A quick look at the SEEK Ltd [ASX:SEK] share price which is spiking today.

The online job advertiser experienced a huge drop in business with the emergence of COVID-19.

The company recovered well from the March fall, but has it run out of steam?

Trading at $20.90 at time of writing, the SEK share price has appeared to be a bit fragile over the last few weeks.

Source: Optuma

What’s happening at Seek?

As a company, Seek is mainly known for its online job advertisement arm. Since the onset of COVID-19 this has taken a hammering.

Job ads are down 30% year-on-year. Which stands in stark contrast to a lot of other online businesses that have flourished throughout the pandemic.

The key difference between Seek and other online businesses is that they sell jobs. And as we all know, to get a job you have to usually leave home and go to work — something unavailable to most in the current climate.

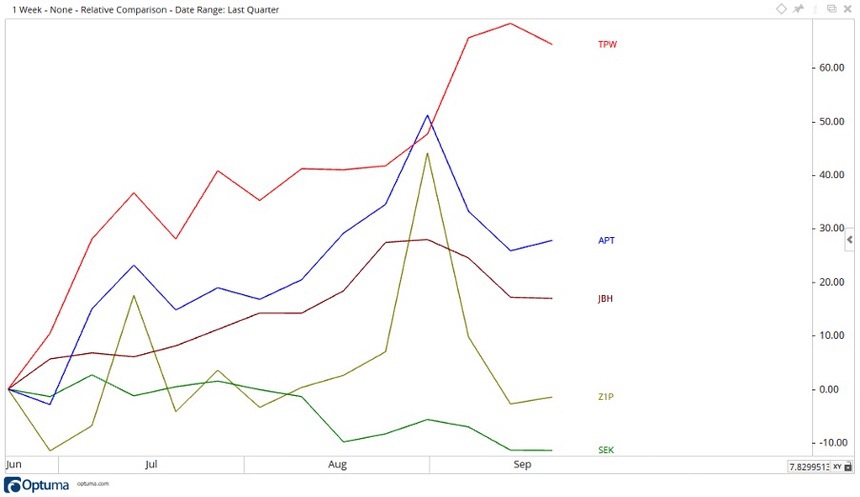

Take a quick look at this comparison of some major winners in the online space relative to the SEK share price:

Source: Optuma

By comparing Seek to some other online companies, it’s easy to see the difference in fortunes in the last quarter alone.

Temple & Webster Group Ltd [ASX:TPW] and Afterpay Ltd [ASX:APT] are top of the pile and surged ahead.

JB Hi-Fi Ltd [ASX:JBH] and Zip Co Ltd [ASX:Z1P] are coming through the middle and SEEK Ltd [ASX:SEK] is wilting away.

While this all seems grim, there is light at the end of the tunnel. The company reported job ads are up by 2.3% month-on-month at the end of July.

While the pandemic continues, uncertainty must be expected in the job market.

Where to from here for the Seek share price?

Over the last four weeks the SEK share price fell away a little, declining on lower volume may indicate the sellers are in control just yet.

Source: Optuma

From where the SEK share price sits at time of writing, if it does fall back then the levels of $20.20 and $18.92 may come into play.

If the share price can keep moving to the upside, then the level of $20.20 may become the focus for future resistance.

Regards,

Carl Wittkopp

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — these innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments