The Renascor Resource Ltd [ASX:RNU] announces a planned capacity upgrade for its battery anode operation on increased enquiries from anode manufactures.

The stock was up as much as 13% in early trade with the RNU share price is up 4.5% at the time of writing.

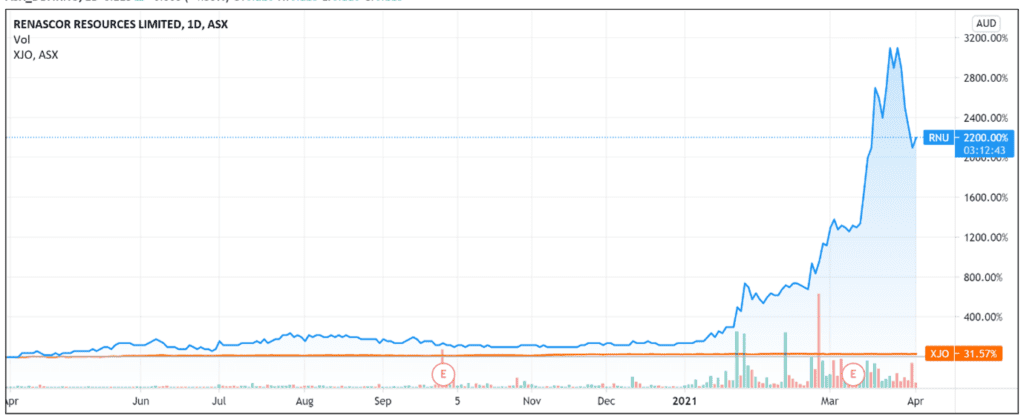

While the share price of Renascor dropped 23% over the last week, the stock is still up 850% YTD and up 2,200% over the last 12 months.

Source: Tradingview.com

Source: Tradingview.com

Renascor planning a ‘major’ capacity upgrade

The diversified explorer today revealed that it is investigating a ‘substantial increase in Renascor’s Stage 1 production capacity’ beyond its current planned capacity of 28,000 tonnes per annum (tpa) of purified spherical graphite (PSG).

Three Ways to Invest in the Renewable Energy Boom

This is due to what the company described as increasing inbound enquiries from ‘major anode manufactures.’

In response to this ‘strong demand’, Renascor stated that it is currently conducting customer product testing with the interested parties.

Renascor’s Managing Director David Christensen commented on the news:

‘We are extremely pleased with the extent and quality of inbound enquiries we are receiving from leading anode and battery companies.’

Mr Christensen thought the inbound enquiries reflect ‘latent demand for volumes that represent a multiple of our currently planned Stage 1 PSG production capacity.’

In parallel to the capacity upgrade, Renascor also announced that it will bring forward the feasibility work for a Stage 2 expansion of its planned battery anode material operation in South Australia.

Renascor progressing with its offtake partners

RNU also announced that it is working with its existing offtake partners to ‘progress product validation testwork and to conclude formal binding agreements.’

So far, Renascor has executed three 10-year offtake memorandums of understanding (MOU) with Minguang New Material, Zeto, and Hanwa.

I covered Renascor’s offtake MOU with Hanwa here last week.

Each offtake MOU is for up to 10,000tpa of PSG.

According to Renascor, once the MOUs become binding, they ‘could cover all of the Stage 1 production capacity’ of Renascor’s planned battery anode material operation in South Australia.

RNU claimed that its existing offtake partners are advancing with their product qualification processes and are nearing ‘more advanced testing’ of Renascor’s product.

RNU share price outlook

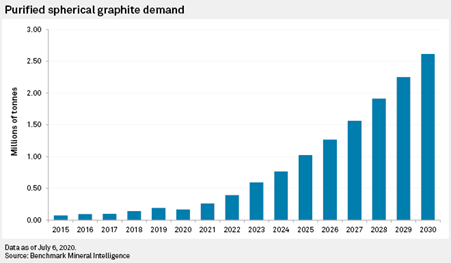

PSG is an important material for manufacturing lithium-ion batteries and is sought by anode and battery manufacturers.

With the world shifting more and more towards green energy, there is anticipated long-term demand for materials necessary for manufacturing electric vehicles.

The Future Battery Industries Cooperative Research Centre expects that the global automotive lithium-ion battery market will grow 11% each year to reach US$95.3 billion by 2030.

This can benefit miners and suppliers of materials like PSG.

Source: spglobal.com

Source: spglobal.com

But as I’ve said last week, a strong addressable market is not sufficient for success.

Competitors will emerge and existing competitors will jostle to meet demand.

For instance, Syrah Resources Ltd [ASX:SYR] also specialises in producing graphite and it, too, wishes to become a leading vertically-integrated PSG business.

Therefore, Renascor still has many checkpoints ahead.

Its MOUs still need to be negotiated into binding agreements.

In part, this will be determined by internal product testing yet to be finished by Renascor’s MOU partners.

Preparation of its bulk PSG samples still needs final validation testing.

And there is the feasibility work yet to be completed for RNU’s Stage 2 expansion plans.

RNU share price may well rest in the near-term on its upcoming updates regarding these matters.

As we’ve covered recently, lithium stocks are thriving at the moment.

There is certainly emerging recognition that the lithium battery and electric vehicle sector is a potential growth market. If you want further reading on investment opportunities in the lithium sector, then our free report on lithium stocks is a great place to start.

Regards,

Lachlan Tierney,

For Money Morning

Comments