Rain on the track. Not what you want to hear on Cup Day.

The forecast for Tuesday’s Melbourne Cup is calling for 20-40mm of rain, with Flemington likely starting on a Heavy 8.

Punters are scrambling to recalculate their form guides, looking for horses that love the wet.

And right now, mortgage holders across Australia are feeling about the same way after last week’s CPI print killed any hope of a November rate cut from the RBA.

The RBA will likely hold rates at 3.6% when they meet on Tuesday. That’s now almost certain.

But here’s the thing about rain delays and rate holds.

They’re temporary.

When one door closes, another cracks open

The “trimmed mean inflation” came in at 1.0% for the September quarter, landing well above the RBA’s 0.6% forecast.

Governor Michele Bullock had already flagged that 0.9% would constitute a “material miss.”

We got 1.0%.

So the RBA’s hands are tied for now. They can’t cut when inflation is running hot and the unemployment rate just ticked up to 4.5%.

But while our central bank sits on the sidelines, something interesting is happening offshore.

The US Federal Reserve just cut rates by 25 basis points at their October meeting, bringing the funds rate down to 3.75-4.00%.

That’s their second cut this year.

And here’s where it gets fascinating for Australian small cap commodity investors.

Trump’s olive branch to China

Remember when Trump threatened an additional 100% tariff on Chinese goods back in October?

Markets tanked. The S&P 500 dropped ~2.7% in a single session.

But then something shifted.

On October 30, Trump posted on Truth Social: “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment.”

The White House then released details of a US-China trade framework negotiated in Seoul.

China agreed to suspend rare earth export restrictions for one year and issue broad general export licenses for rare earths, gallium, germanium, antimony and graphite.

In return, the US lowered certain fentanyl-related tariffs by 10 percentage points and extended Section 301 exclusions to November 2026.

Is it a perfect deal? No.

Is it permanent peace? Of course not.

But it’s a ceasefire. And ceasefires create windows of opportunity.

The commodity setup nobody’s talking about

Think about what just happened.

The Fed has cut rates twice and still has plenty of ammunition left. The funds rate sits at 3.75-4.00%, giving them room to ease further if needed.

China’s central bank, meanwhile, has been dropping Reserve Requirement Ratio cuts since mid-2021, injecting liquidity to support their economy.

Now we’ve got a trade détente that removes immediate tariff escalation risk.

And commodity prices have been setting up for months.

Gold has led the way, as it always does in the early stages of a commodity cycle. The yellow metal is up over 40% in 2025 alone.

But I think the real opportunities are in the energy commodities that power the future: uranium, copper, and lithium.

Uranium’s nuclear renaissance

This year, spot uranium prices are consolidating just above US$80 per pound after hitting US$100 early in 2024.

Any move back to US$100/lb would be explosive for junior uranium stocks.

China, India and several European nations are actively expanding their nuclear reactor fleets. Countries in the Middle East and Southeast Asia are investing in nuclear as part of long-term energy strategies.

Meanwhile, AI data centers are driving massive baseload power demand that wind and solar simply can’t meet reliably.

I really like the developers in this space right now.

For instance, Bannerman Energy [ASX:BMN] raised $85 million in July and now sits on a war chest of roughly ~$140 million as it advances its Etango project in Namibia toward a Final Investment Decision.

We know what generally happens to miners in hot commodities when they start construction.

Copper and lithium: The electrification play

Global copper demand is projected to rise from 23.5 million tonnes in 2019 to 31.1 million tonnes by 2030.

That’s driven by renewable energy infrastructure, data centers, and electricity grid upgrades that have been deferred for decades.

Lithium got hammered in 2024 as prices collapsed from oversupply fears.

Battery storage demand exploded ~50% in 2025.

The lithium market isn’t just about electric vehicles anymore. It’s about grid-scale battery storage, data center backup power, and industrial applications.

The small cap advantage

When commodity cycles turn, small cap developers and explorers with quality projects can re-rate disproportionately.

These companies trade at massive discounts during the doldrums. Then when prices rise and projects advance toward production, the market suddenly remembers they exist.

The ASX is loaded with uranium, lithium and, to a lesser degree, copper juniors that have been left for dead during the underinvestment phase of the cycle.

Quality management teams. Proven deposits. Cashed up balance sheets.

Just waiting for commodity prices to give them oxygen.

Rain eventually stops

So yes, we’re stuck with higher rates in Australia for now.

The RBA won’t cut in November. Probably not December either.

But the global liquidity taps are turning back on. The Fed is cutting. China is stimulating. Trade tensions are easing, at least temporarily.

And commodity cycles don’t wait for permission from the RBA.

The horses that run best in the wet aren’t always the favorites. Sometimes they’re the outsiders that everyone overlooked.

Many small cap commodity stocks still trading like outsiders right now.

But the track conditions are changing.

If you fancy a flutter on a small cap commodity play before the cycle truly kicks into gear, let our experienced geologist James Cooper be your guide. Go here to learn more.

Best Wishes,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

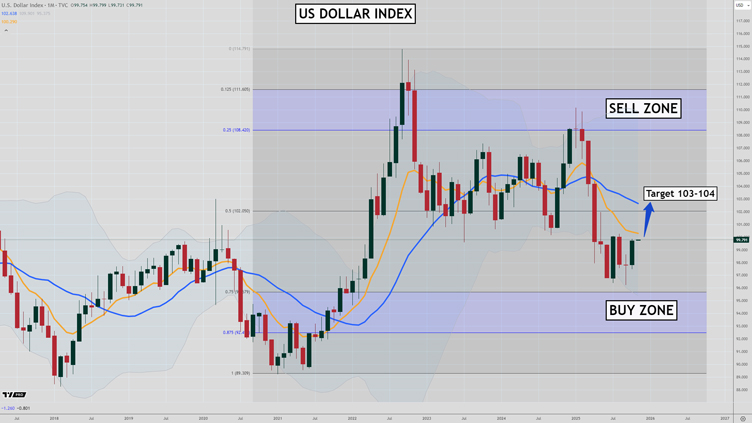

Murray’s Chart of the Day – US Dollar Index

Source: Tradingview

At the beginning of each month I scan through my monthly charts looking for any interesting set ups.

The US Dollar Index [TVC:DXY] is one that stands out.

It looks like it is finally ready to have a rally after a poor year.

I would see any jump in the US Dollar Index as a countertrend rally.

In other words, the long-term downtrend remains, but we could see a jump in the dollar to test resistance.

Last month saw the confirmation of a monthly buy pivot from very close to a major buy zone.

As trends develop you often see many retests of long-term moving averages (mean reversion).

The 20-month simple moving average sits close to 103.00, which is 3% above the current level of 99.80.

The midpoint of the range the US Dollar Index has traded in this year is at 103.20.

There are other technical levels pointing that region as a high probability outcome.

When you get a confluence of indicators pointing to an area it can add to the probabilities.

If we do see a jump towards 104.00 it will be interesting to see how the dollar performs from there, because there should be quite serious resistance around that level.

If the downtrend is going to continue we should see a reversal around that zone, which could be a great entry point for the bears to capture the next primary down-wave in the long-term downtrend.

With the monthly buy pivot confirmed the dollar should be good buying around 98.00-99.00, but if it plummets below 96.00 all bets are off and I will be proven wrong.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments