Early Monday morning, payments solutions platform Tyro Payments [ASX:TYR] posted strong results for the first half of FY23.

Shares have been rallying for the fintech, and by noon, they were surging more than 7% — upping the stock to $1.47 a share.

Tyro also upped its earnings guidance off the back of its strong results and reignited confidence.

For the calendar year 2023, so far, shares have moved up 4%. However, over the past full year, they remain down by 42%.

Source: tradingview.com

Tyro achieves record results in first half

Reporting from Sydney this morning, Tyro provided a trading update, its unaudited results for the first half of FY23.

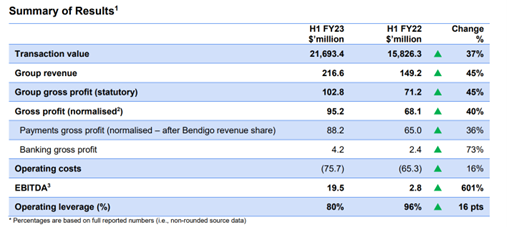

The company reported a 37% increase in transaction value in the prior year to $21.7 billion (on H1 FY22’s $15.8 billion).

TYR’s EBITDA range also improved to $37–41 million, with a target operating leverage of 79%.

The group said that its banking business saw strong growth, with loan originations up 101% to $72.7 million and banking profit rising by 73%.

For the first half, an operating leverage of 80% was reported. This is down from 96% over the prior corresponding period.

Tyro also noted that its cost reduction program is on track to offload $11 million in annualised cost base.

Jon Davey, Tyro’s CEO, commented:

‘The 37% increase in our transaction value has been driven by a 9% increase in our merchant base, growth in customer applications, and loan originations. External factors such as the absence of COVID lockdowns and inflation have also positively impacted Tyro’s transaction values, particularly in our hospitality and retail verticals.

‘The resulting focus has facilitated the accelerated delivery of key strategic priorities including the Tyro Go reader, the Tyro Pro next generation terminal, and automated onboarding. They provide a strong foundation from which we can build new customer experiences and drive further operational efficiencies.’

Source: TYR

TYR revises FY23 guidance

Tyro believes it is on track to reach positive free cash flow by the closure of FY23, especially upon reflecting on its strong results for the first half of 2023.

Also, based on these strong results, Tyro has decided to up its earnings guidance.

The payments solutions company has forecast a transaction value increase to the range of $42.5–43.5 billion, which is a significant improvement from the previous $40–42 billion.

The company also anticipates a gross profit of $187–191 million, as well as targeted operating leverage of around 79%. As Davey said:

‘The first half of FY23 has been exceptionally strong, however in forecasting the second half of FY23, we are taking a cautious approach and have allowed for some softening of consumer trading conditions due to rising interest rates and other macro-economic factors.

‘We are also focusing on a more disciplined approach to managing the profitability of our merchant portfolio. Based on our forecast for the remainder of FY23, we will be targeting a full year operating leverage of 79% or better.’

Source: TYR

Five bargain stocks

The end of 2022 was a period fraught with challenges.

With some effects of the pandemic lingering, we were handed an influx of new challenges — inflation, the war, continually rising rates…

The hard yards aren’t quite over yet, which is why everyone is looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning