Ye olde Aussie mortgage is going to sting a bit more.

The chief practitioners of the ‘dismal science’ at the RBA (that’s economists) have decided the masses shall be punished further.

And meanwhile in the US, we had another AI-fuelled selloff in major software names overnight.

The ASX 200 and many of my watchlists were looking quite good yesterday.

Today?

Not nearly bad as I thought it could be.

It’s almost as if the market is now immune to foul omens and pervasive dread is largely priced in.

Perversely, Australia is more immune to tech driven sell-offs emanating from the US because we are so poor at technology innovation.

That’s because the top end of our index is heavily weighted to big financial names and large resource companies.

So when fear hits big US software companies, the fear that drives the selling doesn’t quite align with fear about the Aussie banking and resource giants.

Meaning oddly enough, the Big Four banking oligopoly and the mining sector we still try to sabotage came to the rescue today!

Jokes aside, there are some deep implications from yesterday’s sell-off that will be guiding my thinking when I go hunting for the next ASX tech success stories.

But first, here’s what triggered the sell-off in US markets overnight…

New AI tools point to pain

ahead for software giants

AI giant Anthropic launched new capabilities for its Claude Cowork tool that can automate legal work like contract reviewing and briefings. The company also released legal plugins that directly compete with established legal data services like Thomson Reuters and RELX.

The result: US$285BN in market cap erased. Six consecutive days of declines and Goldman Sachs’ software basket down 6% in a single session.

Anthropic’s new AI tools triggered a bloodbath across the software sector that bled out into other sectors.

Source: Bloomberg

These moves should be unsurprising – everyone knows that software giants that have monetised code and data monopolies were easily the most vulnerable to the new technology.

In the grand scheme of things, the sell-off is mostly a slight repricing of AI’s realised potential relative to expectations of how quickly we thought software giants could become dinosaurs.

Expect more of the same in the years ahead.

So after yesterday’s mini-meltdown, is AI the harbinger of an economic apocalypse? Or is it the herald of a new utopia for financial markets?

Here’s what recent history is showing us…

Software as a Service (SaaS) margins have been under pressure for years.

And competition is now in over-drive.

AI enables people to ‘vibe code’ new apps and create start-ups far quicker than ever before.

AI is thus requiring increased capital deployment by established SaaS companies to keep up.

RBC Capital Markets expects software gross margins to drop from 75% to around 60% as companies shift from cloud to generative AI. The infrastructure costs are brutal.

Training models requires expensive GPUs, specialized cooling, and massive data centres. Electricity bills would make your eyes water.

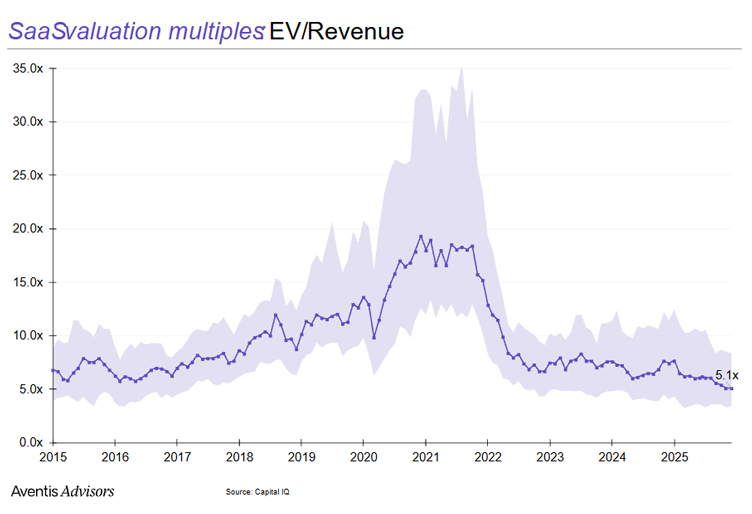

Valuation multiples have followed. Software EV/Revenue multiples have fallen from 2021 peaks of ~15-20x to around 6.5x for public SaaS companies and ~3.5-7x for private firms.

When Anthropic’s Cowork tool sparked Tuesday’s selloff, it exposed the vulnerable. Legal tech. Data services. Credit information firms. These companies face genuine disruption risk.

The grind lower in EV/Revenue multiples can be seen below:

Source: Aventis Advisers

That means the growth in top-line (revenue) that really drives SaaS company valuations is becoming less attractive to the market.

You might be fooled into thinking that this multiple reduction makes them cheap.

In the context of AI though, that doesn’t quite add up.

Big Tech’s Moat Is Cracking

The hardest hit yesterday weren’t small fry. Thomson Reuters, RELX, and London Stock Exchange Group took massive losses. These are supposed to be entrenched giants.

The market is pricing in a new reality. Incumbency in tech has become a liability.

Nimble upstarts can rebuild from scratch. They don’t carry decades of technical debt. They move fast while Big Tech files compliance reports.

Where The Real Opportunity Lives

Tech remains more crucial than ever. AI infrastructure needs massive compute power, networking equipment, specialized chips, and enormous amounts of critical minerals.

Some big tech names will flounder as market share loss fears play out. That could drag indices lower. But the opportunity is moving to smaller, more agile players.

These won’t show up in the ASX 200. They’re the micro-caps and small-caps operating under the radar while titans stumble.

So yes, I’m definitely looking at ASX small cap tech that fits the bill.

Not just commodities.

But just like commodities that feed the AI beast, they need to have a novel differentiating factor that makes their product essential in a crowded field.

Warm regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

Murray’s Chart of the Day – US Software Sector

Source: Tradingview

There is currently some panic selling on display in software companies that the market thinks will be disrupted by AI.

Last night Anthropic released an agent that will assist lawyers and other lawyer facing software stocks were promptly dumped.

There is also fear that private credit has plenty of exposure to software companies, so the selling is spreading to them as well.

The chart above shows you the iShares Expanded Tech-Software Sector ETF (Exchange Traded Fund) [CBOE:IGV].

I have used a logarithmic scale to show you the chart since 2002.

You can see the impressive rally that software companies have been on over the past few decades.

The recent price action is interesting because it is confirming a false break of the high in 2021.

That gives targets that are lower than current prices, so the selling may just be warming up.

But big picture I think this could lead to the trade of 2026, if strong companies are sold with the weak.

AI can certainly disrupt software companies if it becomes simple to create bespoke software for corporates rather than buying off the shelf.

But what of businesses that have a wide moat with solid network effects?

Do you really think AI will magically disrupt their market position?

Spotify Technology [NYSE:SPOT] has lost 40% of its value since mid-2025.

If they are suffering a drawdown as a result of this issue, does it really make sense?

I know I won’t be leaving Spotify because… AI.

So it looks like this selling panic has further to run, but sharpen your pencils and start trying to figure out which companies are the baby and which the bathwater.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments