Retail Food Group [ASX:RFG], Australia’s biggest multi-brand food and coffee product retailer launched a $47.4 million debt and equity capital raising on Friday, comprising a $24.9 million share placement and $20 million debt facility.

Along with the $24.9 million share placement — which is based on an offer price of 8 cents per share — the group also launches its Share Purchase Plan (SPP) for around another $2.5 million, depending on investor response.

In launching its share-based fundraiser, the company’s share price dipped 7% to 79 cents each.

However, RFG rose 13% in share value over the past year and retains a strong lead on its sector average by 16.5%:

Source: tradingview.com

Retail Food Group undertakes fundraising frenzy

Global food and beverage company Retail Food Group is Australia’s biggest multi-brand food and coffee product retailer. The company supports Donut King, Gloria Jean, Michel’s Patisserie, Crust Pizza, and Brumby’s — and it intends to go bigger.

Retail Food Group has officially launched its three-part $47.4 million debt and equity capital raising to grow its business opportunities, core business model, and build up its balance sheet.

Retail Food hopes to raise the bulk of that through $24.9 million (before costs) via a share placement of 311.5 million ordinary shares to its sophisticated and institutional investors at an offer price of 8 cents per share.

On top of that, there is the question of the SPP, which is intended to grab around another $2.5 million. This will depend on eligible shareholders being willing to participate in the company’s capital-raising campaign.

The mega food retailer also said it signed a binding three-year term sheet for a further $20 million. This is to be accessed through a debt facility hosted by investment company Washington H Soul Pattinson at an initial interest rate of 7.5% for the first six months.

RFG Executive Chairman Peter George stated:

‘The Company’s strong 1H23 results demonstrate the resilient nature of the Group’s brand system portfolio and validate the strategic decisions implemented throughout the Company’s ‘franchisee first’ turnaround journey. We have carried considerable momentum into the 2H23 and remain focused on delivering solutions to unlock growth and drive enhanced profitability for both our franchise partners and shareholders.

‘We are pleased to welcome a number of respected institutional investors amongst new shareholders to the register, and extend thanks to those existing shareholders who have endorsed the Company’s strategic growth platforms and initiatives by increasing their shareholding via the Placement. Retail shareholders will also have an opportunity to participate in the capital raising via the share purchase plan, which is intended to raise approximately $2.5 million at the same Offer Price applicable under the Placement.’

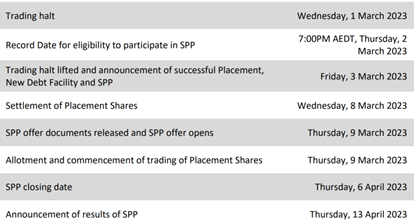

Shares for the placement will be issued on Thursday, 9 March, and will be in accordance with listing rules.

The offer price represents a 12.1% discount to Tuesday’s close price of 91 cents and an 8.9% discount to Wednesday’s VWAP (volume weighted average price) of 0.0878 cents.

It’s also a 19.7% discount on the 30-day VWAP, up to and including Wednesday.

Shares acquired through capital raising are to have an equal ranking with RFG’s existing ordinary shares.

Below is the placement and share plan schedule:

Source: RFG

Are you prepared for the big economic shift?

Australia’s 30 years of abundant, robust trade is now broken.

The change is all around us, especially the fact inflation is so high, and we’re getting less for our money.

Most Australians just don’t know what it all really means or how it happened.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has — certainly not the mainstream media.

Australia is going to be looking very different very soon, and so will everyday life…

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime, click here to learn more.

Regards,

Mahlia Stewart,

For Money Morning