Australia’s second-largest almond grower, Select Harvests [ASX:SHV] shares are up by 9.2%, trading at $4.40 per share today as the company released its 2024 crop and market update to investors.

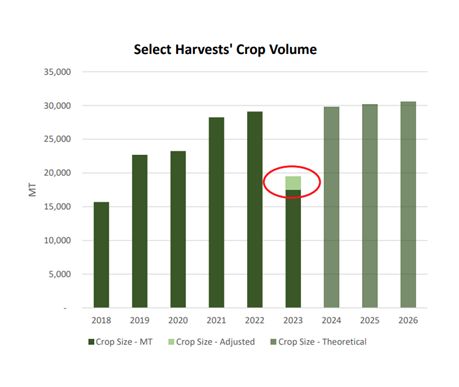

After a tough 2022 and the first half of this year, the company battled low-quality almond crops and volumes. SHV cut production estimates for 2023 back in March after what was described as an unusually colder and wetter condition throughout the growing season.

For those of us in Australia who can remember last Summer’s terrible weather, it comes as little surprise that growers faced challenges throughout the start of the year.

Share prices have struggled to recover to the $5.56 highs seen in September last year, with shares down 12.52% in the past 12 months as almond prices sit at a near-decade low.

For now, almond prices remain muted, but expectations of rising demand should match production, and with a strong El-Niño Summer predicted, the forecasts are looking sunny for this major producer.

Source: TradingView

SHV crop update excites investors

Shares in Select Harvests rose 7% today after the company reported positive outlooks for its 2024 crop.

The company currently operates in both a lease and own model for much of its crop and has a market cap of approximately $500 million.

In its update, SHV said its fiscal 2023 profits are now in line with consensus with annualised gains of $21 million.

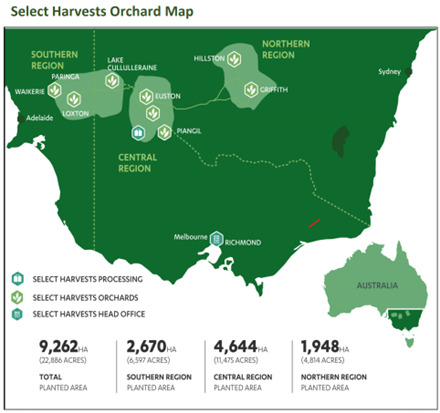

The company remains one of the largest almond companies in the world. It is unique for its operations’ wide geographic diversity and scale, currently operating 9,262 hectares of planted land.

Source: Select Harvests

The company’s new chief executive, David Surveyor, managed to maintain the ship throughout the tough year of weather and was matter-of-fact when outlining the news to investors, saying:

‘We need to manage the reality of these events but not lose sight of the fact that we have got fundamentally great assets. We need to position ourselves for growth.’

Now, as the next season lines up, investors are buying in again.

With Australia’s growers looking towards a better Summer, American growers are facing hardship after Hurricane Hillary on 19 August impacted the start of harvest operations and brought the wet and mould to growers there.

Outlook for Select Harvests

Looking ahead, Select Harvests is targeting further growth in the coming years. The company plans to increase its almond production by 7,000 tonnes in 2024, which will be achieved through a combination of its own supply and increased grower volumes.

With the challenges faced throughout the past couple of years, leadership has refocused strategy.

The company says it’s focused on achieving its strategic priorities, which include improving orchard yield and quality, securing water resources, reducing costs, and exploring lower capital-intensity growth options.

These efforts aim to ensure sustained profitability and long-term growth

But for the time being, investors will be focused on the next six months of revenue from the company as volumes being to recover at a time where supply shortfalls from America could bring new opportunities.

Source: Select Harvest FY23 Report

Overall, the strong sentiment surrounding Select Harvests’ results and growth plans could be reflected in a growing share price in the coming days and weeks.

Investors who are interested in investing in the almond industry may want to consider adding Select Harvests to their portfolio.

Nothing is guaranteed when it comes to relying on Mother Nature for your profits, but as seasons go, it can’t be much worse than last year.

Why you can’t rely on nature for everything

The sun can make or break a company’s profits, like Select Harvests. It can also play havoc on our power systems.

Renewable energy sources tend to fluctuate in generation as they rely on natural forces we can’t control.

The sun doesn’t always shine, and the wind doesn’t always blow.

Similarly, the demand for power changes throughout seasons and times of day. Often, these requirements can be at direct odds with renewable power sources.

With the flawed intermittent nature of renewable energy, many expensive solutions are required to fill the gaps so that heavy industry, manufacturing, or homes can get reliable power when needed.

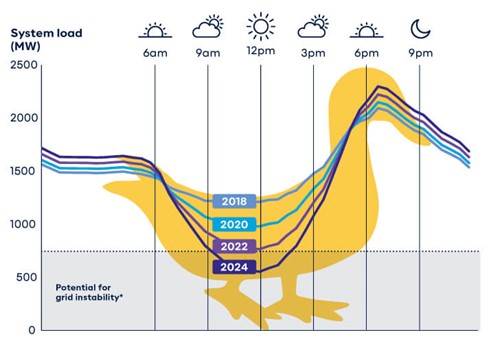

This gap is known in the solar industry as the ‘duck bill curve‘.

Source: Synergy (WA Estimates)

During the day, when demand is lowest and the sun is shining the brightest, solar can overload transmission lines that are designed for one-way electrical flows, leading to instability in grids.

At the head of the duck, these grids are again put under stress as demand rises and solar output falls to nil.

To make up for these shortcomings, expensive solutions are touted for new battery storage solutions and over 10,000 kilometres of new transmission lines to carry these renewables.

That’s a nine-fold increase in transmission lines that will also require batteries and new infrastructure to manage the needs of renewables.

And all of this is supposed to come in the next seven years.

If only there were a clean and consistent power supply that we have an abundance of in Australia…

Well, there is! It’s nuclear and it will be our future.

Nuclear: The Only Sound Energy Future — Interview with Rob Parker

Our Editorial Director Greg Canavan has been looking into the cost and implications of Australia’s energy transition to renewables from both an economic and political perspective.

In this video — a bonus episode of our podcast series What’s Not Priced In — Greg talks to Rob Parker, founder of Nuclear for Climate Australia. Rob uses the example of Ontario, Canada, as a model for Australia. The province has significant nuclear energy, no coal, and lower retail electricity costs than Australia.

It’s an enlightening conversation and one you certainly won’t hear in the mainstream media.

Check it out here.