At time of writing the share price of ReadCloud Ltd [ASX:RCL] is up 10.94%, trading at 35.5 cents. Meanwhile the ASX 200 [XJO] has also gained, up 2.07% to 4,640.2 points.

The ReadCloud share price has avoided a major sell-off and is up 42% in a 12-month period, but is still a ways off its July high:

Source: tradingview.com

ReadCloud does e-learning solutions for Australian secondary schools — so the increased interest today is understandable as Australia comes to grips with COVID-19. We take a look at their most recent financials and the ReadCloud outlook going forward.

RCL share price bounces on rare good day for ASX

After an awful month for the ASX, the ReadCloud share price gained on a day when some investors may be thinking the bleeding has stopped.

I have a feeling there will be more dips and rips from here on out.

With Victorian schools shut from Tuesday, parents, teachers, and students will have to adapt to new ways of learning as the coronavirus pandemic spreads.

ReadCloud sources content from publishers, releases this content via interactive e-books, allowing students and teachers access to the Australian school curriculum.

As of 23 March, they had 100,000 users on their platform.

Investors clearly think this number will swell in the months ahead, based on the surge in the ReadCloud share price today.

But are they positioned to capitalise on this emerging e-education trend?

ReadCloud’s financials and outlook for their share price

In their latest financial report for the half-year ended 31 December 2019, ReadCloud’s revenue was up 34.8% to $3.15 million.

However, their loss for this period was also up 17.3% to $1.1 million.

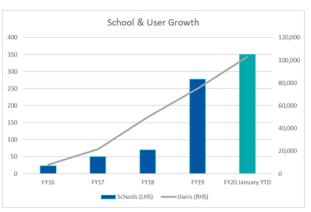

You can see strong growth in schools and users below:

Source: newswire

With cash and cash equivalents of $2.84 million against a market cap of $31 million, this would usually be a potential point of concern.

However, the company notes that their revenues typically increase in the second half of each year.

If they can keep their costs down and scale up effectively in this crisis, there may be an opportunity for the company to turn a profit in their next results.

Consequently, the outlook for the ReadCloud share price could be more positive as a result of this rapidly evolving situation.

If you would like to get the names of three potential ‘solutions’ stocks in this coronavirus crisis, be sure to read our in-depth report on the types of assets that could shine during this trying period.

You can download that for free, here.

Regards,

Lachlann Tierney,

For Money Morning

Comments