Over the past few months there has been no shortage of news when it comes to Aussie gold explorers.

Despite the gold price tracking sideways, gold is still commanding a lofty price.

Which could be contributing to this unofficial micro gold rush we’re currently witnessing.

June has been particularly busy, stacked with a number of high-grade gold finds (you can read about them here and here).

One area in particular seems to have contributed the lion’s share of finds, the Yilgarn Craton.

Bucking the trend this morning is Zenith Minerals Ltd [ASX:ZNC].

The small-cap developer and explorer has announced some interesting results from its maiden drill program at Red Mountain Gold Project in Queensland.

ZNC share price is up 46.34% or 3.8 cents at the time of writing, to trade at 12 cents per share.

Source: Tradingview.com

Yes, gold mining in Queensland exists

To be fair, Queensland is not a renowned gold mining state — not in the way WA is, or even SA for that matter.

Mining in Queensland is usually synonymous with coal or iron.

But that is not to say there isn’t gold to be found.

The Red Mountain project is situated within about 100km of operating gold mines at Cracow and Mt Rawdon.

Cracow produces 80,000 ounces of gold annually and Mount Rawdon produces about 95,000oz annually.

Both mines have an all-in sustaining cost of around AU$1,200, according to owner Evolution Mining Ltd [ASX:EVN].

That’s a pretty decent margin when the gold price in AUD terms is floating around the $2,500/oz mark.

Exclusive interview from The Daily Reckoning Australia: ‘The New Case for Gold: An Interview with Bestselling Author and Wall Street Insider, Jim Rickards’. Click here to learn more.

What’s ZNC found?

ZNC had been in a trading halt since Monday.

Trading in ZNC shares has resumed today on the back of its Red Mountain Gold Project announcement.

With drilling only commencing about a month ago, the 10-hole program has returned some decent near-surface, high-grade gold results.

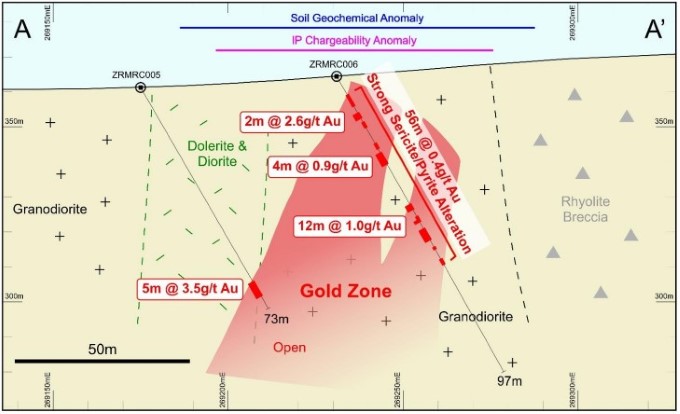

These include:

- 14m at 5.5 grams of gold per tonne including 6m at 12.3 g/t from surface

- 5m at 3.5 g/t including 2m at 8.0 g/t from 64m depth

- 12m at 1.0 g/t from 42m depth including 4m at 2.1 g/t from 50m depth

Sample cross-section from Red Mountain

Source: Zenith Minerals

It’s worth noting that these results have tested roughly 250m of a 1200m long high-order gold anomaly.

While the share price might indicate this is big news, what the results today show is that there could be significant gold mineralisation at Red Mountain.

Initial results have indicated there could be a solid target that has the hallmarks of a significant mineralised system.

However, as I wrote yesterday, gold explorers are extremely speculative, and several factors must be considered before deciding whether to invest.

If you’d like to learn more about Aussie miners and explorers, or you just want to stay up to date, make sure to subscribe to The Daily Reckoning Australia, it’s a great way to stay ahead of the curve when it comes to Australian miners. It’s free too. Subscribe here.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

Comments