As one of the leading independent oil and gas producers in the Asia-Pacific region, Santos [ASX:STO] comes under considerable scrutiny when it fails to deliver as expected.

That said, it didn’t come out with the best news on Thursday, when management released an oil production and operations summary for its latest quarter.

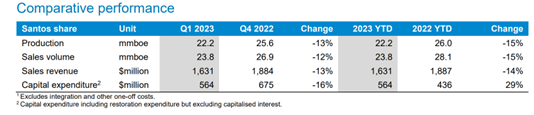

Santos said it has experienced lower production by 15% to 22.2 million barrels of oil, after production moved much slower than the previous quarter.

Sales revenue subsequently decreased by 14%, totalling US$1.6 billion (around AU$2.4 billion).

STO’s share price was trading for around $7.03 by midday, having tumbled 2.5% in the past week, and 14.5% in the last 12 months. In its sector, STO is down 16% and down 12% versus the S&P 200:

www.TradingView.com

Santos experiences downgraded production

The oil, gas, and fuel heavyweight Santos has put out its first quarter report for the period ending 31 March 2023.

The company revealed production was 15% lower than the prior quarter, posting 22.2 million barrels of oil (mmboe).

The reason given by the company was a reduction in domestic gas volume in WA, with some support from an extension of production at the group’s Bayu-Undan field.

Sales revenue therefore came out with a total of US$1.6 billion, a dip of around 14% on the last quarter, all up displaying a 13% slide in both sales and production for the latest quarter.

Financially, Santos maintains balance sheet strength in US$466 million from the on-market share buyback so far, which it expects to reach US$700 million.

The company said it has been able to maintain its promise to provide adequate shareholder returns as part of its share deliverance strategy and posted free cash flow of around US$720 million in the first quarter.

Santos projects update

Santos’ Barossa project is now 56% complete, however, drilling activities remain halted on resubmission and approval of the environmental plan.

The group hopes that drilling activities can recommence before the end of the year.

Pikka Phase 1 is scheduled to begin drilling activities in the second quarter and FEED entry on the integrated Papua LNG project was completed in March, with first production expected by the end of 2027 to early 2028.

The group’s Moomba CCS project is also now 60% complete with first injection expected early 2024.

With construction of the first 0.25 tonnes-per-day Direct Air Capture unit has been completed, field trials in the Cooper Basin are planned for the first half of 2023.

All guidance for 2023 remains unchanged, which includes PNG LNG at a 42.5% working interest and excludes Bayu-Undan.

STO said guidance will be revised once the expected sell-down of its 5% interest has been completed.

Managing Director and CEO Kevin Gallagher said:

‘Our Santos Energy Solutions business continues to work on building new revenue sources through decarbonisation projects. The Moomba CCS project, which will be one of the biggest in the world, is 60 percent complete and on track for first injection of CO2 next year. We have also established a partnership with Osaka Gas to investigate the feasibility of carbon neutral synthetic e-methane from green hydrogen in the Cooper Basin.

‘Despite the uncertain external environment Santos continues to perform strongly against the backdrop of regulatory and economic uncertainty. The disciplined operating model we have in place positions us to deliver on our strategy to backfill and sustain our infrastructure, decarbonise and develop future clean fuels.’

Source: STO

Australia’s drilling boom

The wider energy industry is making massive bull market-like gains despite recession fears and interest rate hikes.

It’s been described as a ‘new golden age’ for junior explorers — and for investors who get in early.

There are many are small caps primed to grow into successful mid-to-large caps, but how do you tell which ones?

You may need a little help from our commodities expert, James Cooper.

He’s found six ASX mining stocks that are heading to top the charts.

Regards,

Mahlia Stewart

For Money Morning