At time of writing, the share price of Silver Lake Resources Ltd [ASX:SLR] is up a significant 12.59%, trading at $1.76.

You can see how the last 12 months has played out for the SLR share price below:

Source: tradingview.com

In a rare divergence from the markets up/gold stocks down narrative, the Silver Lake share price is up when the ASX 200 is tacking on 0.58% or around 31 points. Here’s why this could be an important signal.

Silver Lake’s share price is up while markets are up, could mean that a relief rally could stall soon

We normally see Aussie gold stocks move up and the broader market down and vice versa.

Such is the oft-remarked on negative correlation.

But today, the Silver Lake share price is up — which adds credence to the idea that this is exactly why it’s called a relief rally.

A bit of relief before a further fall.

Looking back at the charts, I’ve noticed that the fall in the Silver Lake share price between late-February and mid-March pre-dated a fall in gold in USD terms, and paused the rise of the gold price in AUD terms.

You can see the Silver Lake share price (candles) matched up with the USD gold price (orange) and the AUD gold price (red):

Source: tradingview.com

If history is to repeat, then what is happening with the SLR share price could be a form of leading indicator.

The theory being that gold stock investors may be moving on shares before it shows up in the spot price.

We recently discussed why the Resolute share price is stagnant in the face of a rising gold price.

We argued it comes down to political risk exposure and where mines are located.

With operations in WA, Silver Lake doesn’t really have this problem compared to Resolute.

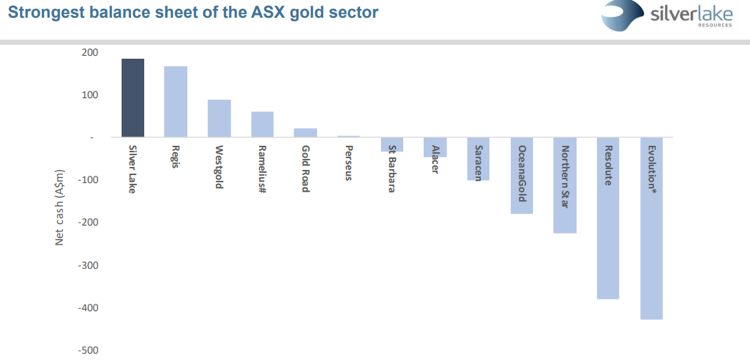

In a recent investor presentation, it also boasted of having the ‘strongest balance sheet’ of any ASX-listed gold producer:

Source: Silver Lake Resources Ltd.

Which could mean with a smart acquisition, it could be poised to grow further.

If you want to understand the main reasons behind a potentially massive gold bull run, be sure to grab a copy of our editor Shae Russell’s Pandemic Roadmap. It takes you through step by step, what could happen if this financial crisis finds its legs. Well worth a read, especially if you have never heard of central bank backed digital currencies (CBDCs). You can download it for free here.

Regards,

Lachlann Tierney,

For The Daily Reckoning