Diversified miner, Rio Tinto [ASX:RIO], reported its fourth-quarter production results earlier today, with the company flagging rising costs and a campaign to raise ore production.

RIO’s stock has improved by more than 9% over the past full year, and it remains a leader in its sector by around 3% up on its sector average and nearly 10% on the wider ASX 200 average.

Source: Tradingview.com

Rio Tinto’s fourth-quarter production outlined

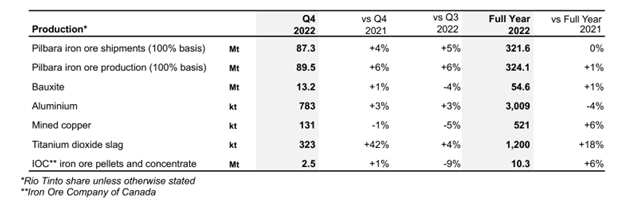

Rio Tinto provided a summary of its production highlights for the fourth quarter, claiming a number of operational records were achieved in the second half across the Pilbara iron ore mine and rail system.

Overall production was also said to be higher versus 2021 across all commodities — save for aluminium and alumina.

Rio Tinto lifted total iron ore production by 1% in 2022 versus 2021 with 322 million tonnes, in line with guidance of 320–335 million tonnes.

Mined copper equalled 521,000 tonnes, up 6% on 2021, said to have been due to higher grades at Kennecott and Escondida, partly offset by lower grades and recoveries at Oyu Tolgoi.

Aluminium production fell 4% compared to 2021 due to a reduction of output at both Canadian and Queensland smelters. Recovery at both smelters is progressing, and a ramp-up is planned for 2023.

Bauxite production of 54.6 million tonnes was 1% higher than in 2021, despite equipment reliability issues.

Pilbara’s iron ore unit costs for 2022 were tracking slightly above the top end of guidance due to inflation, diesel processes, and labour costs.

Having said that, guidance for Pilbara iron is unchanged ($21–22.5 a tonne based on AUD:USD exchange rate of 0.70).

In December, RIO completed the acquisition of Turquoise Hill Resources for around $3.1 billion, strengthening its copper portfolio and ownership of Oyu Tolgoi. A cash consideration of approximately $2.9 billion has been paid.

‘The acquisition of Turquoise Hill Resources strengthens our copper portfolio and demonstrates our ability to allocate capital with discipline to grow in materials the world needs for the energy transition and delivering long-term value for our shareholders,’ said Rio Tinto Chief Executive Jakob Stausholm.

‘Copper guidance has been increased accordingly. We continue to invest in future growth, progressing the Rincon lithium project in Argentina and are working with our partners to progress the Simandou project in Guinea.’

Source: RIO

Outlook for RIO

Maintenance setbacks and challenging smelter setbacks have affected copper production. However, the company is aiming to rebuild its refinery in the second quarter of 2023 — an undertaking expected to take around three months.

Gudai-Darri iron ore is also expected to reach its nameplate capacity on a sustained basis during 2023.

Higher rates of inflation continue to impact the company and have increased Rio’s liabilities and underlying earnings, resulting in increased charges for the year of approximately $1.3 billion, pre-tax.

Rio’s 2023 production guidance remains unchanged, aside from mined copper, which changed from 550–600kt to 600–655kt, thanks to its increased ownership in Oyu Tolgoi from 33% to 66%.

Rio said iron ore shipments and bauxite production guidance remain subject to weather and market conditions, and Pilbara shipments are subject to the intended ramp-up from new mines.

An incoming boom for commodities

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multiyear boom in commodities’…

A boom where Australia and ASX stocks stand to benefit.

The next big mining boom is predicted to happen in the next few years.

The same investors that got rich last time are preparing to make their moves — don’t let them take the monopoly again.

You can learn from James’s experiences AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia