The share price of gold producer Ramelius Resources Ltd [ASX:RMS] is on the rise today on the back of an increase in profit and its dividend.

The RMS share price has, like many other gold stocks, tracked the gold price closely over the past months.

However, its strong financial performance has seen the two diverge today as RMS ticks upwards and gold continues lower.

At time of writing, RMS shares are up nearly 2% or 4 cents to $2.05 per share.

Source: Tradingview

Profit increases four-fold

Financial year 2020 produced some strong results for RMS.

In their results released today, RMS announced that net profit after tax had increased by 420% to $113.4 million.

While a historically high gold price likely helped to boost profits, RMS also upped its gold production by 17% to 230,426 ounces, a record for the company.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

RMS also lowered production costs by 2.4% to $1,164/oz.

The effort now marks the sixth consecutive year that the company has posted a net profit after tax.

RMS will also pay its second ever dividend.

The company will pay out around $16 million, doubling their dividend to 2 cents per share.

A pleasing result for sure.

What’s next for the RMS share price?

Today’s strong results are the fruit of sound corporate management, good exploration initiative and a bit of luck.

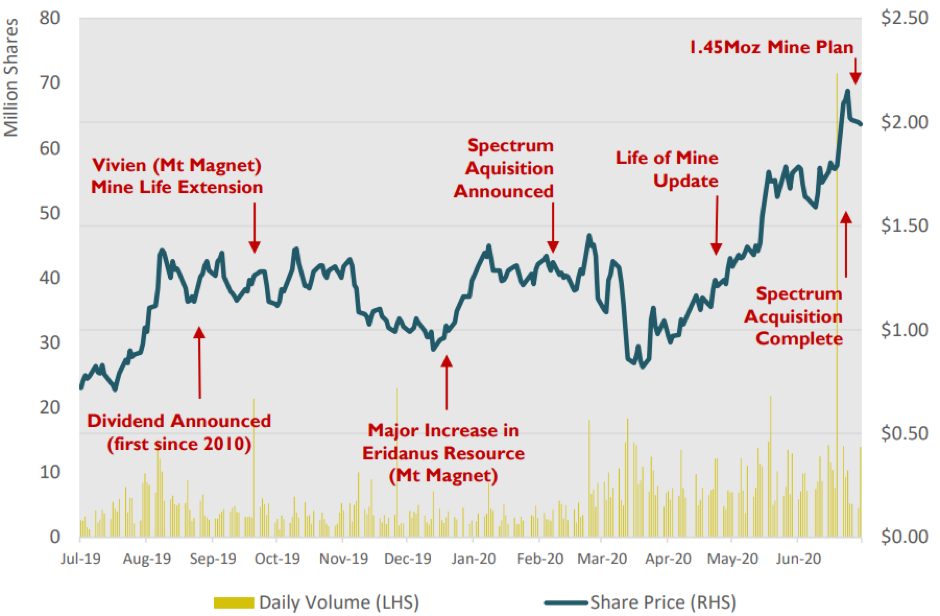

Source: Ramelius Resource

Here’s how the share price has reacted over the past year.

For most of the past 12 months the share price has hovered below the $1.50 mark.

As with many other miners, the share price became strongly correlated to the price of gold.

Which is not surprising seeing as revenues are dependent on the gold price.

As I mentioned with De Grey Mining Ltd [ASX:DEG] last week, there is a curious trend beginning to develop around gold miners.

And the potential to produce is now having a reduced influence on share price.

Why?

Well, in my opinion, the gold price right now is probably a bigger factor for profit.

For example, of their $113.4 million profit, RMS said that the historical gold price accounted for about $65.7 million.

Close to 60%.

The increased gold volume accounts for $43 million in profit.

Or around 40%.

The market is notoriously short-term thinking.

Which might explain this recent behaviour.

But it could leave gold stocks like RMS undervalued.

That’s because Aussie gold stocks could be in for a big bump in price as the gold scene in Australia really heats up. Our gold expert Shae Russell is tipping Australia to be the gold ‘epicentre’ and is predicting big flow on effects for Aussie gold stocks. Read the report for free here.

Regards,

Lachlann Tierney

For The Daily Reckoning Australia

Comments