It’s enough to drive you mad!

Yep — I’m talking about the stock market.

All year I’ve battled the bears, bores and sceptics.

I said to buy up small-cap stocks while they were hated and in the dumps. For 10 months the ASX grinded sideways. It was exasperating and dispiriting.

Then in four weeks it rips up!

What about all those concerns that pressed on the market for so long?

We can name them: inflation, interest rates, war, energy, recession.

Are they solved? Not 100%, no! But the market has factored them in…and is now moving to a different thematic.

Sounds good to me! Some of my recommendations are barnstorming their way up now.

Here’s the good news: I believe a bull market is clearly beginning. History says this could run for a long time.

Midyear, I could hardly get anyone interested in the small-cap space.

I grew frustrated. I said to hell with everybody else.

I put a presentation together for you, mostly by myself. I was so utterly sick of the mainstream piffle going out.

Look at the issues above. None of these issues are unique in the history of markets.

Nor is a ‘bear’ period. They come. They go. The world moves on. The smart investors buy up when shares are depressed. They cash in later.

You can still read that presentation now. It looks better with every passing day.

Here’s a chart and comment I included at the time:

| |

Here’s what I said:

‘I’d say most people are at somewhere between despondency and scepticism right now.

‘By the end of listening to me you should be at hope…and prepared to ‘invest on it!

‘Do you see the implication?

‘In my view…

‘Putting your money to work in the market right now is exactly ‘what you should be doing!’

Now look at the chart of the ASX since the market bottomed in October….

| |

| Source: Optuma |

Hello! This is a huge move. A whole lot of ‘relief’, wouldn’t you say?

The world isn’t ending. The American economy is fine. Most people can still pay their mortgage — and have a job.

All this has been in play for a while now. Finally, investors have thrown fear off their backs.

The bear market is over. There is going to be abundant opportunities for years. I’m not saying it’s without risk. I can’t promise you that.

Again…you can grab my top recommended stocks by clicking here. I still like them a lot, despite the big recent rally.

Now, a warning: I wouldn’t be surprised to see a move to the downside soon. It’s been a roaring move up.

Shares don’t go up in a straight line. But look through any volatility and play the long game. Think of 2025 and 2026.

Now is the time to think like a hunter, stalking your prey for the big potential killing to come.

It’s no good huddling in Woolworths and CBA if you want a crack to make a fast and furious buck in the market.

Small caps are where the action is at.

Let me show you.

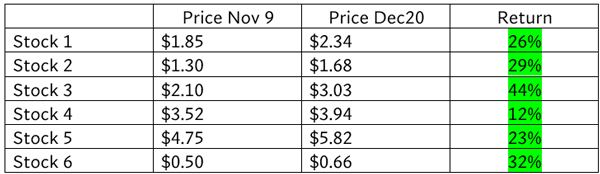

In November I gave a speech to Fat Tail Alliance members. I gave them six small-cap stocks to buy.

Here’s the returns up to yesterday’s close…

| |

See what I mean? The small-cap sector can be so exciting.

Granted…some context here is appropriate.

The last two years have been difficult. When things are suppressed like that, for a long time, a big rally can come. But it can’t last forever.

However, long term, small caps can deliver returns in the hundreds of percent.

This happens when investors switch away from being ‘defensive’ and go looking for growth.

I say we’re going into a 2–3-year period where investors will be doing exactly that.

Of course, there are no guarantees here. Small caps sit at the riskiest end of the market and are highly speculative.

However, I believe now’s a great time to sign up to my small-cap advisory Australian Small-Cap Investigator.

Either way, best of luck with your returns and investing in 2024.

2023 is ending with a bang, but it’s been a long year in the market. I’m knackered.

I’ll sign off in the same way as the late, great, gardening guru Peter Cundall…

For 2023, that’s your bloomin’ lot!

Best wishes,

|

Callum Newman,

Editor, Australian Small-Cap Investigator and Small-Cap Systems

Comments