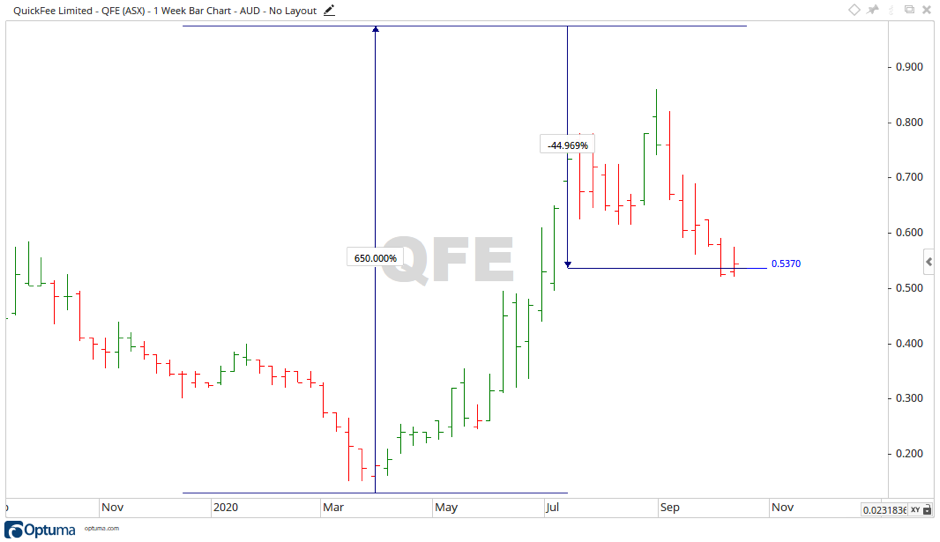

The ‘advice now, pay later’ provider saw its share price rise sharply between March and early July.

QuickFee Ltd [ASX:QFE] is trading at 53.7 cents per share at time of writing.

Source: Optuma

Today’s update was a bit of a mixed bag.

Why the QFE share price is down — US growth decent, AUS stimulus hurts model

It’s all about market expectations, and today was no different.

Strong growth in the US market, headlined by a 91% surge in lending quarter on quarter, would have been a big boost were it not for the Aussie numbers.

Australian lending was down 41% — and although the company is pursuing the US market heavily, Australia is still their bastion when it comes to total lending numbers.

Here’s the key passage:

‘Lending in Australia for Q1 FY21 was heavily impacted by government stimulus measures that are in place in response to the COVID-19 pandemic. These measures are providing a significant boost to cash flow for small to medium businesses, which has meant a reduced need for financing of professional services invoices. This has resulted in quarterly lending reducing 41% on pcp to A$6.4 million. QuickFee anticipates that more normal levels of funding will return as JobKeeper and other stimulus measures unwind.’

Basically, the government has cut into their market with stimulus.

But there is light at the end of the tunnel for the company once these measures are rolled back.

Where to from here for QuickFee?

From the low in March the QFE share price recovered quickly, jumping up over 650% to an all-time high of 97.5 cents in July.

The price has since fallen back just over 44% to where it trades at time of writing.

Source: Optuma

Source: Optuma

The QFE share price fell away over the last few weeks, hitting the support level of 52 cents. Should the price continue to decline, then the level of 43 cents may be enough to halt a further fall.

The fall took place on lessening volume, indicating the sellers may not yet be committed to a further push down.

If the price can turn to the upside, then the level of 61 cents may come into play.

Regards,

Carl Wittkopp,

For Money Morning

Comments