Silver Lake Resources [ASX:SLR] released its March quarter activities report, detailing production and sales for its gold and copper across Mount Monger and Sugar Zone.

SLR reported 63,153 ounces of gold and 340 tonnes of copper were produced in the March quarter, of which 62,852 ounces and 262 tonnes were sold, respectively.

The announcement, released earlier on Friday morning, was somewhat sobering. The group explained that it expects its FY23 group sales to meet the bottom end of guidance.

SLR was trading for $1.27 at the time of writing, keeping mostly flat on share price since last closing.

The stock is up 14% in the month, yet has bumped down 32% over the past 12 months:

Source: TradingView

Silver Lake addresses production, sales and guidance

The gold and copper producer produced 63,153 ounces of gold and 340 tonnes of copper in the March quarter.

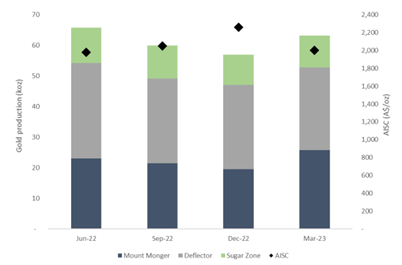

Of that number, 62,852 ounces of gold and 262 tonnes of copper were sold an at average price of $2,785 an ounce and all-in sustaining cost (AISC) of $2,014 an ounce.

In the year so far, Silver Lake has managed to sell 176,831 ounces gold and 720 tonnes copper at an average price of $2,614 an ounce and AISC of $2,104 per ounce.

The group said its ore stockpile build of 11,289 ounces reflects a record for mine tonnage, supported by a higher ore contribution from the Deflector South West (DSW).

Silver Lake’s Mount Monger mine produced quarterly gold production of 25,702 ounces with sales of 26,474 ounces, which were valued at an AISC of $2,113 an ounce. This included a non-cash inventory charge linked to stockpile treatment.

Year-to-date production at Mount Monger hit 66,712 ounces, of which it managed to sell 66,467 ounces at an AISC of $2,337 each ounce.

Silver Lake plans to start up the open pit at Santa in January 2024, having achieved successful exploration and optimisation of pit shells, believing there to be potential open pits which may foster leverage mining and processing infrastructure.

As for activities at Sugar Zone, SLR said it hit quarterly gold production of 10,290 ounces with sales of 9,066 ounces, at an AISC of $3,132 per ounce.

Year-to-date production of 30,824 ounces resulted in sales of 29,116 ounces at a per-ounce AISC of $2,849.

The group is planning a fleet renewal project and maintenance system launch for step chance in equipment and productivity, which it believes should prove a sustainable avenue for growth.

The group ended the quarter with cash and bullion of $268.1 million (excluding a $10.4 million quarter-on-quarter increase in circuit gold, and concentrate on hand to $31.4 million, at net realisable value) with underlying cash build reaching $20 million during the quarter.

110,000 ounces were hedged in the quarter at $3,006 an ounce, marked for delivery through 2024 to 2025.

Total hedged ounces of 137,000 at $2,946 an ounce will also go out for delivery through to December 2025.

The company expects FY23 group sales to be at the bottom end of the 260,000 to 275,000 ounces guidance range at an AISC of $1,950 to $2,050 per ounce.

Source: SLR

The universe of booming Australian drillers

Many in the resources industry are making raging bull market-like gains regardless of recession fears, interest rates and wider market actions.

This can be described as an alternate universe: the universe of booming drillers.

And guess what? More booms are marked to happen for many other metals.

It’s the ‘new golden age’ for junior explorers who get in early.

Aussie mining is at its best right now, but who, where?

It’s a big universe, and you may need a little help, that’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Fat Tail Commodities

Comments