I was in Melbourne last Thursday to attend Fat Tail’s in-person event, ‘The Assembly of Fat Tailers’, which brought together some of our most loyal readers at Fat Tail Investment Research.

The last time we held such an event was in 2018. Much has happened in the world since.

What blew me away was the level of positivity in the room. After all, 2023 wasn’t an easy year in the markets.

Whether it was cryptos, small caps, commodities or tech stocks…everything has been incredibly volatile.

But the atmosphere at this event would make you think everyone there had a great year!

Even fellow gold investors were brimming with optimism, despite declaring they were 25–40% down on their holdings.

I tip my hat to them having the winning spirit!

And I think their volatile journey could soon be approaching its fruitful period.

If history is any guide, gold is set to have a great year in 2024. Which should also lead to great gains for gold stocks.

What am I basing this on?

Let us explore that now…

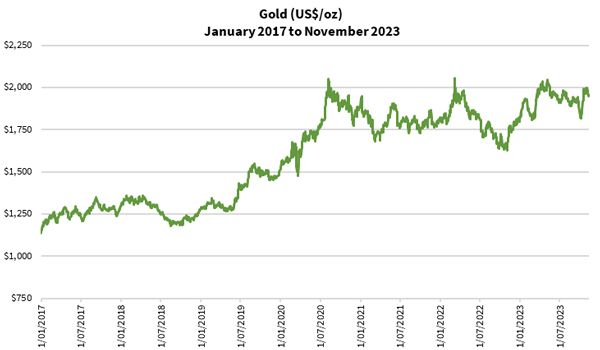

Looking back at gold in the last decade

The world lived a massive economic policy experiment after the subprime crisis.

The zero-interest rate environment was a test on whether policymakers could defy nature and treat the global financial system like a machine.

Gold was the barometer. The experiment would be deemed successful if gold remained stable as policymakers cut and raised rates as they liked.

But gold rallied hard in 2009–11, reaching close to US$2,000 an ounce…and almost derailed the experiment.

Then, in 2013, former US Federal Reserve Chair Ben Bernanke slammed gold down by using an unconventional strategy.

From there, it traded in a tight range from mid-2013 to early-2018. That allowed the experiment to continue.

By the end of 2015, the Federal Reserve felt it was ready to bring the economy back to normal. It started raising rates.

This was the acid test.

However, US President Donald J. Trump shook up this experiment when he took office in January 2017.

He fought the US Federal Reserve for control of the economy. He wanted low interest rates to help the country revive manufacturing and investments. Meanwhile, the Federal Reserve needed higher interest rates to keep inflation down.

The Federal Reserve accelerated the pace in raising rates into 2017–18. President Trump publicly slammed this approach, saying it was destabilising the economy.

In late-2018, the Federal Funds Rate approached 2.5%. The markets had twice corrected sharply during the year. It was close to tipping the markets over. There was no choice but reverse approach — so rates began to be cut from mid-2019.

Gold soared as it happened, breaking out of the tight range of US$1,045–1,400 an ounce.

With the global outbreak of the Wuhan virus, the US Federal Reserve cut the interest rate back to zero. It capitulated on its monetary policy.

Effectively, the Trump administration prevailed, but it was a pyrrhic victory.

While this happened, countries effectively shut down business activity. Governments pumped trillions of dollars into the economy to stop it from imploding.

Gold broke through US$2,000 for the first time, as you can see below:

| |

| Source: Refinitiv Eikon |

The massive flood of liquidity was meant to encourage production and business activity. The opposite occurred. The excess cash led to corporations and individuals speculating in every market imaginable — bonds, stocks, properties, commodities and cryptos.

Even with the Biden Administration taking over in January 2021, this continued with renewed rigour.

Asset prices kept climbing and set new records.

In particular, the crypto market grew phenomenally. That market broke past the US$1 trillion mark on 7 January 2021. Ten months later, it peaked at almost US$3 trillion.

While many who participated ‘increased’ their wealth in this wild speculation phase, it was illusory.

It was wealth in numbers and digital blips.

The world would start returning to reality as it reopened in late 2021.

Inflation began rearing its ugly head. Now it was flowing back into Main Street with a vengeance.

Initially, central banks tried downplaying this. However, by the end of 2021, they conceded inflation would run rampant into 2022. They knew they had to act.

Most of you could remember the first rate rise in March 2022, just as the Russia-Ukraine conflict broke out.

Gold broke above US$2,000 for the second time in 2022 just as the Federal Reserve moved quickly to raise rates.

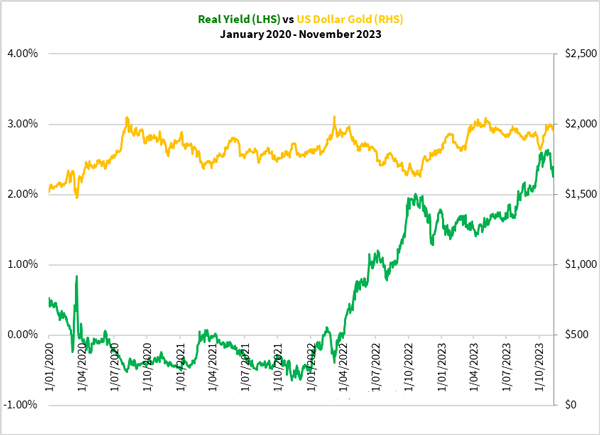

The world sees gold’s resilience

The last time the Federal Reserve tried to kill inflation was in 2013. Gold fell 45% in that cycle.

This time, the Federal Reserve’s monetary policy has been more abrupt. It has been the most aggressive rate rise cycle since 1980.

And gold is standing strong.

You can see below how gold has performed against the long-term US real yield in the last three years:

| |

| Source: US Treasure, Refinitiv Eikon |

This year saw gold again trade over US$2,000 not once, but twice.

And as the year draws to a close, the Federal Reserve is showing signs that it’s done raising rates.

Even the real yield is now falling fast.

It’s looking a lot like 2019 again…

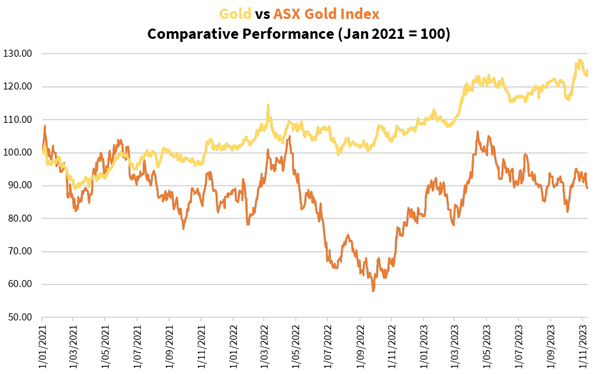

A ‘big comeback year’ for gold stocks in 2024? I’m betting on it

So what picture does this paint for gold stocks?

Let me show you where gold and gold stocks are trading relative to each other:

| |

| Source: Refinitiv Eikon |

Can you see the significant valuation gap between gold and gold stocks?

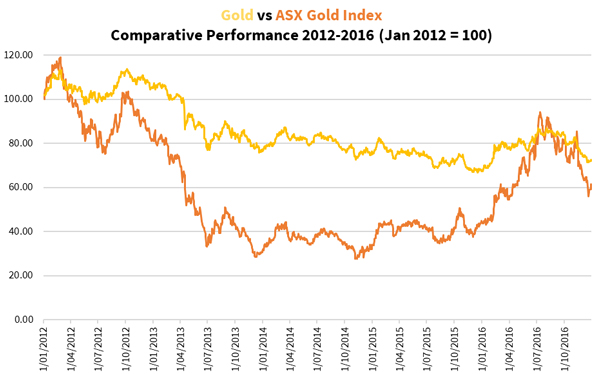

If you look back in history, it’s looking a lot similar to 2012–16:

| |

| Source: Internal Research |

Gold fell sharply in 2013, causing a big selloff of producers and explorers.

It wasn’t until 2015 that larger producers such as Northern Star Resources [ASX:NST], Evolution Mining [ASX:EVN] and St Barbara [ASX:SBM] staged a recovery.

And early 2016 was the main event.

The mid-tier and junior producers took off and outperformed the large producers that moved ahead of them. Small explorers and early-stage developers saw even bigger gains.

I’m talking about a few hundred percent returns, minimum.

Many of these stocks fell by as much as 90% in the lead-up. Those who bought as they fell ended up recouping their losses, and more. And you didn’t have to buy at the bottom and sell at the top to make these gains.

That’s why I’m excited about next year. It also explains why many gold stock investors who attended last week’s event are optimistic.

The stage is being set for a gold stock rally in the coming months.

Start preparing now

If you want to get ahead of a potential 2024 gold bull market, I invite you to join my precious metals investment newsletter, The Australian Gold Report.

You’ll find out how to buy and store bullion, how to build a precious metals portfolio and what gold stocks to consider.

You can find out more in this video presentation, where we also reveal the dark secret behind why governments around the world are quietly buying gold…even resorting to any means necessary to get hold of it.

God bless,

|

Brian Chu,

Editor, Fat Tail Daily