The Sezzle Inc [ASX:SZL] shares sank today despite new highs for underlying sales, active customers, and active merchants in the June quarter.

Sezzle shares were down as much as 9.6% in morning trade.

The ‘buy now pay later’ (BNPL) stock posted 118% year-over-year growth in underlying merchant sales and added 250,000 active customers during the quarter.

But it didn’t impress the market. Let’s examine why.

Sezzle’s 2Q ‘new highs’

Unlike the market, Sezzle management were ‘excited’ about today’s results, saying the quarter reflected ‘new highs in UMS, active consumers, active merchants, and repeat usage.’

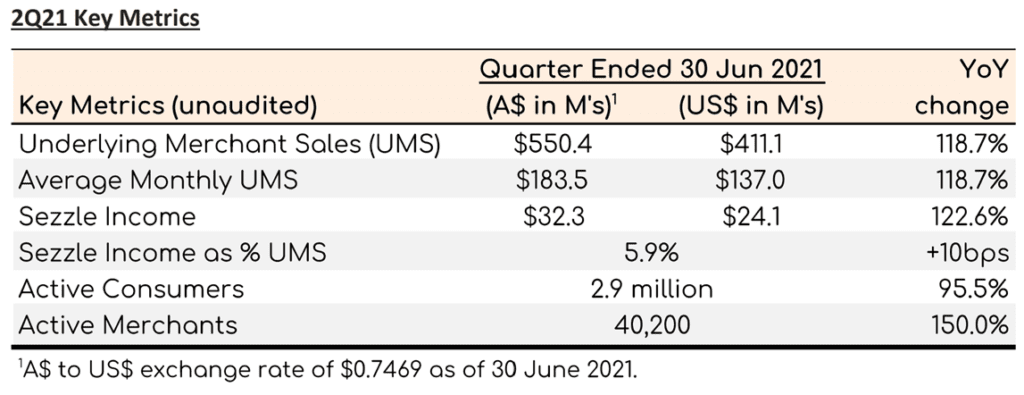

The key BNPL metrics are summarised below:

- In 2Q21, UMS topped US$411.1 million, a 118.7% YoY increase.

- Total active consumers hit 2.9 million, increasing 95.5% YoY.

- 250,000 active consumers added in the quarter.

- In a 30th consecutive month of improvement, Sezzle’s active consumer repeat usage grew to 91.6%.

- Total active merchants reached 40,200, with 6,200 added in the quarter.

Digging deeper: quarter-on-quarter growth

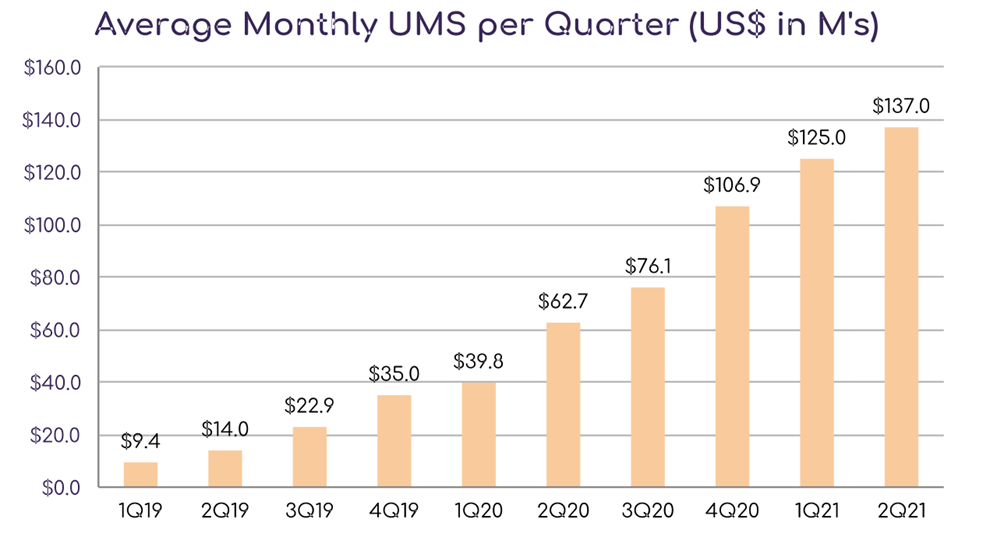

The year-over-year increase in underlying merchant sales of 118.7% is impressive.

But investors may have noticed that quarter-on-quarter growth decelerated in 2Q21.

While the average monthly UMS in 2Q21 rose 9.6% over the previous quarter, the growth was lower than the 16.8% growth reported in 1Q21 over 4Q20.

If we look further back, average monthly UMS growth in 4Q20 was a very strong 40% over 3Q20.

Additionally, while SZL’s active consumers grew 95% YoY, the number of consumers added this quarter was lower than in the previous quarter.

250,000 active consumers were added in 2Q21 but almost 400,000 active consumers were added in 1Q21.

Similarly, Sezzle added 6,200 merchants in the current quarter versus 7,300 merchants in Q121.

Finally, while SZL did record more income this quarter — $32.3 million compared to $29.2 million — the change represented a 10% increase QoQ.

Sezzle was also able to post net cash from operating activities totalling US$745,000.

In the year to date (six months) however, the company recorded a net cash loss from operating activities totalling US$4.66 million.

Sezzle share price outlook

Is today’s sell-off a sign of something transitory or does today’s reaction to Sezzle’s results indicate a more permanent shift in sentiment towards BNPL?

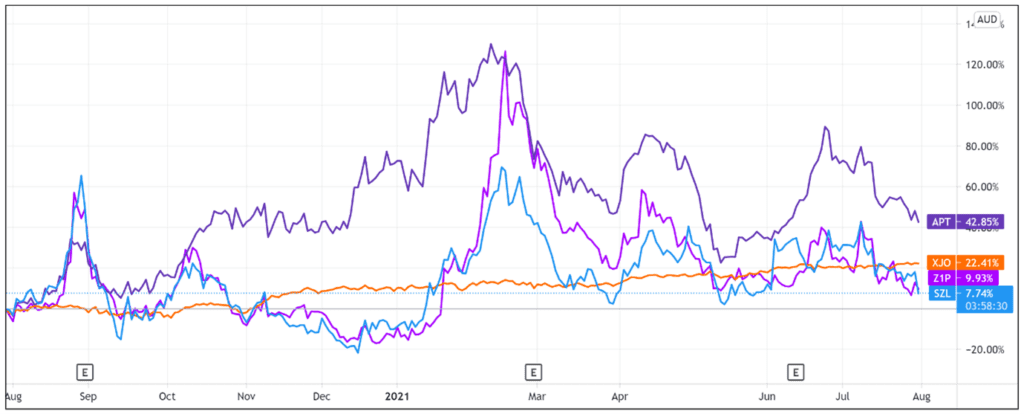

A potential clue lies in how Sezzle’s quarterly release coincided with a fall in the Afterpay Ltd [ASX:APT] share price.

At the time of writing, APT shares were down 5% on no announcement.

Zip Co Ltd [ASX:Z1P] shares were down 3%.

And Splitit Ltd [ASX:SPT] – whose own quarterly results yesterday received a frosty reception – is down 5%, taking the SPT stock to a new 52-week low.

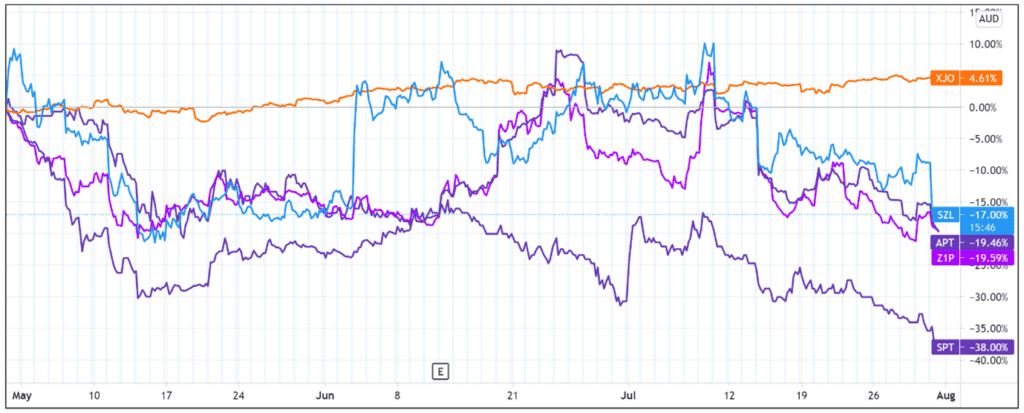

As the chart below shows, the BNPL stocks just mentioned are all underperforming the ASX 200 benchmark in the last three months.

A few months ago, when discussing the recent Afterpay volatility, I mentioned that it seems like the market is signalling that growth in user metrics is not the be-all and end-all for BNPL stocks.

Openpay seemed to corroborate this idea in its latest quarterly results.

There, the company made the interesting point that ‘the market increasingly values not only top-line and customer growth, but also healthy margins and defendable competitive positions.’

With the recent entry of PayPal and the flagged arrival of CommBank and Apple’s own BNPL offerings, it could be that investors are likely to be less taken by top-line growth but rather a BNPL firm’s enduring competitive advantage and ability to turn a profit.

It will be interesting to see how the BNPL landscape shifts (or doesn’t) in the next 12 months.

If you are interested in fintech stocks, then check out our report on three new small-cap fintechs with exciting growth potential.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here