The Sezzle Inc’s [ASX:SZL] underlying merchant sales rose 102% year-on-year in the September quarter.

Sezzle’s third quarter 2021 total income grew 79% year-over-year (YoY) to US$28.5 million.

Sezzle Inc’s [ASX:SZL] share price was flat on the results however, barely budging from their opening price. The SZL share price is currently $5.35 a share.

After earlier strong interest in the local ASX buy now, pay later (BNPL) industry saw stocks offering instalment payments run-up in price, many BNPL stocks are underperforming this year.

Sezzle is no exception, underperforming the ASX 200 by 45% over the last 12 months.

Sezzle continues to grow key metrics

Here are Sezzle’s highlights:

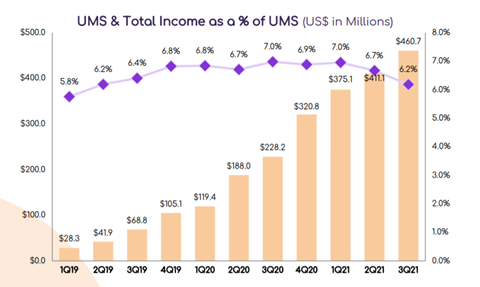

- Underlying Merchant Sales (UMS) for 3Q rose 101.9% YoY to US$460.7 million (AU$633.5 million, plus 12.0% QoQ)

- 3Q21 Total Income grew 78.9% YoY to US$28.5 million

- Active Merchants increasing 112.5% YoY to 44,400 (plus 10.2% QoQ)

- Active Consumers reached 3.2 million at quarter end (plus 77.9% YoY, plus 10.7% QoQ)

- The top 10% of Sezzle users (as measured by UMS) remained highly engaged, transacting 49 times on average over the trailing twelve-month period, ending 30 September 2021

- Repeat usage continued to improve, as it increased for the 33rd consecutive month to 92.3%

- The company significantly lowered its provision for uncollectible accounts receivable, as it declined over 100bps in 3Q21 to 2.3% of UMS from 3.4% of UMS in 2Q21

Sezzle mentioned that consumer adoption of its product offering continued to take ‘positive strides’.

Repeat usage increased for the 33rd consecutive month to 92.3%, while in-store represented more than 5.0% of underlying merchant sales in the quarter.

Sezzle’s Executive Chairman and CEO, Charlie Youakim, said:

‘We are excited to report 3Q21 results that reflect new highs, while concurrently making substantial progress in our receivable loss rates.

‘We are also enthusiastic about the recent agreement with Alliance Data’s Bread, which brings another well-known partner to our long-term lending product.’

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Is top-line growth less important for BNPL now?

Investors are seemingly less moved than they were earlier about the strong growth in key metrics like transaction volume and active customers.

It seems the growth has largely come to be expected.

What’s more important now is apparently turning large customer growth into profits.

Regarding profits, Sezzle ended the quarter with an operating cash loss of $25.65 million, despite registering $423.58 million in customer receipts.

Now, if you’re looking for stocks at the frontier of innovation and think the BNPL market is saturated, I recommend reading the latest briefing from our market analyst Murray Dawes.

Murray believes he’s found seven small-cap stocks on the ASX right now that could explode in value in 2021.

Get the details in his free report.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here