Did gold and silver’s spectacular run just end last Friday?

As Australians headed to bed, gold was still trading well over US$2,350, and silver was over US$31.

While we slept, a selling wave took over gold and silver, plunging it by almost 3.5% and almost 7%, respectively.

This was quite a move and something we haven’t seen for a while. The last time it fell by more than this amount was on 17th June 2021 when it dropped almost 4.5% from US$1,856 to US$1,773.

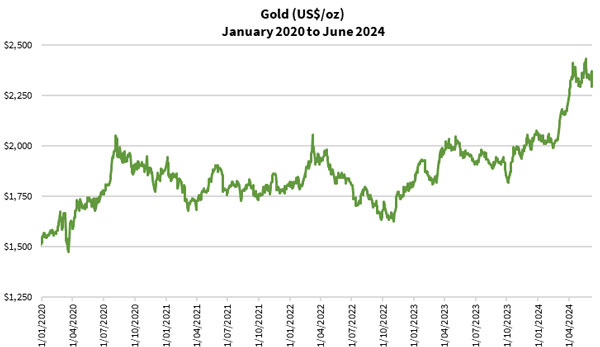

Gold’s moves in the past four years have been impressive. Since breaching US$2,000 for the first time in August 2020, it traded between US$1,610 to US$2,050 for three years.

It suddenly broke out of that range in mid-March this year after the US Federal Reserve announced it could cut rates three times this year.

The pace in which gold rallied was nothing short of breathtaking as you can see below:

| |

| Source: Refinitiv Eikon |

Meanwhile, silver traded in a similarly tight range until it broke out in March 2024 and breached its 12-year resistance level of US$30 in May:

| |

| Source: Refinitiv Eikon |

While precious metals enthusiasts have geared themselves up for what could be a stellar year in 2024, could this latest drop cast a shadow on these hopes?

I believe that four major news announcements contributed to gold and silver selling off.

The first is the Bank of Canada being the first major economy to cut rates last Wednesday to 4.75%.

The European Central Bank moved next the day after, reducing the interest rate to 4.25%.

Next was the release of the US non-farm payrolls data that beat consensus estimates.

And the fourth was an announcement by the People’s Bank of China that it had paused buying gold last month.

In today’s article, we’ll break down these four catalysts and examine to what extent these could affect gold and silver’s levels in the coming months.

But first I’ll provide some context to our financial system so you can see why these announcements matter.

How we lost our way with the

petrodollar system

Most of you know I’m a sound monetary system advocate. I also am particularly critical of the petrodollar system that we currently live with.

Our system involves central banks, governments, financial institutions and households participating through saving, borrowing and investing. The currencies we use are created artificially by government decree (fiat currency) and borrowed into existence from central banks. It comes with interest attached.

Central banks set the interest rate to help regulate the flow of funds in the economy.

Since the creation of the US Federal Reserve in December 1913, we have seen a gradual shift from a monetary standard that uses gold as backing to one that relies on the US dollar.

As the US government (and other governments for that matter) failed to balance their budgets, they borrow more, causing the currency supply to skyrocket.

To date, the US government debt stands at US$34.8 trillion. That doesn’t include household and corporate debt as well as unfunded liabilities for retirement. Including those would amount to over $100 trillion.

This number is staggering. And it’s just the US.

Imagine what the rest of the world is like.

So on one end, you have governments borrowing to fund spending. On the other you have the central banks setting the interest rate to try to regulate economic activity.

Theoretically, if governments and central banks are independent of each other, you have some form of checks and balances.

Of course it’s not that simple.

We’ve seen how government officials appoint people to sit on the central bank boards.

Case closed.

The legacy of zero-interest rate policy

We’ve experienced an economy living on nearly 0% interest rate for much of the last 15 years.

It only started rising significantly since mid-2022.

Before that, we’ve seen the biggest debt creation ever seen in our history.

You can imagine why. Some of you may’ve participated in this too as you borrowed to buy your home and even built your property portfolio.

At the same time, the huge increase in the supply of currency led to a period of inflation.

Prices of almost everything rose as more currencies flowed around the system.

The rising price of gold and silver are just two examples.

Creating an economic illusion

Now let’s delve into how the rate cuts by the Bank of Canada and the European Central Bank played a big role in causing gold and silver to fall.

The proxy for the petrodollar system’s health lies in the US dollar’s value.

It becomes increasingly worthless when the price of everything else rises in US dollar terms. We’ve seen the failure of the Weimar Republic, Zimbabwe and Venezuela as their currencies plummeted.

The price of gold is a good proxy indicator.

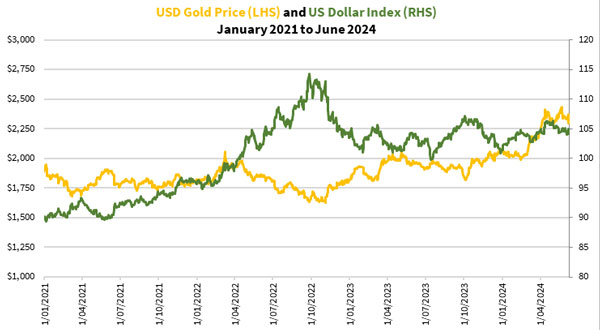

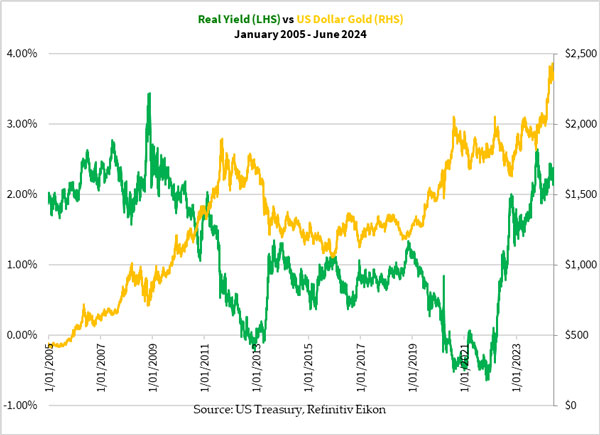

Some of you recall how the price of gold moves in the opposite direction with the US Dollar Index [DXY] and the inflation-adjusted yield of long-dated US Treasury bonds:

| |

| Source: Refinitiv Eikon |

| |

| Source: US Treasury, Refinitiv Eikon |

The US Dollar Index measures the relative exchange rate of the US dollar against major currencies. The higher the index, the more valuable the US dollar is relative to these currencies. However, it’s a relative measure.

Next is the relative interest rates paid by different economies.

With Canada and the European Union cutting their interest rates, the US dollar looks more attractive. Debt in US dollars pays a higher return, assuming all these economies have a similar level of inflation.

And a higher US Dollar Index placed selling pressure on gold and silver.

Next is the non-farm payrolls data release last Friday. The aggregate number of jobs created exceeded consensus estimates. Furthermore, the inflation-adjusted hourly earnings increased modestly.

On the surface, it fuelled the narrative that the US economy is moving in the right direction. This gave the US Federal Reserve a pretext to delay cutting interest rates.

Of course, delving deeper into the report reveals major issues with the types of jobs created and underemployment.

But the narrative stood, and the market responded accordingly.

China paused buying gold last month,

big deal?

The final kick in the guts of gold and silver came from the People’s Bank of China announcing last Friday that it didn’t buy any gold during May. It had been buying gold in the 18 months before that.

The markets took that as another reason to sell precious metals.

One of the biggest proponent nations for gold stopped buying gold! Better sell now!

But I believe this was a red herring.

Just because the People’s Bank of China didn’t officially buy gold, it doesn’t mean the Chinese economy is shunning gold.

Far from it.

Firstly, gold enters the country through different ways, and it’s unlikely to leave it after.

Secondly, there could be other reasons for China pausing the purchase of gold that may strengthen the case for gold.

Perhaps the Chinese economy is facing a major demographic problem and a housing debt crisis? Hence, the priority of the PBOC and the government is to spur the economy rather than buy more gold. And those who want to protect themselves from this economic weakness may seek refuge in gold.

A perfect storm that’ll blow over fast

I hope you can see how these four announcements combined to create a perfect storm for gold and silver to take a dump.

The timing of these announcements also seemed coordinated to achieve the effect of dressing up the US dollar and the failing petrodollar system.

Delving deeper into each case, you’ll see many holes with which may weaken the narrative.

Furthermore, I believe the market will see through this trick, especially the US jobs data.

Therefore, this could be a temporary selloff for gold and silver.

And don’t be surprised that other central banks will rush to take one for the team to help the US Federal Reserve delay the inevitable rate cut. This appears to be their playbook.

Rather than fear the selloff, you might want to consider capitalising on this opportunity to get into precious metals or build your holdings.

Let me help you get started with a comprehensive plan to build a precious metals portfolio with my investment newsletter, The Australian Gold Report. Find out more by clicking here!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments