The share price of small-cap graphite explorer/developer Renascor Resources Ltd [ASX:RNU] has risen today, on the prospect of a deal with one of China’s largest battery companies.

RNU sells itself as a play in the ever-growing electric vehicle (EV) and battery market.

Its key project is the Siviour graphite project near Arno Bay, South Australia, home to the world’s second-largest proven reserve of graphite.

At the time of writing, The RNU share price has climbed 18.18% to 1.3 cents per share as the company looks to shore up its long-term cash flows.

Source: Tradingview.com

A world class asset

If you have never heard of RNU before, it is a fledgling graphite developer with a vertically integrated operation that includes processing Purified Spherical Graphite (PSG) for sale into the growing lithium-ion battery anode market.

Their key Siviour Graphite Concentrate Project is a low-cost, long-term graphite project that boasts one of the largest graphite resources globally.

Basically, RNU plan to turn the graphite from their mine into PSG, which is a component of batteries used in EVs.

As a point of difference, RNU has developed an environmentally friendly purification technique to upgrade graphite to deliver battery-grade PSG in a cost-effective and sustainable manner.

Check out these four innovative Aussie small-cap stocks before lockdown ends. Download your free report now.

Which is all well and good, if you have someone to sell it to.

A problem RNU might have just solved.

In an announcement today, the company outlined its Memorandum of Understanding (MOU) with Chinese anode company Shanxi Minguang New Material Technology Co Ltd.

Minguang is a subsidiary of Fujian Metallurgical Holding Co Ltd, a Chinese state-owned enterprise that also owns China’s largest battery cathode producer.

Minguang is currently developing a 40,000 tonne per annum battery anode manufacturing facility in China’s Shanxi Province.

As part of the MOU, Minguang will purchase up to 10,000tpa of PSG over a 10-year term.

That’s approximately one-third of RNU’s projected initial PSG production capacity.

A big step for the small-capped company.

Poised to ride the EV wave

Though today’s MOU is just short of an actual offtake agreement, RNU said they would work together with Minguang to undertake additional product validation tests before entering into a formal binding agreement.

China currently represents 85% of global anode production capacity and 90% of capacity under construction.

Making it a lucrative target for RNU.

Source: Renascor Resources

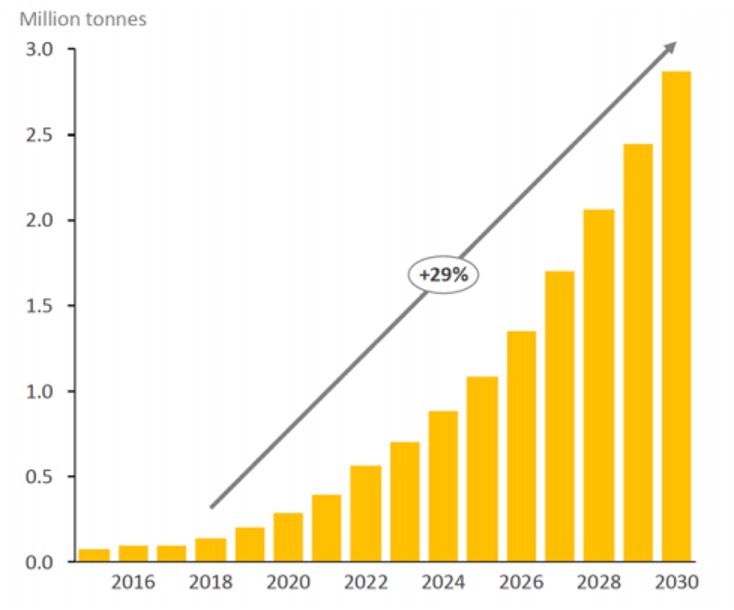

Though, RNU could soon demand a high premium for their product with demand of PSG expected to increase at annual rate of 29% to 2030.

Graphite plays like RNU are not the only companies that could benefit from the rising demand in electric vehicles. As the price of lithium (a major component in EV batteries) lays dormant, we believe it is gearing up for a bull run. Check out these three stocks that could surge on the back of renewed demand for lithium in 2020. Click here to get your copy now.

Regards,

Lachlann Tierney,

For Money Morning

Comments