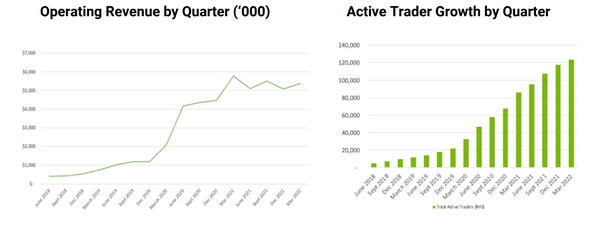

Australian investing platform SelfWealth [ASX:SWF] saw revenues rise 6% quarter-on-quarter as funds under management grew to $9.3 billion.

SWF shares were down 2.5% in afternoon trade, with the stock trading a cent shy of its 52-week low.

SelfWealth’s fall today comes after a sell-off overnight in US share markets, as investors worry about further inflation-fighting measures from the Federal Reserve.

Interest rate-sensitive stocks — like SelfWealth — often lead declines when markets price in rate hikes.

Over the last 12 months, SWF shares are down 65%:

Source: Tradingview.com

SWF’s quarterly cash and activities report

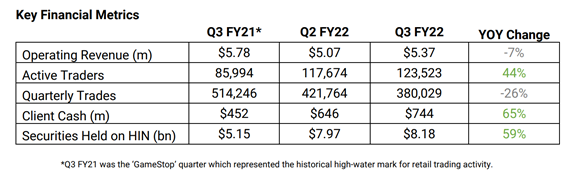

SelfWealth reported that over $9.3 billion funds are now on the platform, up 66% year-on-year.

Operating revenue saw a 6% increase quarter-on-quarter and is now at $5.4 million.

New customers have also risen 5%.

380,029 trades were made during the quarter, down 10% quarter-on-quarter. SelfWealth said this is in accordance with the wider market trading activity for 2022.

Cash balances reached a record of $744 million, a 22% increase quarter-on-quarter.

SelfWealth CEO Cath Whitaker said:

‘SelfWealth is halfway through its 18-month transformation program to build a leading retail wealth creation platform. We have attracted top technology and marketing talent, and our focus is now on increasing deployment velocity. In Q3, Hong Kong trading went live, and in this quarter, we remain on track with the launch of crypto. Based on original roadmap projections, deployment has been delayed by a quarter on each of these new revenue streams due to complex regulatory approvals required and delays in onboarding team members in a COVID disrupted environment.”

‘We are future-proofing SelfWealth by creating a market-leading wealth management platform for retail investors. We are not engaged in the race to the bottom. Instead, we are building a sustainable business model, where savvy retail investors can trust that their cash and equities are safe.’

Source: SelfWealth

Why are shares down despite growth?

SelfWealth shares continue to fall, while its investor base and funds continue to grow.

Why the discrepancy?

SelfWealth reported that investors are reacting to the ‘inflation outlook, interest rate speculation, and geopolitical tensions by switching out of equities and into cash’, which has resulted in a low volume of trades.

The platform believes in benefitting from a rise in interest rates however, expecting a positive impact on net interest and cash margins.

Competition for attention of the younger working generation will present more of a challenge as other contenders in the industry also make this a focus.

SelfWealth has provided a well-rounded analysis of the company’s growth while addressing the need for improvement given the current climate and competition in the market.

Source: SelfWealth

Selfwealth share price outlook

While users of SelfWealth’s trading platform may appreciate the low fees and user interface, prospective investors in SelfWealth stock may find the underlying business unattractive.

In its interim 1H FY22 report, for instance, SWF reported a net loss of $2.42 million, with total accumulated losses running north of $24 million.

And, more recently, in the March quarter, SWF posted a net loss from operating activities worth $1.76 million.

This is despite ‘record funds’ on its wealth platform, which is nearing $10 billion.

Rival RAIZ Invest [ASX:RZI], who is also down 45% in the last 12 months, is also trading a cent shy of its 52-week low.

Despite notching strong top-line growth, RZI posted a $1.58 million loss in its latest half-yearly update.

You could argue there’s a parallel here with ASX BNPL stocks, which continue to post strong customer and transaction volume growth, but at the expense of widening losses and growing competition.

Despite ranking fourth in the Financial Times’ Asia-Pacific High-Growth Companies 2022, SWF still faces steep competition with other big guns like Spaceship, CommSec Pocket and RAIZ.

Investors may be souring on the likes of RZI and SWF until they see a clear path to profitability.

On the topic of small-cap stocks, what other small caps are out there that are worth looking at?

And how do you even find them? Where do you look?

In these turbulent times, it can help to get a pointer in the right direction.

Our research report is a good place to start: ‘Watch These Seven Stocks Like a Hawk’.

The report profiles seven stock picks that are primed to deliver innovation and potentially upend several major industries and sectors.

Regards,

Kiryll Prakapenka,

For Money Morning