Today, Perth-based gas and geothermal energy producer Strike Energy [ASX:STX] said it has had its combined Kingia Sandstone gas reserves and resources independently certified.

What followed was a surge in share price; Strike shares were rocketing 7% upwards merely hours after making the announcement on Wednesday.

While shares were worth 23 cents earlier today, the energy resources stock has seen a tumultuous landslide of 18% over the last month as recessionary fears hit home with many investors.

Nevertheless, despite lagging in its sector by 34% over the past 12 months, Strike has managed a gain of more than 12% on its own metrics in the year so far.

Source: Trading View

Strike’s South Erregulla Kingia progress

This morning, gas and resources producer Strike Energy revealed that its 100%-owned South Erregulla site has now received independent certification by Netherland Sewell & Associates (NSAI).

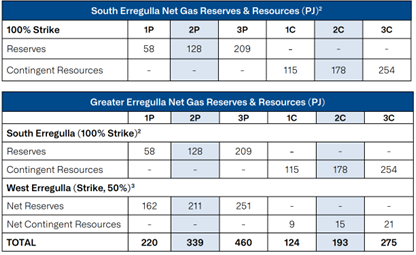

NSAI found the combination of net 2P Reserves and net 2C Contingent Resources total approximately 306 PJ — a ‘substantial upside’ in results for the Kingia Sandstone area alone.

Yesterday, NSAI submitted a report focused on the drilling, coring, log, seismic, and production testing stats from the South Erregulla 1 (SE1) well:

‘NSAI estimates net 3P plus net 3C gas Reserves and Resources totalling approximately 463, which represents substantial potential from the South Erregulla-1 well,’ Strike reported.

According to Strike, these results were due to a successful drilling operation at the SE1 well, and now the company expects appraisal drilling to occur in Q2 2023.

‘Appraisal drilling, which is currently planned for Q2/2023, has the potential to add additional Reserves and Resources and high grade the currently certified numbers, as has been seen recently through the appraisal to the North at the West Erregulla gas field,’ stated Strike.

Further drilling is also expected to further Kingia and Wagina gas Reserves and Resources, with the Wagina gas discovery anticipated to see testing in the coming weeks.

Strike’s Managing Director and CEO Stuart Nicholls said:

‘With NSAI independently certifying a combined net 2P Reserves and net 2C Contingent Resources of approximately 306 PJ in the Kingia Sandstone alone from the drilling of one well, Strike has high confidence in the gas potential of the broader South Erregulla structure and the ability to provide the gas feedstock for our integrated low carbon fertiliser development, Project Haber.

‘Strike now has 532 PJ of independently certified 2P and 2C Reserves and Resources in the Erregulla region alone2 , with the potential to add additional volumes following successful testing of the Wagina gas discovery over the coming weeks.

‘Owning and controlling 100% of the surface and subsurface rights at South Erregulla gives Strike the ability to maximise the value of the gas resource in a timely fashion through its vertically integrated energy and fertiliser strategy.

‘The drilling at South Erregulla-1 has been truly transformational for the Company.’

Source: Strike

What does the future hold for Strike?

Strike is demonstrating that it is well prepared for utilising its resources in the gas industry, laying the groundwork for testing and necessary certifications so it can soon chase production.

Earlier this month, it sought a $30 million investment tip from its shareholders to fast-track production targets to early 2023.

In raising the $30 million through investor funding, Strike would be up $65 million for its project spending balance.

Strike also revealed it would put $14 million into a low-carbon urea fertiliser acquisition in WA (the Project Harber) as it chases strategies within global decarbonisation goals.

Chasing cleaner energy — the rise of EVs (electric vehicles)

Now, decarbonisation and clean energy are expanding fast as the world chases net-zero targets.

And one of the best ways to achieve our decarbonisation goals is via EVs.

And while lithium has dominated the headlines surrounding EVs in 2021, we should not forget the other equally necessary battery tech materials — copper, nickel, cobalt, and graphite.

With lithium stocks correcting in 2022, there may be a smarter way to play the EV theme this year.

In our latest report, we profile this smarter way, and it involves what you might call lithium’s little brother.

Regards,

Kiryll Prakapenka