Nuns used a cane. Christian Brothers preferred the harder, thicker leather strap. The teacher was the judge, jury and executioner. Punishment was dispensed according to the ‘crime’. One hit (or ‘cut’ as we called it) was for a minor misdemeanour. Six cuts were reserved for the more serious offences.

That was the Catholic education system my brothers, sister, mates and I grew up in. The rod wasn’t spared, and the child was most definitely not spoilt. And the teachers administered their brand of discipline with the support of our parents.

Am I advocating a return to the old days of ‘corporal’ punishment?

No.

It is more of a reflection of how society’s attitudes have changed over the decades.

In my youth, the police officer and teacher were highly respected within the community. Granted, some abused their positions of authority, but they were mostly good, decent people…at least the ones our family knew. They had an (almost) unquestioned moral authority to discipline society’s youth.

Not today.

The tables have turned. The young know their rights. Parents defend and excuse the behaviour of their wayward child. We have a legislative and legal system that, from the outside looking in, appears to extend a great deal of leniency to repeat youth offenders.

The breaking down of discipline and having adequate deterrents is why stories like these (published by the Nine Network) are making headlines:

‘From fatal crashes to car-jackings, home invasions and violent attacks on the street, these incidences at the hands of children and teens are happening more and more frequently.’

And…

‘Police have dealt a firm warning to vigilantes who decided to take the law into their own hands and tried to storm the [Rockhampton] home of an alleged youth offender.’

Reaching this crisis point has not happened overnight.

Little by little, the disciplinary structures of my youth have been replaced with more progressive alternatives. The former police officers and teachers of my generation express frustration (and the occasional outburst of anger) over the erosion of authority their professions once commanded. I suspect many in the community sympathise with the actions of the Rockhampton vigilantes.

Now, what do escalating youth crime and society’s ‘enough-is-enough’ reactions have to do with financial markets? More than you might realise. Things do not happen in isolation. Parallels can be drawn between financial and physical disciplines.

The banking system of my youth

The banking system I joined in 1977 bears no resemblance to the one we have today. Bank managers were once the bastion of conservativism. The gradual financialisation of the system (with more credit facilities and creating instruments of greater risk…derivatives) has consigned the once-staid bank executive to being a relic of the past…one who is a complete enigma to the modern-day banker.

The pursuit of profits (pretty much) trumps all else. Edges of the risk envelope are constantly pushed…and, at times, exceeded. When the ‘cut corners’ are publicly exposed, senior executives rarely (if ever) face prosecution. Fines are paid (from shareholder funds) and the badly behaving executives go back to operating on a ‘business as usual’ basis.

When the banking sector’s risk-taking activities threaten the system, are they held personally responsible?

To quote from an article published in The New York Times on 14 April 2011:

‘…several years after the [global] financial crisis, which was caused in large part by reckless lending and excessive risk-taking by major financial institutions, no senior executives have been charged or imprisoned, and a collective government effort has not emerged.’

What message does that send?

How is it any different to…go on…taking another car for a joyride, doing more house invasions, stealing from an old lady…there won’t be any penalties?

Failure to dispense disciplinary action has consequences. And to make things even worse, when things do go awry (like they did after the busting of the two previous asset bubbles) authorities adopt policies that aid and abet greater levels of irresponsible behaviour.

Blind pursuit of growth at all costs requires more (much more) of the same idiotic ‘solutions’…even more low-cost money and risk-taking.

Moral hazard becomes ingrained in the system. Go for broke (literally and figuratively). If it comes up ‘heads’, we win big time with bonuses. If it’s ‘tails’, the taxpayer loses.

Bankers know they will NEVER be asked to pay the price for their recklessness. Just like youth offenders who know, at worst, they’ll get a slap on the wrist…then be free to re-offend and inflict more physical, emotional and financial harm on society.

Absent any meaningful deterrent — in the case of cavalier bankers, this would be the seizure of personal and family wealth AND incarceration — boundaries get pushed and the system reaches an inflection point. The moment when society says ‘We’ve had enough of this greed is good bulls**t’ and people take to the streets (like vigilantes) in a public display of anger and frustration.

Then, and only then, will those in power take notice.

The public parading of crypto’s juvenile offenders is a case of US authorities flexing their regulatory muscles. Lookie, lookie…we’re protecting US investors from these baddies. It’s all a bit ‘too little, too late’ for my liking. But it’s good PR for the authorities…helping to project an image of being tough on financial vandalism.

But you can be assured…

Crypto is not the only ‘roach’ in the ‘everything bubble’ motel

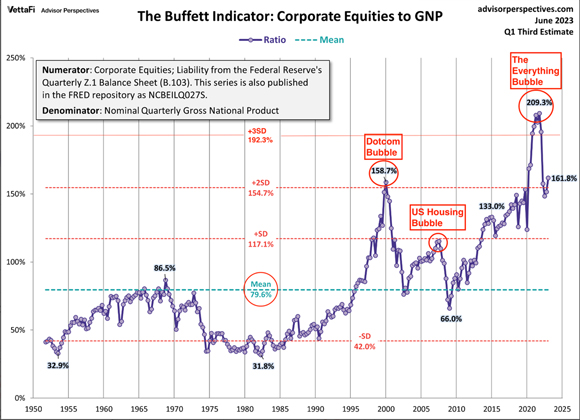

The Fed’s lack of financial discipline is evident in what’s become known as ‘The Buffett Indicator’…the ratio of the total US market to Gross National Product (GNP). Long term, the mean ratio of the Buffett Indicator is 79.6%. This makes sense…market value should not be greater than the economy supporting corporate activity. However, there are moments of regulatory and investor ill-discipline when the market value gets pushed well above the mean.

|

|

| Source: Advisor Perspectives |

At the peak of the dot-com bubble, the Buffett Indicator breached the 2 Standard Deviation (2SD) level. Investors in the tech laden Nasdaq Index paid a heavy price (an 83% fall in value) for their lack of self-control. The US Housing Bubble saw total market value briefly touch 1 Standard Deviation and then the market collapsed.

When both previous bubbles busted, the Buffett Indicator reverted to the mean (and below). The complete abandonment of discipline is what drove The Everything Bubble beyond the 3 Standard Deviation (3SD) marker.

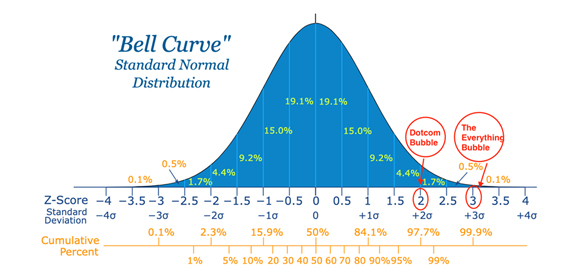

This chart shows just how rare pricing lunacy on this scale is…3SD is a 0.1% event.

|

|

| Source: Math is Fun |

Even with the so-called correction in 2022, the Buffett Indicator still sits above the peak reached during the dot-com mania. Anyone who thinks a new bull market is going to happen from this level is kidding themselves. And when the collapse in value does come, it’s going to have repercussions well beyond Wall Street.

In the broader financial sector, I think we are oh-so close to a historic inflection point…a time when something triggers a seismic shift in public mood and society takes to the streets demanding accountability.

My advice is to exercise some discipline with your portfolio and make sure you build a very healthy buffer of cash and term deposits.

Until next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia