Do you remember China’s ‘bazooka’ moment last year?

That’s what the market dubbed China’s hard-hitting stimulus package.

It caused resource stocks to tear after their mid-year meltdown over Chinese deflation concerns.

So, here we are again, as this Reuters article details:

‘China ramps up stimulus to guard economy from changes unseen in a century.’

China promised more fiscal stimulus last week and a commitment to meet its 5% growth target.

So, will this re-ignite Australia’s iron ore sector?

Mining Memo’s Take

It’s important to understand that China has a fixed long-term plan to hit a 5% GDP growth target. Moving whatever levers necessary to make that happen.

But what about the country’s slowing real estate market?

Won’t this kill demand for steel and the outlook for iron ore producers?

When investors think of the demand for iron ore, they instantly link it to the Chinese real estate market and new building constructions.

But that’s a misconception left over from the last mining boom. Things are much different in today’s steel market.

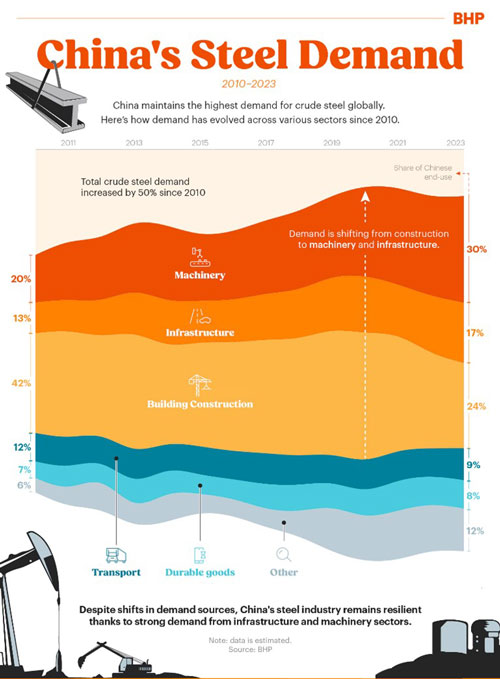

In 2010, at the peak of the last commodity boom, building construction accounted for around half of Chinese steel demand.

Today, that’s fallen to just 24%.

Machinery construction is now the biggest driver of steel demand in China…that includes equipment for agriculture, mining, car parts and tools.

You can see the changing dynamic in the graphic below:

| |

| Source: BHP |

China’s demand for steel is far more diverse than it was back in the early 2000s commodity boom and that potentially makes today’s market more resilient.

Another point lost on most investors is the fact that China is importing more iron (today) than at any point during the early 2000s resource boom!

As this article from Reuters shows, in the second half of 2024, iron ore imports hit a record high.

That speaks to the ‘quiet’ boom happening across machinery construction.

But you wouldn’t know that from the price action of Australia’s iron ore miners or from the poor sentiment towards these stocks.

That’s why I suggested you look at a major like Fortescue Metals [ASX:FMG], in last week’s edition of the Mining Memo.

A stock that’s been under enormous pressure over the last 12 months but perhaps positioned for a surprise recovery in 2025.

But what about the other elephant

in the room, Simandou?

If you’re unaware, Rio Tinto and its partners want to import additional iron ore from Guinea, a small country in West Africa.

It’s generally considered a threat to Australia’s monopoly in the iron ore market… Dubbed the ‘Pilbara Killer.’

But again, Simandou’s fears look overblown.

Consider this: In 2024, Australia mined and exported around 900 million tonnes of iron ore, mainly from WA’s Pilbara region.

Meanwhile, Simandou spruiked as the NEW iron ore epicentre, is expected to deliver a mere 60 million tonnes.

That equates to around 6.5% of Australia’s market share.

But you also need to factor in declining output across some Australian and Brazilian mines which will take supply off the market.

It highlights another misconception in the iron ore market…Simandou is not about to overrun the market with new supply. More likely, it will just replace declining reserves at established operations.

FMG offers one avenue to play this potential turnaround in iron ore stocks.

But if you’re looking for a more speculative opportunity, I recently recommended a small ASX miner to my paid readership group.

A company that’s positioned to rapidly grow its iron ore division this year.

Why does that matter?

Well, to leverage gains from higher commodity prices, you need to be in stocks that are ramping up production.

If everything goes to plan, that’s precisely what this company should achieve in 2025.

If you’d like to find out more, you can do so here, by joining me at Diggers & Drillers.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments