Equable, published this report:

|

|

| Source: Equable |

Why are the retirement systems in such a fragile condition?

To quote from the report:

‘Asset allocations have shifted away from relatively safe fixed income investments into riskier categories in a search for stronger investment returns.’

That same shift in asset allocations has happened in Australia, the UK, Europe, and other developed world retirement funds.

Why?

E + R = O

Event — lower rates.

Response — go in search of higher risk/higher return investments.

Outcome — a system that’s on the verge of collapsing under the weight of all that reaching for return.

Until next week!

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia