The Renascor Resource Ltd [ASX:RNU] share price is up 13% at time of writing after offtake memorandum of understanding (MOU) to supply purified graphite to Japanese-based global trading company.

The diversified explorer released an ASX announcement today outlining a non-binding MOU with Hanwa, a global trading company based in Japan.

Under the MOU, Renascor will supply purified spherical graphite to the company.

The release details that Hanwa is one of the largest traders of battery chemicals in Asia.

Hanwa operates a dedicated battery team focused on graphite supply across the global battery value chain.

Hanwa’s market capitalisation is AU$1.7 billion with reported net sales of more than AU$21 billion in 2020.

The RNU share price was up as much as 23% in early trade on the news and up 13% at noon.

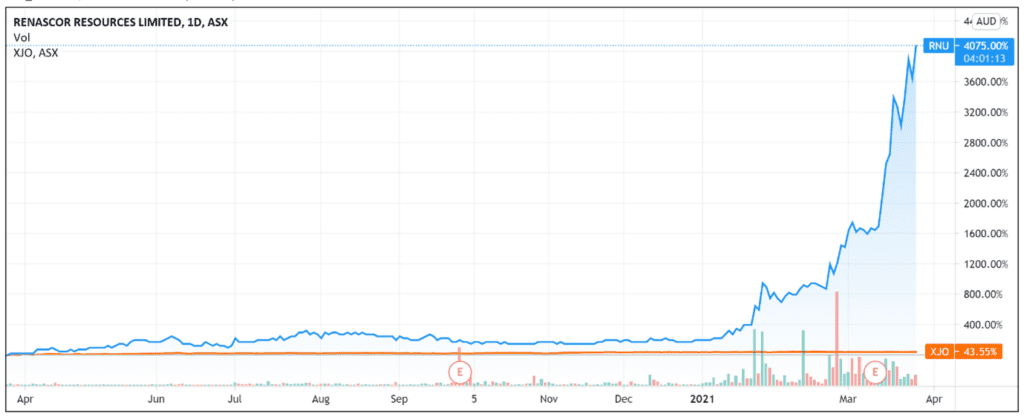

The Renascor share price have been riding a big wave of momentum over the last few months.

The RNU share price is up 200% over the last month and up 1,250% YTD.

Renascor’s offtake memorandum of understanding

Renascor’s MOU with Hanwa includes the purchase of up to 10,000 tonnes per annum (tpa) of purified spherical graphite (PSG) over a 10-year period.

Three Ways to Invest in the Renewable Energy Boom

This represents about a third of Renascor’s projected initial PSG production capacity of 28,000tpa in its planned Battery Anode Material operation in South Australia.

Renascor explained that it has now achieved potential commitments ‘covering in excess of 100% of Siviour Stage 1 PSG production’, after executing MOUs with anode companies Minguang New Material and Zeto.

In an important caveat, Renascor noted that the first annual amount to be delivered under the offtake and the term of the offtake will need to be finalised as Renascor and Hanwa ‘progress to a formal binding agreement.’

Offtake agreements are common in resource sectors. They involve an arrangement between a producer and buyer to purchase portions of the producer’s upcoming goods.

An offtake agreement is usually entered into to secure a market for a producer’s future output, as initial capital costs to extract resources are large.

RNU share price outlook

Renascor said in today’s ASX release that it is ‘progressing additional potential PSG offtake agreements and undertaking PSG validation with other anode and battery companies.’

In qualified language, Renascor stated it aims to secure further offtake agreements that ‘may allow for an expanded Stage 1 production capacity and/or enable a further expansion of the project with additional Stage 2 PSG production capacity.’

So while investors will see today’s release as a positive update, it is also only a stepping-stone announcement.

Renascor Managing Director David Christensen did think today’s step was ‘significant’ as — in his view — Renascor is now closer to constructing the first integrated, in-country mine and PSG operation outside of China.

But many more steps lie ahead for Renascor in a field getting more and more crowded.

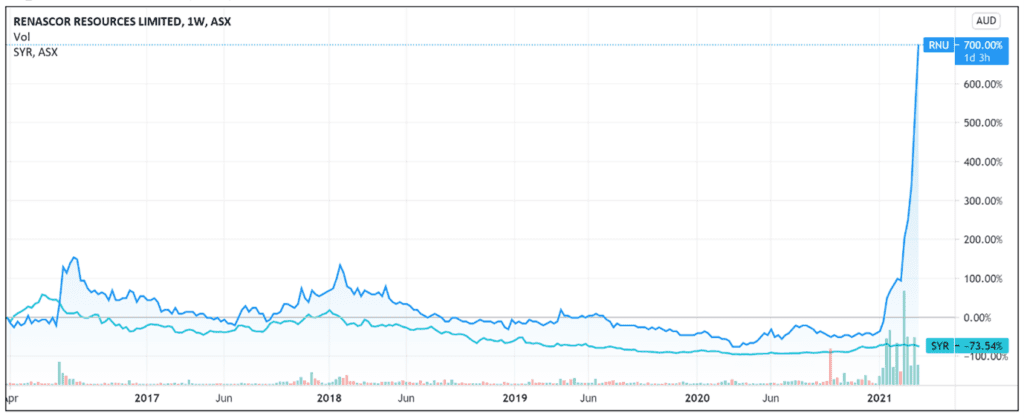

For instance, Syrah Resources Ltd [ASX:SYR] also specialises in producing graphite. Its market capitalisation is $527 million to Renascor’s $250 million.

While the underlying thesis for both is the same — supplying graphite needed for lithium batteries — RNU shares have enjoyed steeper growth of late.

RNU’s share price is trading near all-time highs, while SYR shares are still way down from their June 2016 high when SYR stock was trading at $5.7 per share.

This week, Syrah updated the ASX on its furnace installation at its Active Anode Material Project in Vidalia, US.

Like Renascor, Syrah believes it reached a ‘significant milestone’ as this ‘further positions Syrah as the most progressed vertically integrated natural graphite AAM supply option outside China.’

Syrah toll treats purified spherical graphite to active anode material (AAM).

SYR’s share price movement shows that Renascor’s recent momentum is not guaranteed to continue.

Investors will be watching how well the company can consolidate its offerings and whether it can capture significant market share.

That said; there is certainly lucrative potential within the lithium battery and electric vehicle sector. It’s just a matter of finding it.

Our free report on lithium stocks is a great place to start.

Sign off,

For Money Morning