Mining giant Rio Tinto [ASX:RIO] finds itself at the centre of a potential game-changing acquisition in the lithium sector. As today, it confirmed a non-binding takeover approach for Arcadium Lithium [ASX:LTM].

The move comes as lithium prices have plummeted amid oversupply concerns and sluggish demand from electric vehicle manufacturers. Creating an opportunistic environment for acquisitions in the sector.

Rio Tinto’s share price has seen a modest drop on the news, falling -1.35% to $122 in trading so far today. Meanwhile, Arcadium Lithium’s shares have skyrocketed, surging 44% to $6.02 on the ASX.

Yet despite the initial market enthusiasm, questions remain about the deal’s valuation and strategic fit for Rio Tinto.

What could the consequences of this potential acquisition be for Rio Tinto’s future? And is lithium a boon or burden for the mining giant’s portfolio?

Deal Details Emerge

While Rio Tinto has confirmed its approach, the company emphasised that ‘there is no certainty that any transaction will be agreed to or will proceed’.

Reports suggest the deal could value Arcadium between US$4–6 billion. Though financial details remain unconfirmed.

Its current market value is around US$3.3 billion, so anything in this range would be a significant premium.

Arcadium, formed through the merger of Allkem Ltd. and Livent Corp in January, has long been touted as a potential takeover target.

The company’s vertical integration in lithium production, from carbonate to hydroxide, makes it an attractive asset in the battery metals space.

However, the proposed valuation has already drawn criticism from some Arcadium shareholders.

In a letter to Arcadium’s board, Blackwattle Investment Partners argued that any offer below US$8 billion would ‘significantly undervalue the company’s growth potential’.

Strategic Rationale and Market Dynamics

Rio Tinto’s acquisition of Arcadium would be a massive push into the lithium sector. The deal would make it the world’s third-largest lithium supplier, with assets across almost every continent.

This move contrasts sharply with rival BHP Group’s strategy, which has shunned lithium in favour of copper and potash.

Rio Tinto CEO Jakob Stausholm recently commented on the company’s lithium ambitions, saying:

‘We see lithium as a critical material for the energy transition. This potential acquisition aligns with our strategy to grow in battery materials and supports our vision for a low-carbon future.’

However, the lithium market’s recent volatility raises questions about the timing and valuation of such a deal. Lithium prices have fallen dramatically since their 2022 peak, with the price down by over 80% year-to-date.

Stausholm has previously said he was unphased by plunging lithium prices. These have dropped from a peak of US$6400 per tonne of spodumene in December 2022 to just US$790 a tonne.

‘I couldn’t care less about what the lithium price is in the next 12 months, I am more thinking about how will the market and the demand be over the next decade or two,’ he said in July.

Outlook: The Future of Lithium Demand

While the short-term outlook for lithium remains challenging, long-term demand projections point to massive growth in the sector.

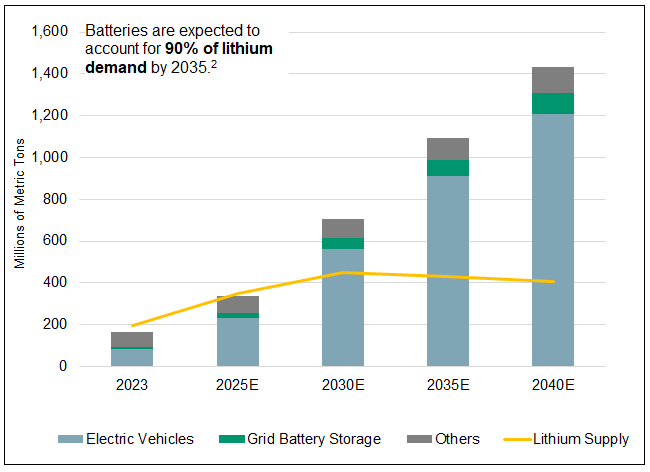

The International Energy Agency (IEA) forecasts that lithium demand could grow by up to 40x by 2040.

That would be in a future that is aligned with the Paris Climate Agreement goals. Here’s what their bull-case would look like:

However, near-term oversupply and demand uncertainty continue to weigh on the market. As Pilbara Minerals CEO Dale Henderson noted in a recent interview:

‘The lithium market is experiencing growing pains. We’re seeing a temporary disconnect between supply and demand, but the long-term fundamentals remain incredibly strong.’

For Rio Tinto, the potential Arcadium acquisition represents a significant bet on the future of lithium and electric vehicles. However, several challenges remain.

Integration risks loom large, as absorbing Arcadium’s operations into Rio Tinto’s existing structure could prove challenging. Especially as its assets span many continents.

The current lithium price slump also raises questions about the deal’s timing and potential returns.

The deal is clearly opportunistic. Rio wants to pick up assets that could be valuable a decade later, but will they drag on the company until then?

We’ve seen a host of major carmakers recently scale back their EV production plans. While in China, the world’s largest consumer, oversupply is the word in the mouths of many.

Many carmakers and mines are sitting on vast quantities of inventory.So it will likely take some time for those to run down.

While these lower prices have caused the shuttering of mines across Australia and China, African mines have also begun to ramp up.

Also, given lithium’s strategic importance, the deal would likely face regulatory hurdles in multiple jurisdictions.

Finally, and probably the largest hurdle. With Arcadium shareholders already pushing for a higher valuation, negotiations will be tense.

‘It’s not easy to justify big premiums, and we are definitely not in the M&A game in order to be bigger. We are only in the M&A game if we can create shareholder value,’ Stausholm said back in July.

Arcadium has kept a straight face so far, saying today that it ‘remains focused on executing its strategic vision and pathway to significant growth’.

As this potential deal unfolds and the lithium landscape evolves, investors should consider if they are willing to join Rio in taking the long-term view.

The Season of Mergers and Acquisitions

This mammoth deal isn’t the only big play for miner’s assets we’ve seen.

In fact, our resident Geologist, James Cooper, has been predicting these moves for some time.

He foresaw BHP’s $3 billion copper deal for Filo Mining and thinks the giants aren’t done.

AFR described that as the beginning of a ‘multi-year takeover cycle’. While James has called it a new phase of M&A mania.

That’s why he is currently targeting THREE relatively small players that could be in the M&A crosshairs.

If you manage to invest in these kinds of companies before deals are announced, you can potentially see upside gains of 100% to 300%.

But nothing is guaranteed in this space. To find the right stocks you need an expert on your side.

To learn more about what makes a great target and what stocks are on his list.

CLICK HERE to watch the video.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments