Lithium developer Sayona Mining [ASX:SYA] said the restart of its North American Lithium operation in Quebec is on track for Q1 23.

Despite the update, SYA shares were down over 7% in late afternoon trade on Friday.

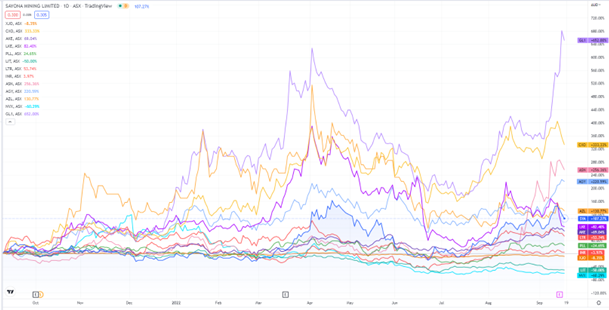

Year-to-date, SYA shares are up 110%:

www.TradingView.com

Sayona’s NAL project inches closer to restart

SYA’s North American Lithium (NAL) operation in Quebec has been declared ‘on track’ for its anticipated Q1 23 restart, as certain works push towards completion stage.

94% of the mine’s purchasing is now complete, and 95% of permits have come back with the necessary approvals.

NAL’s project team saw the installation of HP300 and HP400 Cone Crushes with the change room now complete. Wet High Intensity Magnetic Separators (WHIMS) have also been placed.

Sayona also reported around 70 new hires entered the site, having focused on filling management and senior team roles.

The budget for the project has seen some alternations, lowered overall to CA$95.5 million, down from CA$97.75 million.

This was due to some scoping reductions and a change in commitments that have dropped expenses from CA$45.4 million to CA$41.6 million.

With its teams working closely with contacts and vendors, some innovative strategies have been formed, benefiting the project’s scheduled and contingency plans, such as avoiding delays in deliveries of equipment.

Sayona’s Managing Director, Brent Lynch, commented:

‘We are delighted to see the continued progress towards the recommencement of lithium (Spodumene) production at NAL in Q1 2023. Our project team has overcome potential challenges due to proactive forward planning and the early ordering of critical long-lead equipment items, while the near completion of permitting and procurement puts us in an excellent position.’

SYA outlook

The company also announced that 50% of its lithium carbonate plant has been built.

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

Sayona is also assessing whether to go into lithium carbonate or hydroxide production, having committed to launch downstream processing in the Canadian province.

SYA also revealed it has been accepted into the S&P 200 Index for trading beginning on Monday, which the company anticipates will bring a new level of investments in the business.

From Brett Lynch:

‘Our recent achievements have been recognised by investors, as seen by our promotion to the S&P/ASX200 index, and I would like to thank shareholders for their continued support.

‘With the right team in place, an ESG-friendly operation due to Quebec’s clean and green hydro power and the backing of key stakeholders, we are well placed for further growth as the leading lithium producer in North America.’

Overlooked ASX lithium stocks

New analysis from Morgan Stanley showed that lithium remains a hot commodity for retail investors with strong interest in juniors, like Lake Resources [ASX:LKE].

Morgan Stanley analysts found that the retail value traded in lithium stocks rose past $3 billion in August, up from $500 million in August 2020.

Lithium stocks still dominate the attention of retail investors.

That makes it harder to find bargains and mispriced opportunities. With so many eager investors scouring the sector, the easy money has likely already been made.

So, do any neglected ASX lithium stocks remain?

Yes, according to Money Morning’s recent research report on the local lithium sector, which profiles three overlooked lithium players.

Regards,

Kiryll Prakapenka

For Money Morning