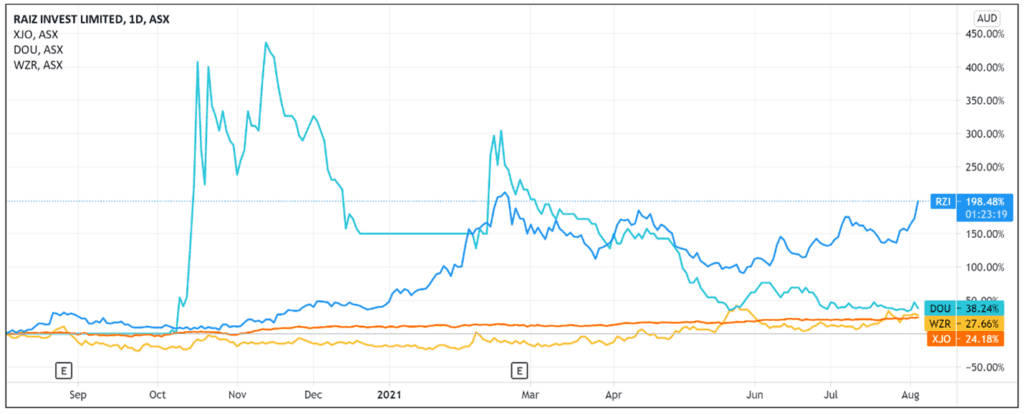

The RAIZ Invest Ltd [ASX:RZI] share price is rising after the release of its July 2021 key metrics.

At time of writing, RZI shares were up 8% to $1.95 per share.

The release of RZI’s July key metrics along with an update on the solid performance of its investment portfolios served as a catalyst for the boost in the Raiz share price.

Raiz’s July 2021 metrics

Investors were today updated on Raiz’s Funds Under Management (FUM) for the active consumer bases in Australia, Indonesia, and Malaysia.

A big contributor to the company’s FUM growth was RZI’s recent — and first — acquisition of Superestate.

The July metrics marked the first time Superestate’s business was included in the Raiz numbers.

Superestate poured $71.6 million to RZI’s FUM in superannuation, leading to a 69.8% increase and an extra 6,073 active customers.

Putting aside the acquisition’s contribution, Raiz reported it is on track to hit $1 billion FUM by the end of this calendar year.

Raiz’s retail FUM climbed a solid 4.4% in July, and the total FUM currently stands at $904.82 million.

Now, let’s look at RZI’s performance in its Southeast Asia segment.

The company said that its performance in the region was not significantly compromised despite the impact of COVID-19 in Malaysia and Indonesia.

Active customers in Indonesia grew 9.9% to 129,574 in July, representing a 26% increase over the course of three months till 31 July.

Active customers in Malaysia grew 10.5% to 72,982, a 25.3% increase for the three months.

Raiz’s global active customer base now stands at 484,975, an increase of 12.8% for the three months ending 31 July and a substantial 88.4% increase for the past 12 months.

Investment portfolio performance update

Raiz also managed to post a strong three-year investment performance for six of its seven portfolios.

Five of RZI’s investment portfolios that are directly benchmarked against Chant West outperformed the index, with the Emerald portfolio emerging on top.

Raiz’s Emerald portfolio stood out with an annual average of 12.44% per annum, compared with Chant West’s 7.90% per annum for the three years to 30 June 2021.

The Moderate Conservative and Sapphire portfolios, which are not benchmarked, also performed well.

The Moderate Conservative portfolio posted an annual average return of 6.52% per annum over the previous three years.

And Sapphire’s one-year return to 30 June 2021 was 32% against its Chant West benchmark of 22.4% per annum for the year to 30 June 2021.

The only portfolio that delivered returns below the benchmark over the past 12 months was the Conservative portfolio.

Investors in the Conservative portfolio notched a 12-month return of 6.5% p.a. compared with 7.90% p.a. benchmark.

Brendan Malone, Raiz Australia CEO, was upbeat:

‘These results are extremely encouraging, especially the three-year numbers when viewed from the perspective of our customers who have superannuation accounts.

‘It demonstrates we have consistently outperformed the index across our portfolios, with our strategy of using ETFs not detracting from our performance as our Funds Under Management (FUM) increase.’

Raiz and the rise of fintech

Raiz was founded in 2016 and within four years grew to a market cap of $155 million and funds under management tracking towards $1 billion.

Bullish investors may well think that Raiz is well positioned to leverage the emerging fintech trend.

From 2021–26, for instance, the fintech sector is expected to grow at a CAGR of 8.7%, reaching $161.2 billion.

The key for Raiz will be its ability to sustain FUM and user growth while capturing market share in a hot sector.

If you are looking to explore the fintech sector further, then I recommend checking out Money Morning’s 2021 fintech stocks report.

The report outlines the growing fintech industry and also profiles several fintech stocks.

Access your free copy of the report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here