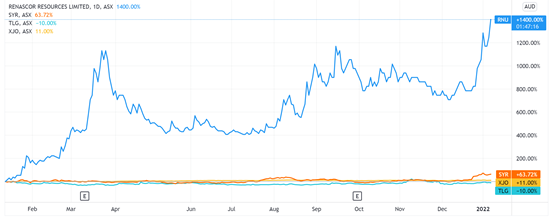

Renascor Resources Ltd [ASX:RNU] shares are soaring today after the exploration company revealed it had finished up its commercial-scale milling trials.

The trials were conducted to support Renascor’s proposed graphite mine and battery anode manufacturing operation in South Australia.

This morning, RNU indicated it had achieved markedly increased spherical graphite yields.

The RNU share price is up over 10% at time of writing and is trading hands at 20 cents per share.

Today, we’ll look at the announcement in more detail.

We’ll also share our outlook on how the Renascor share price could be affected in the coming months…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

What were the highlights of RNU’s trial findings?

Renascor’s milling trials at its Siviour Graphite Deposit achieved spherical graphite yields in excess of 65%.

This is a 15% jump from the 50% yield adopted in the company’s battery anode material study.

RNU thinks these higher yields mean it has the potential to produce more purified spherical graphite (PSG).

In turn, the explorer argued this can improve profit margins as a higher proportion of PSG material is produced per unit of graphite concentrate feed.

Renascor identified a further benefit to discovering higher yields. RNU said the trial results corroborate its ambition to process Siviour graphite concentrates into spherical graphite products.

These can be used in high-volume lithium-ion battery anode applications, as well as other high-performance, specialty products.

It’s certainly an exciting space to be in right now, as global demand for lithium-ion batteries continues to increase…

Management suggests further upside for the company

Comments from Renascor’s Managing Director David Christensen would have likely helped to fuel the positive sentiment in the market today.

In his statement, he commented:

‘The completion of the downstream equipment trials is another important step in advancing and de-risking the Siviour Project, with the potential for improved yields offering further upside in our plans to become a global leader in the production of high-quality, sustainable Purified Spherical Graphite products for lithium-ion battery anode makers worldwide.

‘We look forward to using data generated from these trials to complete engineering design works and for final equipment selection for our manufacturing facility in South Australia.’

What’s the outlook for RNU shares in 2022?

Although the trial’s findings indicate a bright future for Renascor, several other companies on the ASX are making waves in this space right now…

It’s also worth noting that successful trials like these are not the only factor needed to ensure a company’s success.

Strong financials, sensible management, and continuing market demand are all essential ingredients, too.

If history’s anything to go by, a few explorers may crash and burn.

But that’s not to say Renascor will necessarily be one of them…

In any case, it’s important to research lithium stocks before you buy — including Renascor.

For the first time ever, Money Morning has covered how to research and evaluate lithium stocks in a detailed, easy-to-read guide.

To get your free copy, simply click here, and we’ll send it to your inbox.

In the meantime, I’ll be keeping my eye on this stock for any further developments…

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here