Do you feel an ominous mood hanging over the markets?

We’re into our third week of August and I’m sensing that the market sentiment is turning bearish quite quickly.

The NASDAQ Index [NASDAQ] may’ve peaked late last month. The rally coming from the AI boom might be done for now. Top technology stocks such as Apple Incorporated [NASDAQ:AAPL] and Nvidia Corporation [NASDAQ:NVDA], which helped pull the NASDAQ Index up by 40% since the start of the year, have pulled back by more than 10% and almost 20%, respectively.

The sector in the market that’d provided fuel for the recent bull run is now retreating. It’s likely the party is coming to an end. The CNN Fear and Greed Index is showing clearly that the market’s appetite for risk has turned. It peaked at 83% (Extreme Greed) on 18 July and currently sits at 66%.

Perhaps a combination of the Federal Funds Rate rising late last month — along with a rising price of oil and inflation accelerating again — could build up for a nasty ride ahead. After all, past market selloffs and economic recessions have come about from these drivers coming together.

The only thing that’s different this time is the magnitude of the accumulated debt, which is largely parked in financial assets rather than the real economy. Years of a zero-interest rate environment have distorted our global financial system such that there’s a huge gap between the conditions of businesses on the ground and the financial markets.

Are things about to snap in the financial markets? The conditions seem ripe for it.

And could this bring about the revival of the ultimate monetary asset, gold?

Let me show you how this asset fared over the last 50 years:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Notice gold rallied big on two occasions — from 1977–80 and 2003–11.

We’re amidst the third rally that started back in 2015 and gained pace in 2019-20.

Interestingly, the rally in 2015–16 looks like just a blip in the figure. But ask those who lived through that rally, and they’d tell you it was anything but!

Now that the markets are looking fragile, I believe this is a great time to cast your eye on gold once again.

So, what causes the price of gold to rise and fall? More broadly, you could ask the same question for literally everything that exists in this world — houses, land, food, clothing, shares, etc.

Knowing this is the key to understanding why gold could outshine other assets going forward!

Let’s get into it.

A monetary experiment doomed to fail

For over 6,000 years, gold has been money and a benchmark by which we determine value.

The last 50 years have been an experiment to see whether it’s possible to run a system decoupled from gold.

Things changed gradually in the 20th century until 15 August 1971 when the system decoupled from gold, making the US dollar ‘defacto money’. Everything was valued under the US dollar from that point on.

This means the price of an asset is measured against something that doesn’t have a constant value.

This is something that people miss. They focus on the price and assume that when something rises then it’s worth more, and they could become richer by holding it.

It’s more complicated than that.

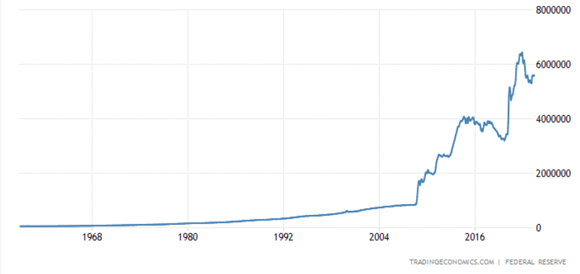

The US dollar is borrowed into existence through the US Government from the US Federal Reserve. Therefore, the supply constantly grows (shrinking every so often but only for a short time). Let’s have a look at how the base money supply grew over these last 60 years:

|

|

| Source: TradingEconomics.com |

With tremendous growth like that, is it any surprise that the price of almost everything would rise in response to this? After all, nothing is created at such a phenomenal pace as that of the US dollar and other fiat currencies!

That’s why we’ve had booms and busts, asset bubbles, and crashes.

People have been chasing momentum around the markets. However, all this arose from the confusion created by an unreliable pricing standard. The few who know how this works fleece the many that don’t, over again.

Gold the ledger of the errors in our financial system

If you set your sights on the right place, then you could ride above this confusion.

Compare the price of gold and the growth in the US dollar supply and notice how they rise together.

In a sense, gold acts as a ledger for the US dollar. The price of gold rises as more US dollars flow into the system. It keeps a record of the major mistakes committed in this financial system.

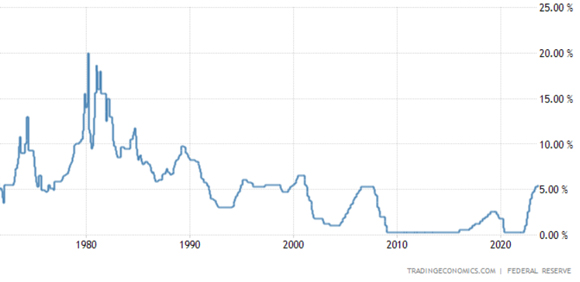

Each time the financial system fails, the US Government borrows more from the US Federal Reserve to try to paper over the problem. When things look better, the US Federal Reserve would step in to increase the interest rate to try to drain the excess monetary supply to reset the system.

It worked at first in the 1980s when the interest rate rose to almost 20%. That killed inflation for almost two decades.

However, this strategy has a diminishing impact with each subsequent market panic.

Indeed, that’s why the supply of funds increased causing the interest rate to fall. Here’s a figure showing the US Federal Funds Rate over the last 50 years:

|

|

| Source: TradingEconomics.com |

You can infer from these figures that the problem’s never solved, only deferred — allowing the problem to metastasize until it blows everything up.

A winning game plan with gold

So far, I’ve talked about the merits of gold. It’s clearly something to help you stay above water as the fiat currency system crumbles.

However, there’s more to it than buying gold bars and coins. That strategy is a good starting point. Make no mistake, it won’t make you rich.

And neither would the price of gold spiking to US$5,000, US$10,000 or US$50,000 change that fact. I explained why in a recent article that you can read here.

You’ll need to take bigger risks to truly grow your wealth, which means either leveraging on futures and options contracts or buying shares in gold mining companies.

Personally, I stay away from futures and options. It’s where the big sharks from investment banks and hedge funds lurk. You can easily end up losing more than your capital playing here!

Instead, I prefer gold mining companies. There’re many companies to choose from, allowing you to spread your risks. Even better, the competition is stacked more in your favour when you know the right value drivers.

In fact, I’ve been in this market for over a decade and my private family investment fund made significant gains during the 2015–16 and 2019–20 booms, as you can in my track record below:

|

|

| Source: Australian Gold Fund website |

Gold stocks have had an underwhelming two years as challenging operating conditions pushed down production while costs increased sharply. Even those who’ve invested in this space for decades are feeling uneasy about the share price performance and the profitability in this space.

The typical investor shuns this space because it lacks the momentum to attract money. But market veterans know that these are the exact conditions to make gold stocks the ultimate contrarian play. You can’t ‘buy low and sell high’ in a crowded market!

Later this week, I’m releasing a presentation all about this very topic — and how I can help you start building your precious metals portfolio designed to grow your wealth and prepare for the inevitable collapse of the fiat currency system.

Stay tuned…

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments