The world’s second-largest mining corporation, Rio Tinto [ASX:RIO], released its third-quarter production results on Tuesday.

RIO shares are down 20% year to date.

Source: tradingview.com

RIO’s Q3 production and operations

Rio Tinto released the latest production results for the third quarter of 2022.

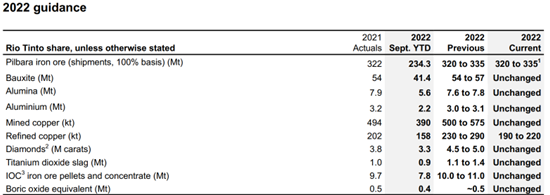

Here are the production highlights:

- Bauxite production was 2% lower than in Q3 2021, churning 13.7 million tonnes despite issues regarding equipment reliability.

- Aluminium was also 2% lower, with 0.8 million tonnes, 4% higher than the previous due to smelter issues experienced last quarter.

- Copper production was 10% higher at 138,000 tonnes.

- Pilbara operations were 1% higher, producing 84.3 million tonnes, 7% higher than the prior quarter with ‘continued commissioning and ramp-up of Gudai-Darri and Robe Valley’.

- Third quarter shipments were 1% lower at 82.9 million tonnes.

- 29% of sales were made on a free-on-board (FOB) basis, with the remainder sold including freight.

- Titanium dioxide slag production was 48% higher, at 310,000 tonnes.

- Iron ore pellets and concentrate were 28% higher, thanks to improved operational performance.

- The company’s Pilbara iron ore in unit cost guidance for 2022 of $19.5–0 per tonne remains unchanged.

- Copper C1’s unit cost guidance has been revised to 150–170 US cents/lb for 2022 (previously 130–150 US cents/lb)

Source: RIO

RIO’s ‘full potential of our assets remains a priority’

RIO also outlined its business deals and ongoing projects that transpired and progressed over the third quarter.

It’s joint-venture with China Baowu Steel saw the investment of $2 billion to develop the Western Range iron ore mine in Pilbara — a mine with an annual capacity of 25 million tonnes — to begin construction in 2023.

Rhodes Ridge (co-owned with Wright Prospecting) has plans to, over the coming decade, develop a plant operation capable of producing 40 million tonnes yearly.

RIO also touched on its Turquoise Hill acquisition and $29 million investment to build a new aluminium recycling facility in Quebec.

The company acknowledged deals with energy and battery-making companies earned over Q3, and its partnership with the Canadian government, to invest up to C$737 million over the next eight years to decarbonise Fer et Titane operations in Québec.

Outlook for RIO

Rio said shipments and production guidance remain subject to weather and market conditions and warned of COVID restrictions continuing to impact its workforce.

The company expects 2022’s capital investments to be around $7 billion, reduced from $7.5 billion, due to a strengthened US dollar and decarbonisation investment timing.

‘Our best estimate of the investment required to decarbonise the business remains at $7.5 billion until 2030,” stated Rio.

‘Exploration and evaluation expense in the first nine months of 2022 was $593 million, $77 million (15%) higher than the first nine months of 2021, with continued ramp-up of activities in Guinea, Argentina and Australia.’

RIO also said commented on the commodity market:

‘Labour markets are holding up relatively well although consumer confidence has waned. Fears of recession are emerging on the implementation of aggressive interest rate hikes in the US and Europe, while a weak property sector continues to weigh on China’s economy. Freight rates are falling amid slowing global trade as global supply chains show signs of improvement.’

Five inflation-busting stocks

There has been a growing sense of unease in global markets.

Households and businesses have been squeezed as inflation continues to remain elevated.

Yet some businesses can deal with inflation better than others.

Some stocks could even prove ‘inflation busters’ in the current environment.

Discover our team’s five top dividend stocks with this ability.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia