It’s not quite negative yet.

But it’s getting mighty close.

This from Bloomberg:

‘Australia’s central bank will boost its bond-buying program or cut interest rates to help revive the economy from its first recession in almost 30 years, a survey showed.

‘Seven of 11 economists predict the Reserve Bank will ramp up quantitative easing by expanding its bond purchasing program, with UBS Group AG’s George Tharenou positing that this could begin as soon as next month. Most of the others, however, expect it will occur either toward the end of this year or early 2021.

‘Cutting the cash rate and 3-year yield target to 0.10% was less popular. Of the three who said it was likely, Deutsche Bank AG’s Phil O’donaghoe expects the easing to happen by February and AMP Capital Investors Ltd.’s Shane Oliver similarly sees it in the next six months.’

So, more money printing hijinks are afoot and a cash rate of .1% may as well be zero.

What can we learn from countries that went negative though?

Bye bye dividends: why income stocks are in the firing line (free report)

Swiss negative rates: an example of what not to do

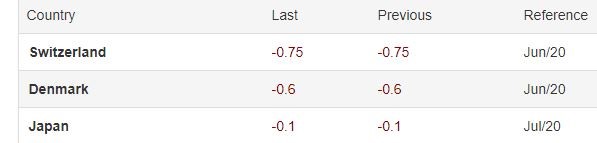

Here are the countries that currently have negative rates or interest rates at zero:

|

|

| Source: tradingeconomics.com |

Switzerland is an interesting case study.

Back in October of last year, there was significant debate over the impact of the Swiss negative rates.

Thomas Jordan, head of the Swiss National Bank, said the rates were ‘essential’.

The problem here is that it squeezed the margins of Swiss banks, turned bond yields negative, hurt pension pay outs and increasingly fuelled property speculation in the landlocked country.

But when you say something is essential, and then a real crisis comes around (ie: a pandemic), you’re left with little ammunition…

Where do you go? More negative rates?

Rate tinkering and asset purchases beget more of the same.

Over the weekend I discussed how the Federal Reserve now owns nearly a third of mortgage bonds.

The effect — an exploding US housing market.

So it will be interesting to see what the money printer does to the Australian property market…

Sydney property auctions could be ‘panic buying’

I suspect it will be a tale of two cities…meaning if Sydney goes into lockdown and Melbourne continues to grapple with rising cases, you could see a polarised market.

Places like Perth (especially given the potential for a commodities boom) and Brisbane may see significant upticks in house prices, while Melbourne and Sydney struggle.

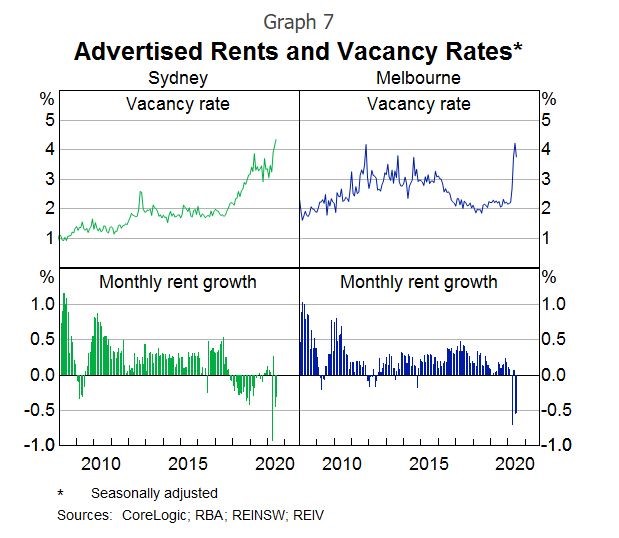

Vacancy rates in the two cities are already through the roof as you can see below:

|

|

| Source: RBA |

The flow-on effects to property prices should follow.

With weekend auctions in Sydney 18% higher than last year, this may be a case of property ‘panic buying’.

And the Melbourne property market is a sign of where Sydney could be in the coming months.

SQM Research managing director Louis Christopher, was quoted in the Australian Financial Review saying:

‘Melbourne’s auction market was dead on arrival this weekend…

‘This is an absolute disaster for the economy and for the state government revenues. It’s catastrophic for real estate agents who are getting smashed right now, as they rely heavily on sales turnover for income and currently not getting any sales…’

While CoreLogic’s head of research Tim Lawless says just 13 auctions are scheduled for this weekend.

Just 13 homes up for grabs — grim.

Where to consider investing if negative interest rates happen in Australia

I’ve previously discussed how gold and bitcoin operate as a ‘trust quotient’.

That is, they tell you how much we trust central banks.

And the short answer is: not much.

I expect gold in AUD terms and bitcoin to continue on the uptrend as trust in fiat decays.

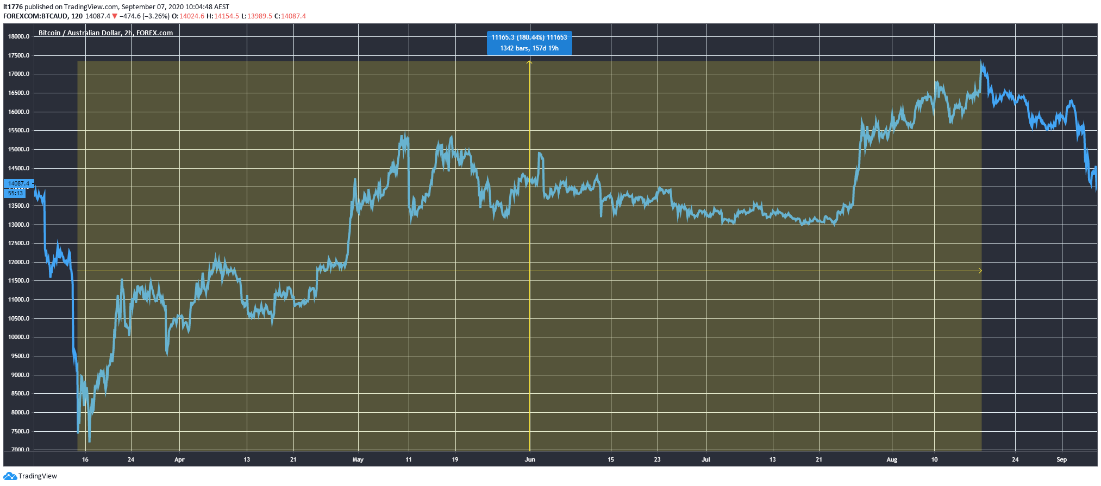

At one stage last month, the bitcoin price in AUD was up as much as 180% from the March low as you can see below:

|

|

| Source: tradingview.com |

Recent trends for these two assets could be supercharged should global rates go negative.

Why?

Because paying money to a bank to keep your money there is a financial perversion of the highest order.

A negative interest rate is theft. Pure and simple.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments