A collision point like no other, a heap of cheap money, the prospect of negative rates, and technology waiting to pick at the carcass of the traditional banking system.

Everyone knows strange things are afoot.

But today I’m going to suggest that certain unheralded resources with exposure to the green revolution could be the investment theme of the next decade.

Again, I think Australia has little option but to dig its way out of the current mire we are in.

To make my point, I want to cast your memory back to the good old days of Australian mining.

How to buy into the NEXT battery boom (free report)

RBA chief on Australia’s last mining boom — a sign of what’s to come

And I call upon an old Philip Lowe paper, published in 2011, prior to his ascension to the RBA throne:

‘At the start of the 2000s Australia was derided by some for being an “old economy”. It lacked a substantial information and communications technology sector and was seen to be overly dependent on the extraction of resources, an activity that was not going to be enriching due to the declining relative value of commodities and weak potential productivity gains. However, by the end of the 2000s Australia was once again seen as the Lucky Country, riding on the back of rapidly rising commodity prices and having experienced only mild downturns at the time of the two international recessions that bookended the decade. Overall, it was indeed another prosperous decade; the unemployment rate fell and incomes rose strongly. The 2000s was the first decade since Federation in which the annual growth rate of real GDP in Australia remained positive throughout the decade.’

He continues in the same paper:

‘The increase in the size of the mining sector is likely to make the Australian economy, and its fiscal position, more cyclical. Commodity prices are inherently more volatile than prices of services or manufactured goods because supply is typically less elastic in the short run and demand more sensitive to economic cycles. In addition, historically, the difficulty in forecasting commodity demand and prices, particularly at the long horizons of resource investment projects, has often led to over-investment and “hog cycles”.’

And it appears we are at a low ebb in the cycle.

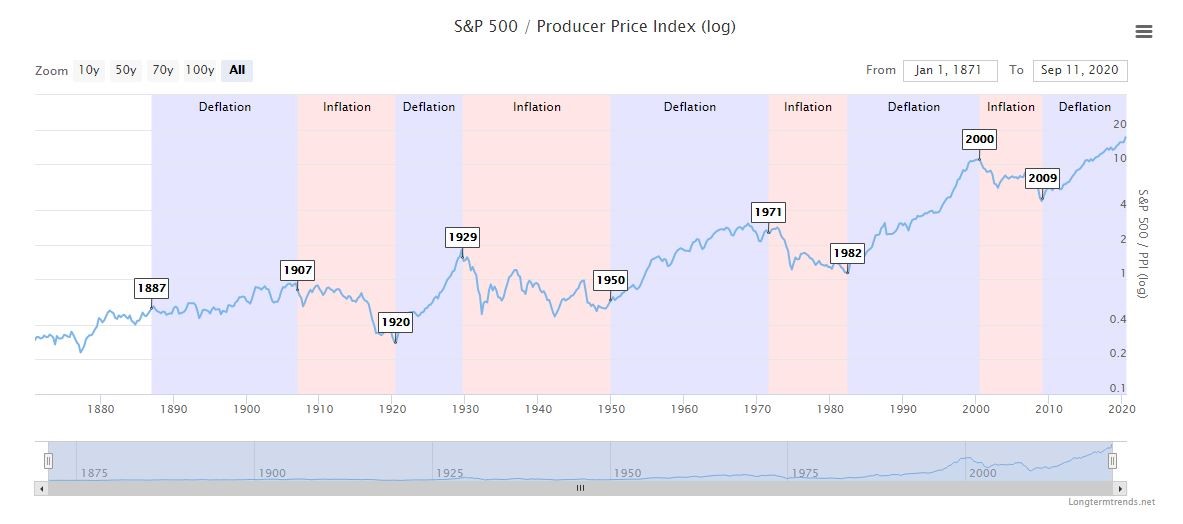

For reference, I draw your attention once more to the stocks-to-commodities ratio:

|

|

| Source: longtermtrends.net |

The ratio is at its highest point in more than 100 years.

The purple channels are called deflationary periods and the pink channels are inflationary periods.

We know the US Federal Reserve is now happy to let inflation run ‘hot’.

Commodities have a long history as a hedge on inflation too.

Inflation and resources shaping up for a big combo

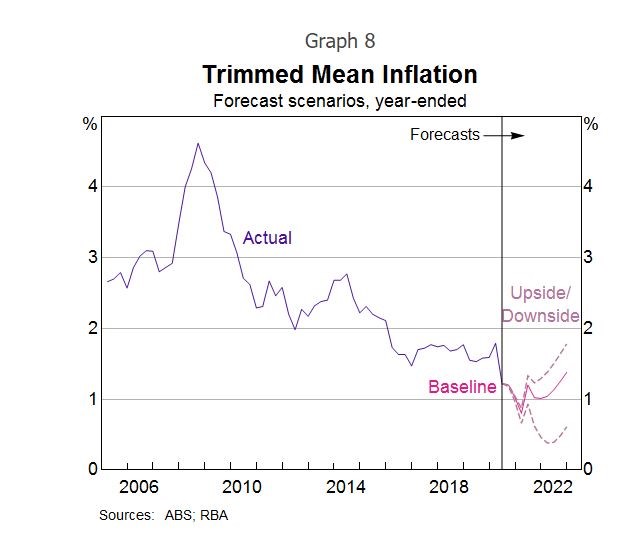

But what does the RBA forecast?

|

|

| Source: RBA |

A sharp uptick back to 2% or 1.5% in the first two scenarios over the next two years.

It could keep going from there if they don’t keep a lid on it.

However, inflation in the US is potentially the real driver here.

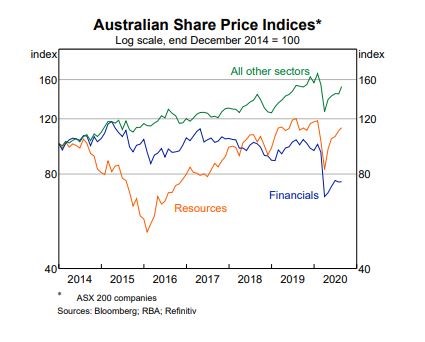

Having previously drawn attention to the fact that the ASX Resources Index [XJR] is outperforming the ASX Banks Index [XBK], how are resources doing in the long run?

This from the RBA:

|

|

| Source: RBA |

That’s still comparatively cheap, relative to all other sectors.

We will see how the story develops over the next six months, but now is a great time to be looking at resources.

Which brings me to my next point.

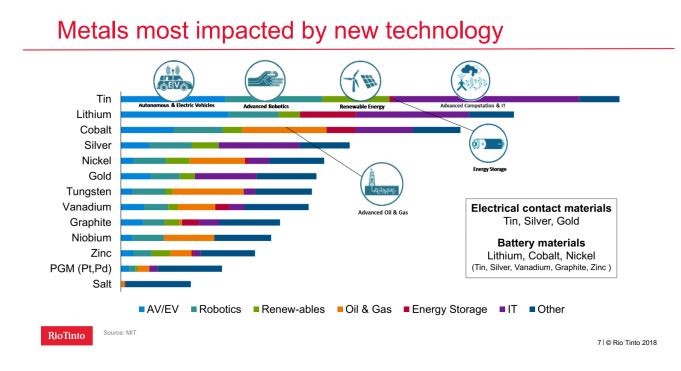

What metals have the most exposure to the green revolution?

We’ve covered nickel and copper, but check out this relatively unknown metal:

|

|

| Source: stellarresources.com.au |

Now this chart is from 2018, but it’s surprising to see tin up there.

And we all know about lithium and cobalt for battery tech, but silver is worth a mention as well.

Silver is usually thought of as a precious metal, but it’s actually more of an industrial or tech metal now.

Particularly in the photovoltaic cells in solar panels.

Which type of resources companies offer the most compelling case for investment in this green revolution?

You have producers, developers, and explorers.

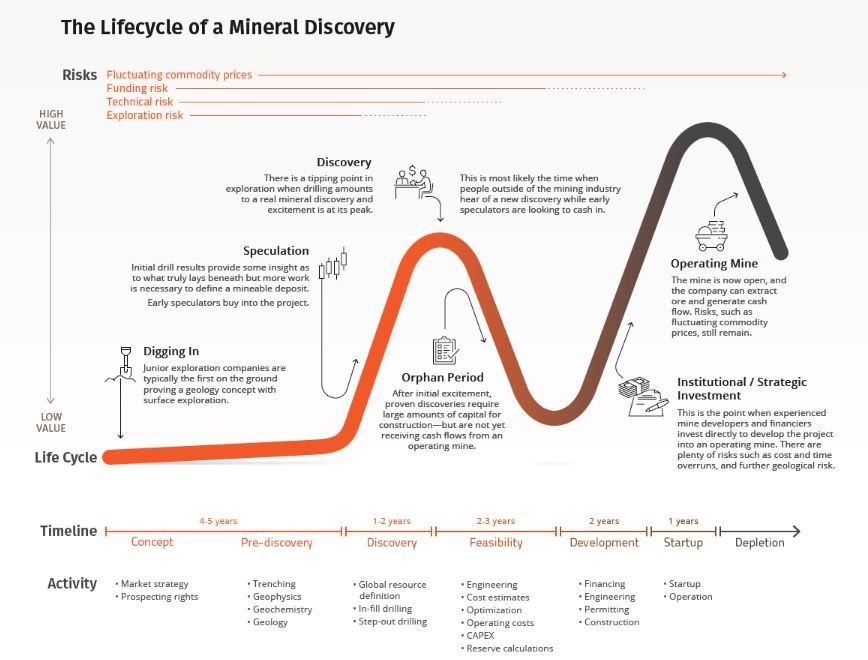

I think the biggest value could lie in companies that are in the ‘trough’ on this chart:

|

|

| Source: visualcapitalist.com |

Companies that are about to exit that ‘orphan period’ and on the cusp of institutional/strategic investment.

If you can pick the right ones, then that’s where the real exponential potential lies.

So, if all this intrigues you, check out our free report on the commodities ‘supercell’ we think is forming right before our eyes.

It’s a great read and has more information on what we are looking for over the next few months in Exponential Stock Investor.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments