Everybody loves to talk about battery minerals, but iron ore is still where the big money is.

The same month, we have the price going back to more than US$120 a tonne, we also find China pushing deeper into Africa.

The Australian Financial Review reports that the fabled Simandou project in the West African country of Guinea could be a lot closer to fruition than previously presupposed.

Simandou has hung over the iron ore market for years, something akin to the Spanish gold dream of El Dorado.

In this case, it’s not that the Chinese can’t find it, it’s just getting the Simandou ore to port that’s difficult.

The Simandou deposit is 550 kilometres from the coast. And as yet there are no rail lines, bridges, or tunnels to get it there.

The Chinese look set to flex their muscles, at least in terms of money, to build the necessary infrastructure.

Whether Guinea can stay stable and clean to allow the project to start shipping iron ore out by 2025 remains to be seen.

Generally, Aussie investors view Simandou the same way they did Amazon before its arrival here in Australia: with suspicion it’s coming to wreck the party for the incumbents.

I’m not so sure. It’s possible the world needs major investment into the iron ore industry to keep it well supplied.

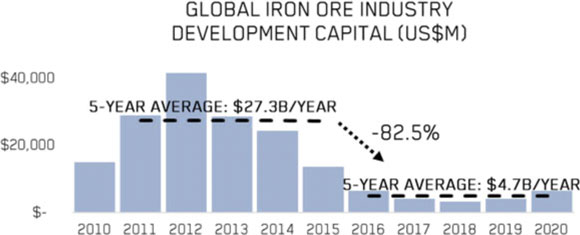

Here’s a chart I shared with my paid readers in their last monthly report. It shows the major drop off in iron ore capital spending over the last 10 years:

|

|

| Source: Champion Iron |

Granted, Simandou is not an Australian project.

But the fact that the Chinese are so willing to fund this suggests iron ore demand could stay robust for the next five years and potentially beyond. That’s a good sign for Australia.

And as stated above, iron ore is back to a booming price of US$120 a tonne.

The profits are huge for BHP, Fortescue, and Rio Tinto at this price. And they make a big proportion of index weighting…hence why the ASX is back very close to all-time highs.

Here’s another thing…both Rio Tinto and BHP released their quarterly production reports this month. Both are running at full speed to basically match what they did last year.

Point being: Everybody is always worried that the iron ore market will go into oversupply and kill the price.

There’s another scenario worth thinking about: that demand for iron ore keeps pressing ahead and the Aussie miners are already too stretched to lift production.

If, for example, coal prices can soar to US$200 or US$300 a tonne, as they did last year, there’s no reason to think iron ore can’t do the same.

Granted, I can’t tell you how likely this scenario is.

But the iron ore majors have been chewing through their reserves for a long time, and the windfall from the juicy price since 2019 has returned to investors in massive dividends…and not new mines.

Many in the market make the same argument about the oil industry, and it’s true for the same reasons.

There’s been little capital investment in future supply, but demand hasn’t gone down in the way people assumed years ago.

For some reason, the same logic is forgotten or ignored when applied to iron ore.

Here’s a bigger issue, as I see it…

The modern world tends to take raw materials for granted as if they just appear for our benefit to make iPhones and Teslas.

If only! Capital needs to be invested, projects financed, staff found, and big risks run. But most of all investors need a ‘narrative’ to believe in.

The previous massive iron ore expansion was built on the expectation of an emerging world giant in China.

Those days are long gone. China’s population is in decline, people believe China has overbuilt infrastructure, and its property market is in crisis.

Good luck convincing investors to invest billions in an iron ore project!

Why bother with that when you can talk turkey until the cows come home about the hot lithium market, or the whizz bang projections around nickel thanks to electric cars.

Coal, again, is the example here. Nobody gave a rats about coal. It was almost socially unacceptable to invest in it.

The consequence was the market went into shortage, the price spiked, and ironically, I suppose, investors who caught on early made massive gains.

Personally, I’ve been buying and recommending some of the iron ore juniors to benefit from this dynamic.

I’m up 6% on one of them, and it’s currently yielding somewhere between 10–20%, depending on how generous management decides to be in terms of the payout.

Again, the iron ore price right now is back over US$120 a tonne. That’s very good margins, with the Aussie dollar bobbing around 70 cents.

And if iron ore goes higher? Those profits will go higher again!

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Every month, I release the ‘Top Five to Buy’ from my current recommendations. I just uploaded it last week. Get started with what you need to know by going here. My favourite iron ore junior is top of the list.

Comments