- Yesterday, we touched on the bullish moves in property thanks, in part, to low interest rates.

Hence the inevitable question arises: how long can this go on for?

One way I look to gauge this is comparing my expectations about what players in the industry are doing.

We got an example of this yesterday via Maas Group Holdings Ltd [ASX:MGH].

What gives?

Maas announced that it was buying a 38-hectare development site in Dubbo with zoning for 280 housing lots.

Clearly they are bullish and think that acquiring this site now will bolster their pipeline of real estate earnings in future years.

These aren’t houses that they can sell tomorrow in the last-ditch attempt to cash in on the bubble before it bursts.

I like the move.

But I’m still not sure I’d buy Maas Group today.

I recommended the stock to readers of Cycles, Trends & Forecasts around the time it first came to market.

They were able to bank an 80% gain in pretty short order. The price began to look overripe to me, so we took the quick win.

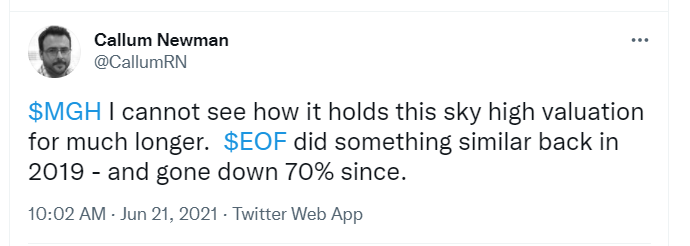

It then proceeded to coast up to more than $6 at one point. I pointed out on Twitter back on 21 June that this was way over the top (as you can see below)…

|

|

| Source: Twitter |

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

MGH closed at $5.18 on that day. It went as high as $6.32 intraday on 28 June.

It’s now down 28% to around $4.50. Even that is still a PE ratio of 80, according to Market Index.

It has a nice business model and a founder in charge of the business.

But there’s a whole lot of earnings growth already priced into the stock. Hard to see a big win on this anytime soon.

That comparison to Ecofibre Ltd [ASX:EOF] in the tweet above still looks solid too.

EOF listed at $1 or so back in 2019. It went as high as $3.50…and has pretty much grinded down ever since. You can now buy it for less than 70 cents per share.

Point being: Valuations do matter in the share market…so you need a powerful reason to enter a stock if you’re buying at a rich valuation already.

That brings me to those with much less rich prices…

- It’s the big iron ore miners! The Australian Financial Review reports that BHP, FMG, and Rio Tinto have collected a record $65 billion in profits between them.

Fortescue supremo Twiggy Forrest is reported to be warning investors, ‘they bet against the iron ore boom at their peril.’

I own all three stocks. I have no plans to sell them either. All three have paid down substantial debt and generate huge cash flows at today’s iron ore price of more than US$150. All three also trade on low price-to-earnings ratios.

What’s to like about that?

That depends on your view of inflation risk. I think it is high.

However, the bond markets, and general view, fed by central banks, is that it is ‘transitory’.

An inflation breakout would likely cut down stocks with high PEs or expected profits further out into the future. We saw a taste of this in February earlier this year.

The big iron ore miners are making big money right now and you don’t pay much for the future earnings.

You don’t have to have a fixed view of this. If things start looking shaky, you can always cut them.

Pause for a moment and consider that iron ore just fell 40% to US$130 before bouncing quickly to near US$160.

That’s still above its long-term average of around US$50 and last decade’s average of US$110 — in the middle of a pandemic, no less.

And if iron ore rises in the next few years? Few consider this but the windfall would be astonishing in scope.

On a risk-adjusted basis, I like the idea — especially if dividends are a significant incentive.

The whole mining space can offer great value. Not every stock will go up of course, but the gold sector is also offering big cash flows. Gold is more than $2,400 an ounce for Aussie miners…that’s big margins.

They could be about to get even bigger if my colleague Brian Chu is correct. He just put together a cracking presentation on why gold could be about to surge…and take certain miners up with it. Make sure to check it out here!

Regards,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.