Financial risk management and claims company QBE Insurance Group [ASX:QBE] issued an update on its business performance for the third quarter of 2022.

Upon revealing certain sombre insights, the QBE share price dropped 3.5%.

QBE revealed ‘higher than expected catastrophe costs’ in 2022 will see the insurance industry fork out more than US$100 billion for a second time.

QBE has dropped 2% over the last 12 months and nearly 5% over the last week alone.

Having said that, the financial stock has gained over 5% year-to-date and has managed to keep ahead of the wider market benchmark for the most part.

www.tradingview.com

QBE on catastrophes, trade, and outlook

The company has alerted investors to higher-than-expected costs relating to global catastrophes that have accumulated in the 2022 fiscal year, impacting the company’s outlook and the industry as a whole.

The company reported a continuation of catastrophe levels carrying into the second half of the year, and the global industry was to lose US$100 billion to cost claims.

Subsequently, QBE states this now brings some risk to the company’s full-year outlook.

Net catastrophe costs were already reaching $430 million by the October period, with total net catastrophe cost claims to reach $880 million for the year to October.

The company revealed its catastrophe allowance for November and December is now as little as $180 million, with an expectation of FY22 net catastrophe costs to extend to $1.06 billion (QBE’s full-year catastrophe allowance was set at $962 million).

Claims linked to the Russia-Ukraine war have reached $75 million alone.

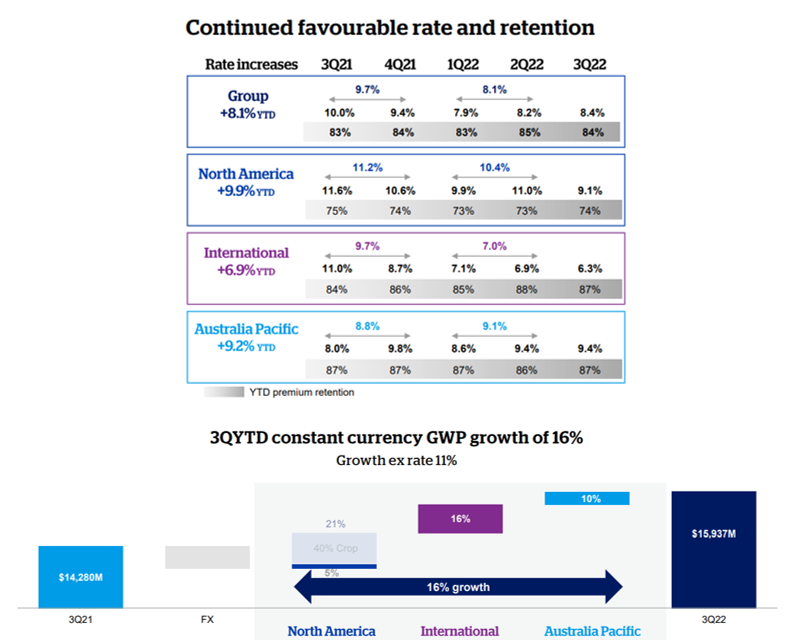

The company said inflation trends are not much changed since its 1H22 results announcement, with rate increases at or above inflation for most business segments.

As in most businesses right now, inflation risk remains a central concern.

In order to mitigate the impact of prolonged inflationary pressures, QBE aims to buffer long tail reserves and is otherwise offset by waning COVID claims.

Weather-related concerns have also been up there — however, QBE noted that North American crops have not been as heavily impacted by Hurricane Ian as initially anticipated.

QBE reported risk asset and credit performance has been fairly strong in spite of financial market volatility. However, increased interest rates have impacted the third quarter’s negative asset risk-free rate of $461 million.

This was impacted by a beneficial liability claims discount of $413 million.

The third quarter had a fixed income running yield of 3.7% (on 2.5% in 1H22), and total investments FUM (funds under management) were $26.3 billion ($26.7B in 1H22).

QBE reported gross written premiums were solid for the quarter, increasing 6% on the previous period.

Renewal rates increased by 8.4%, and growth ex-rates dropped by 8% compared to 1H22.

Source(s): QBE

QBE gives warning for continued challenges

In consideration of the macro environment pressure right now, QBE provided the following statement:

‘Challenging operating conditions have persisted into the second half, and while performance remains resilient across many facets of our business, higher than expected catastrophe costs have introduced some risk to our original full year outlook.

‘QBE continues to expect FY22 Group constant currency GWP growth of around 10%, and we expect the supportive premium rate environment should continue into 2023.

‘Based on our assessment of underwriting performance to date, we now expect a FY22 Group combined operating ratio of around 94%. As outlined at the 1H22 result, QBE’s FY22 combined ratio outlook excludes the impact of the Australian pricing promise review.’

Top five stocks to retire on

Global crisis continues to the beat of rising rates.

Households and businesses alike have been squeezed as inflation remains high.

As QBE says, these challenging conditions continue to persist.

Rest assured, some businesses can deal with inflation better than others.

Our Editorial Director, Greg Canavan, has released a research report profiling five steady stocks able to generate a strong income.

Greg thinks these stocks have the potential to outperform in today’s volatile market and be ‘inflation busters’, despite the current bear market.

Regards,

Mahlia Stewart,

For Money Morning