Shares of Red 5 [ASX:RED] and Silver Lake Resources [ASX:SLR] have moved in opposite directions following the announcement of their planned merger today.

The deal will see Red 5 acquire 100% of Silver Lake’s shares to combine two of Australia’s prominent mid-tier gold mining firms.

The merger had been expected by many after Silver Lake became Red 5’s largest shareholder last year by amassing a 12% state in the Goldfields miner.

Silver Lake’s shareholders seemed unimpressed by the deal. The company’s share price dropped by -11.66% today, trading at $1.18 per share.

Meanwhile, Red 5’s shares shrugged off the broader mining rout today, gaining 3% and trading at 34 cents per share.

Before trading this morning, the combined company was valued at over $2.2 billion, with significant assets including Red 5’s King of the Hills mine and Silver Lake’s Deflector and Mount Monger operations.

So what’s next for the combined entities, and when will the deal be finalised?

Source: TradingView

Merger creates leading mid-tier miner

The merger is presented as a no-premium merger, setting the stage for the combined entity to become a major player in the Australian gold market.

As part of the deal, Silver Lake shareholders are set to receive 3.434 RED shares for each SLR share, granting Red 5 shareholders a 51.7% stake in the merged entity.

This entity will boast a significant reserve and resource base across operations in Western Australia and Ontario, Canada.

The new entity will trail only Northern Star [ASX:NST], Evolution Mining [ASX:EVN], and West African Resources [ASX:WAF] in gold ore reserves.

The merger also improves the financial position of the two, potentially aiding in debt repayment and future acquisitions.

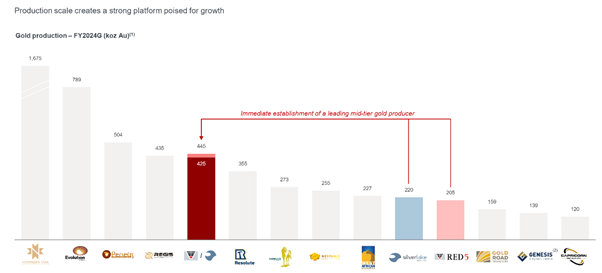

This strategic alliance positions Luke Tonkin of Silver Lake as the CEO and managing director of the newly formed company, which is anticipated to produce 445,000 ounces of gold for FY24.

Despite the merger’s strategic advantages, concerns have been raised about the longevity of Silver Lake’s mining assets.

Many have pointed to the need for significant exploration investment in the Sugar Zone mine.

Back in August last year, Sugar Zone halted operations with a plan to ‘reset’ the mine plan to understand the geology of the mine.

Nevertheless, Red 5’s management remains optimistic about the potential for extending the mine lives of their combined assets through further exploration.

Mark Williams, Red 5’s Managing Director, said today:

‘This transaction represents a logical merger of two leading mid-tier gold companies and represents an exciting inflection point for Red 5 shareholders following the successful development, ramp-up and achieving steady state production at King of the Hills. The merger creates a -445,000 oz pa diversified gold producer with assets in tier one jurisdictions. With a sector leading balance sheet, the merged entity provides a strong foundation for future growth.’

Approval from Silver Lake shareholders and an independent expert’s report are still required to finalise the deal.

The merger is exclusive, with provisions to prevent discussions with other parties, but allows for withdrawal if a better offer is presented.

The first court hearing is expected in mid to late April 2024, with completion expected in June.

Outlook for the merger

Despite the early jitters, the deal is widely expected to go through…although nothing is guaranteed.

If it goes ahead, the new entity looks very appealing on paper.

Holding a combined gold production of ~445Koz annually and a significant Ore Reserve and Mineral Resources of 4Moz and 12.4Moz, respectively, it’s a strong Mid-tier miner.

Source: Silver Lake Resources

Its assets are also well-diversified across tier-1 WA and Ontario gold regions, giving it some robustness to any disruptions.

The two would also have a combined $378 million in net cash and investments. That improved balance sheet will support Red 5’s repayments on its King of the Hill Project’s redevelopment.

For some, the fly in the ointment will be SLR’s Sugar Zone mine in Canada.

The mine requires significant investment in exploration to bring it back to life after its mothballing last year.

Due to its depth and unsure geology, there could be hidden costs here that could trip up progress.

But zooming out from this one project, we largely see a merged miner that will quickly race into relevancy in ASX gold mining.

How to catch the next Aussie mining boom

Junior miners have had it rough in the past year. Facing depressed commodity prices, many players can’t seem to catch a break.

But with trouble comes opportunity. Today, in the market, massive resource holders are worth cents.

Mining juniors that could be holding some of the largest reserves in the world in a range of minerals can be collected at discounts unseen in 50 years.

While uncertainty remains high, gold miners are having a field day.

As cautious investors hedge in gold, ASX miners are standing out as great picks to watch to balance a portfolio and diversify your holdings.

Want to know which critical minerals to look for in the next boom or what Aussie miners are holding the keys to our tech future?

Click here to learn more about the opportunities forming for the next mining boom.

Regards,

Charlie Ormond

For Fat Tail Daily