On Wednesday morning, the buy-now-pay-later (BNPL) platform Sezzle [ASX:SZL] decided to provide its October trading results, having also released its business operations and financials the prior day.

The fintech’s share price rose 10% by the mid-morning after declaring that its total income saw an increase of 18% year-on-year (YoY) and 8.7% month-on-month (MoM) with a total of AU$18 million.

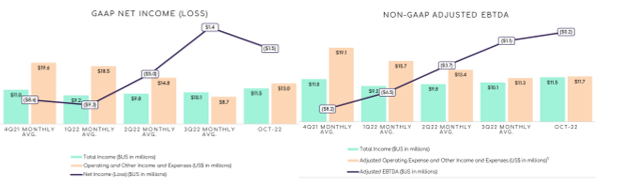

The company also revealed that it has managed to curb its losses in the October month, down to US$1.5 million in comparison to the company’s average monthly net loss of US$8.6 million — as calculated from results made in the fourth quarter of 2021.

Sezzle’s share price has climbed by more than 19% in the last month, but it is still down 86% in the year.

BNPL peers Zip [ASX:Z1P] and LayBuy [ASX:LBY] are both down the same in the year.

Source: tradingview.com

Sezzle’s income on the march, up 18% YoY

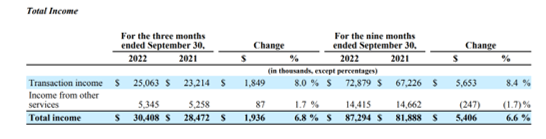

Yesterday the BNPL firm released a full rundown of its operations and financials for the past nine months of the year compared to 2021 — with SZL detailing transaction income reaching $72.9 million by September 30 in 2022, an increase of 8.4% on 2021’s $67.2 million.

Source: SZL

Today the fintech sought to update the market, including the results of its October month of 2022 and revealed a rise in total income of 18% YoY, including a bumper of 8.7% MoM.

Sezzle’s latest financial highlights were as follows:

- ‘Total Income increased 18.0% YoY and 8.7% MoM to US$11.5M (A$18.0M2), reaching a new high as a percentage of UMS of 7.8%, a 190bps YoY improvement.

- ‘The Company’s previously announced initiatives of US$60.0M in annualized revenue and costs savings remain on track to be fully rolled out in 1Q23.

- ‘Significant progress continues to be made towards profitability, as measured by Net Income (a GAAP measure) and Adjusted EBTDA (a non-GAAP measure).

- ‘For October, Net Loss was US$1.5M compared to an average monthly Net Loss of US$8.6M in 4Q21. (And a loss of US$4.3 million in September)

- ‘For October, Adjusted EBTDA was a negative US$0.2M compared to an average monthly Adjusted EBTDA of negative US$8.2M in 4Q21. (And negative US$3.4 million in September)

- ‘Sezzle Premium has over 105,000 active subscribers (15 November 2022).’

Source: SZL

Vast improvements for Sezzle bode well for future

Sezzle’s adjusted EBITDA has been significantly improving every three months — starting from a negative US$24.5 million in December to US$19.3 million in March, US$11 million in June, and then US$3.4 in September before dominating the thousands in October.

Losses also inched down by similar rates in the same timeframe before reaching the negative US$1.5 million mark.

Does this mean Sezzle is fast approaching profitability?

Based off the most recent results, Charlie Youakim, Sezzle’s Chairman and CEO, sure seems to think so. He stated:

‘Our path to profitability is not just about cost cutting, but also growing revenue. October was the Company’s second-best performance ever, in terms of revenue.

‘We are looking forward to the upcoming holiday season and expect to reach new highs in top line performance.

‘We are even more excited about 2023, as we expect to turn the corner in profitability and launch additional revenue generating and cost savings initiatives beyond the US$60.0M announced in 2022.’

Given the results released today, it will be interesting to see just what plays out for the fintech in 2023.

Exciting fintech stocks for 2023

2022 was tough for fintechs; profitability has been like a far-fetched dream up until now.

But fintechs can still provide valuable opportunities — at the right price and with the right growth prospects.

Many fintechs suffered from overconfidence in the ‘growth-at-all-costs’ business model that caught them off-guard when the markets turned.

But with the right choices, some fintechs can grow into very sturdy, lucrative businesses.

Our market expert, Ryan Clarkson-Ledward, has done the necessary research required for discerning these.

He’s discovered three profitable fintech stocks flying under the radar. One of them, he says, is a start-up ‘wrestling with the big banks — and winning’.

Click here for the free report.

Regards,

Kiryll Prakapenka,

For Money Morning