Australian airline and icon Qantas Airways [ASX:QAN] announced continuing strong travel demand has pushed results to the point of raising company expectations for increased profit by the end of FY23.

This means the group will more aggressively chase designs on fleet investment, required to meet demand as flying activity increases in the second half.

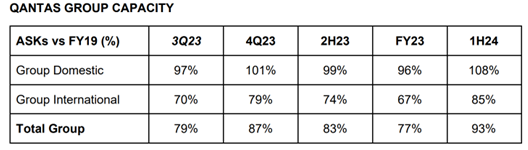

Qantas’s domestic capacity will surpass pre-COVID levels at 104% by the end of 2H23, with more routes opening around Australia.

The new era has brought Qantas higher in shares too, with an increase of more than 8% so far in 2023 and 19% up over the last 12 months.

In its sector, the airline is riding 12% above the average, and more than 15% above the S&P:

www.TradingView.com

Qantas optimistic on surging travel demand

This morning, Qantas reported a return to the travel boom, resulting in stronger performance and offering opportunities for new investments in its fleet and shareholder returns.

Qantas’s highlights included new expectations of a FY23 underlying profit before tax of between $2.42 billion and $2.47 billion, which was also thanks to the completion of its three-year recovery program.

The travel group celebrated increased flying activity and said new aircrafts continue to arrive, along with widebody jets that had been in long-term hibernation as post-pandemic operational reliability continues to improve.

QAN also predicts group domestic capacity will reach above pre-COVID levels by 104% by the end of the second half, and for international capacity to grow more than 80% once certain supply and workforce issues are resolved.

Qantas sees a further ramp-up in flying from October 2023 onwards that should boost international capacity by 100% of pre-COVID levels by March 2024.

The steady return of total market capacity has seen fare levels moderate, yet yields are expected to remain materially above pre-COVID levels through FY24.

Jet fuel prices also remain elevated but recent falls are expected to deliver a cost improvement in 2H23, partly offset by expected volatility in foreign exchange.

Qantas’s board increased the existing on-market buyback by up to $100 million, with the existing buyback (of up to $500 million) now 78% complete at an average price of $6.49 per share.

The group is on track to achieve its revised capital expenditure target of $2,600 million to $2,700 million for FY23, which includes forward payments for aircraft due for delivery in future years.

Including the additional buyback announced today, the QAN’s net debt is now expected to be between $2,700 million and $2,900 million by end of June, below the bottom of its revised target range of $3,700 million to $4,600 million.

CEO Alan Joyce commented:

‘We’re seeing the broad trends we expected as the industry recovers and trading conditions remain very positive.

‘More parts of the aviation supply chain are returning to normal, which means we’re able to put some of the spare aircraft and crew we kept in reserve back in the schedule. That’s combining with lower fuel prices to help put downward pressure on fares, which is good news for customers.

‘The industry remains capacity constrained and the travel category remains strong, so there’s still a mismatch between supply and demand that’s likely to persist for some time, especially for international flying.’

Source: QAN

Australia is set for some big change

Australia’s 30 years of abundant, robust trade has broken.

Global supply chains have changed, and they’ll never be the same.

You might’ve noticed there’s less on our supermarket shelves…and wondered why inflation is so out of control, why the banks are closing branches, and packaging is shrinking (while costing more!).

Jim Rickards, one of the world’s top financial and geopolitical analysts, has looked into these patterns.

He says the Australian economy as we know it may soon end, and it could happen as soon as within the next 12 months…

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime click here for more.

Regards,

Mahlia Stewart

For The Daily Reckoning